ADA, Inpulse and the Grameen Crédit Agricole Foundation joined forces in 2020 to monitor and analyse the effects of the COVID-19 crisis on their partner microfinance institutions around the world. This monitoring was carried out periodically throughout 2020 to gain a better insight into how the crisis has developed internationally. We are extending this work this year, on a quarterly basis. The conclusions presented in this article follow the second quarter of 2021. With this regular analysis, we hope to contribute, at our level, to the construction of strategies and solutions adapted to the needs of our partners, as well as to the dissemination and exchange of information by and between the different stakeholders in the sector.

In summary

The results presented in the following pages come from the seventh survey in the series shared by[1] ADA, Inpulse and the Grameen Crédit Agricole Foundation. Responses from our partner microfinance institutions (MFIs) were collected in the second half of July 2021. The 78 institutions that responded are located in 40 countries in Sub-Saharan Africa (SSA-32%), Latin America and the Caribbean (LAC-30%), Eastern Europe and Central Asia (ECA-22%), North Africa and the Middle East (MENA-9%) and South and Southeast Asia (SSEA-6%).[2]

The fairly positive overall trend nevertheless conceals highly contrasting realities, with the largest number of institutions returning to growth and others continuing to encounter difficult economic conditions. The first group shows growth in their assets and positive development projections for the end of 2021. This outlook remains measured nonetheless (mostly between 0 and 10% of portfolio growth) as factors such as client demand and risk management continue to affect expansion opportunities.

Conversely, some institutions are facing difficulties specific to health contexts, the effects of which are weighing on economic life and are having a strong impact on transaction volumes. As a result, the profitability of their financial performance has been affected to the point of having a negative effect on the equity capital of the most fragile.

- An operating environment that continues to improve overall

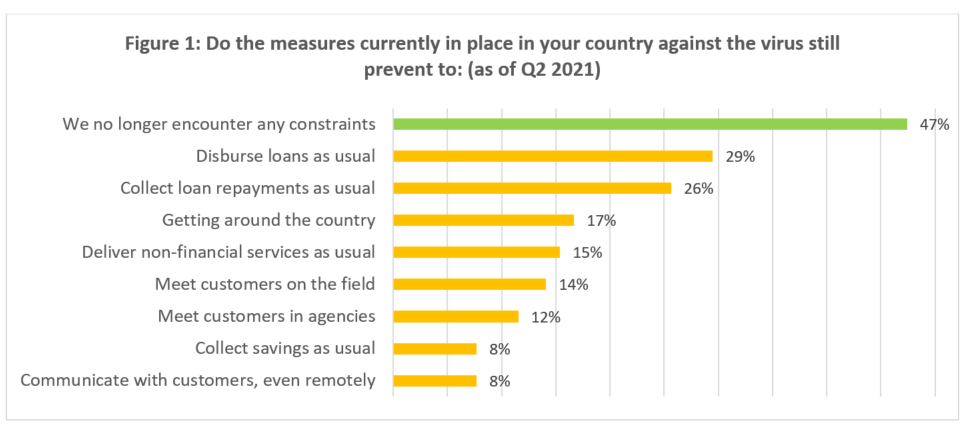

The reduction of operational constraints and the gradual recovery of business activities are again confirmed in this latest survey. Needless to say, this trend hides some disparities that are less well oriented due to the measures taken to fight the spread of the virus. At the beginning of July 2021, 47% of the institutions surveyed said that they no longer faced operational constraints on a daily basis (Figure 1). Also, all constraints relating to traveling in the country and meeting clients do not concern more than 20% of respondents.

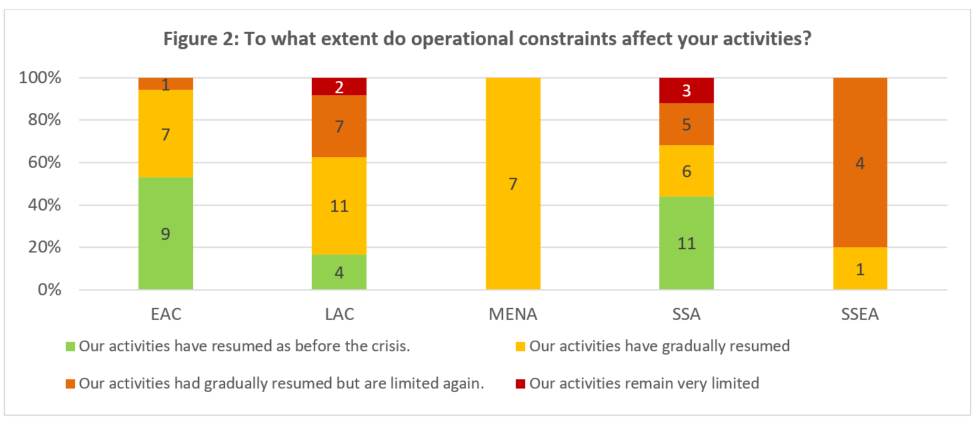

This is reflected in the level of activity of the institutions: 72% of the MFIs have either returned to a pace similar to that before the crisis or are experiencing a gradual recovery without major interruptions (figure 2). This phenomenon is particularly visible in the ECA region, where the level of activity has not declined for almost all institutions. In the LAC and SSA regions, a majority of organisations are in the same situation (63% and 68% respectively). In these areas, the difficulties are particularly acute in East Africa, Panama, and Honduras. Finally, for MFIs in the MENA region, the trend is towards recovery while those in SSEA are largely facing new difficulties (Cambodia, Laos, Myanmar, Sri Lanka).

- Part of MFIs have returned to growth

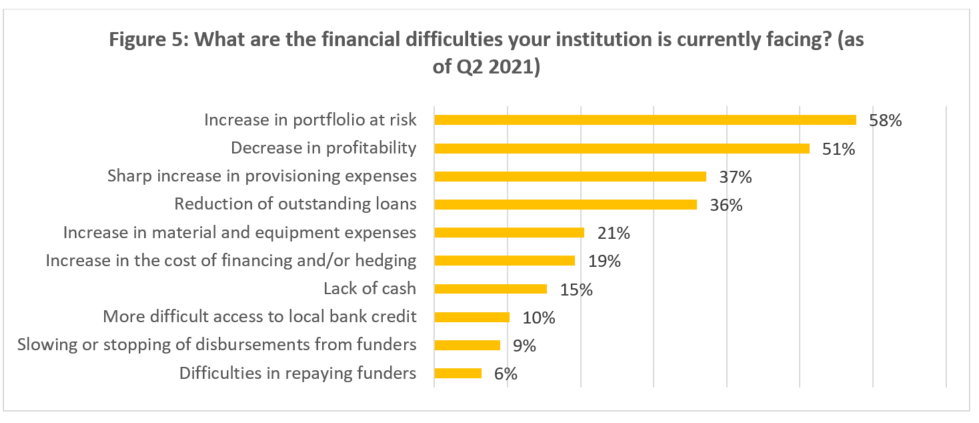

It is in this context that MFIs continue to disburse loans to their clients. Whereas the increase in portfolio at risk (PAR) and the reduction in the loan portfolio were the major financial consequences of the crisis in 2020, only 36% of the MFIs surveyed in July still report a decline in their outstanding loans (figure 5).

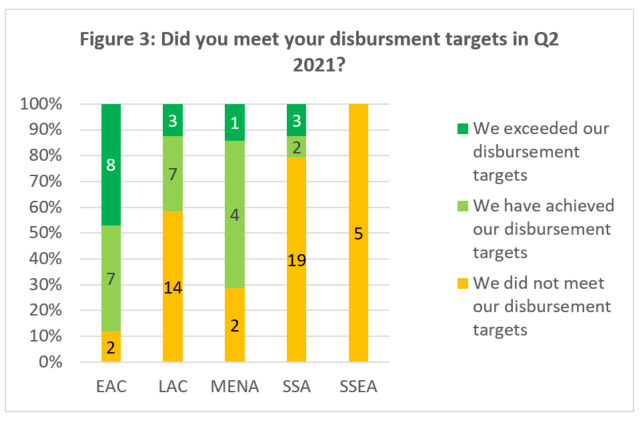

This positive analysis masks a slow process, however, as shown by the response of our partners to whether they met their disbursement targets in Q2 2021. More than half (53%) indicated that they did not meet their disbursement targets in this period, a figure that is relatively close to that obtained in Q1. This result is not entirely correlated with an organisation’s level of operations: more than half of the MFIs in the LAC and SSA regions report unmet targets despite a favourable operating environment. Note that three major reasons are cited by MFIs that did not meet their growth targets this quarter: the drop in amounts requested by clients (45%), clients’ reluctance to commit to new loans (43%), and managing risk by focusing only on existing clients (38%). Thus, MFIs in the EAC region are the exception with excellent performance in Q2 2021.

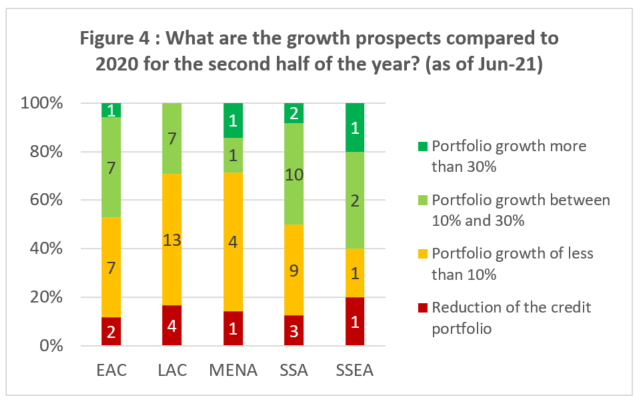

Even if these indicators reveal an inconsistent pace of development, the year 2021 is expected to end with growth in outstanding loans for the vast majority of MFIs. In fact, 86% of the institutions surveyed expect to have more outstanding loans than in December 2020 by the end of the year 2021. This growth will be reasonable for a large proportion of them: 44% of respondents expect portfolio growth of between 0 and 10%, particularly in the MENA and Latin America & Caribbean regions. For slightly more than a third of MFIs (36%), it will be between 10 and 30%. Projections are split between these two estimates in the other three regions analysed. Finally, it should be noted that 10-20% of MFIs in each region expect to reduce their outstanding loans.

- Credit risk remains under control but is still present

Despite these reassuring signs of portfolio growth, MFIs still face a high credit risk, a lingering remnant of the crisis. In point of fact, 58% of respondents in Q2 2021 stated that the current portfolio at risk remains higher than in early 2020. While some institutions still have an active moratorium (only 5%), the loans of clients in trouble at the beginning of the crisis are now showing up in the PAR as restructured or delinquent loans. In addition, there are clients in arrears who did not have a moratorium. All these loans are provisioned to cover the proven risk of default. The decline in profitability is another major financial consequence of the crisis, fuelled by the sharp increase in provisioning expenses and the reduction in the number of outstanding loans.

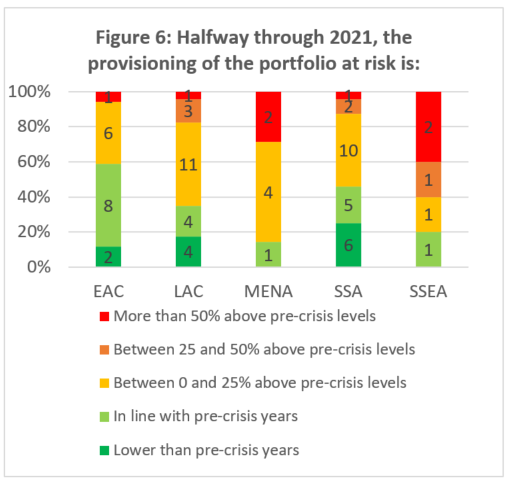

In detail, it appears that 59% of our partners have increased their provisioning levels compared with before the crisis (Figure 6). For most (71% of these 59%), the increase is between 0 and 25% of the usual amount, a situation that is found in every region except the SSEA. Conversely, there is a group of MFIs (40%) that no longer see a major increase in credit risk and whose provisioning expenses are similar to the past or even decreasing. In this respect, the ECA region again stands out, as this is the case for nearly 60% of the organisations surveyed in the region.

As we noted in our recent studies, however, this has not yet translated into a very large increase in loan write-offs. At the end of Q2 2021, 59% of respondents indicated that loan write-off levels for the year were either down from previous years or at the same level. Nevertheless, 13% of MFIs had to write off at least twice as many loans as they did before the crisis.

- Equity has been largely unaffected so far

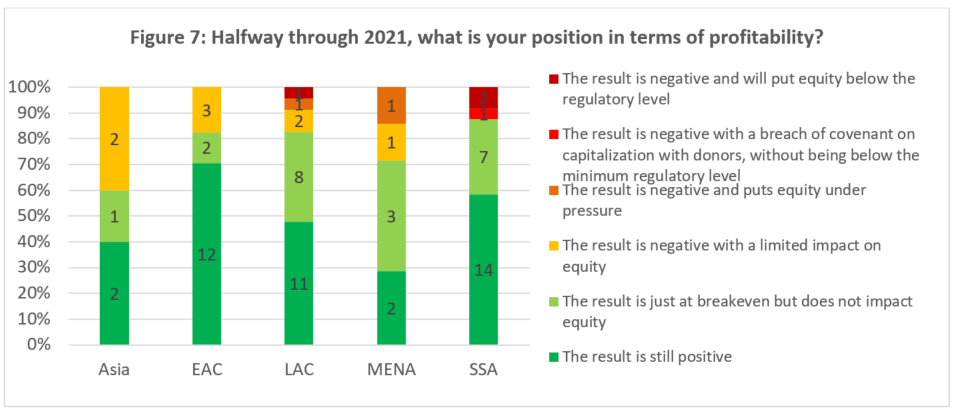

The profitability of microfinance institutions is affected by the return of business activities, the variation in outstanding loans and the risk coverage (factors presented in the foregoing paragraphs). The trend is downward for 51% of our partners (Figure 5). However, the information collected at the end of June 2021 is reassuring: 80% of respondents have a level of profitability that is at least balanced, which does not affect the capital of their structure (Figure 7). In the same vein, despite a negative result, 11% of respondents do not feel pressure on their equity. The situation is nonetheless more critical for 8% of the partners surveyed, whose level of capitalisation is at risk, leading to a potential breach of covenant with their funders or the regulator.

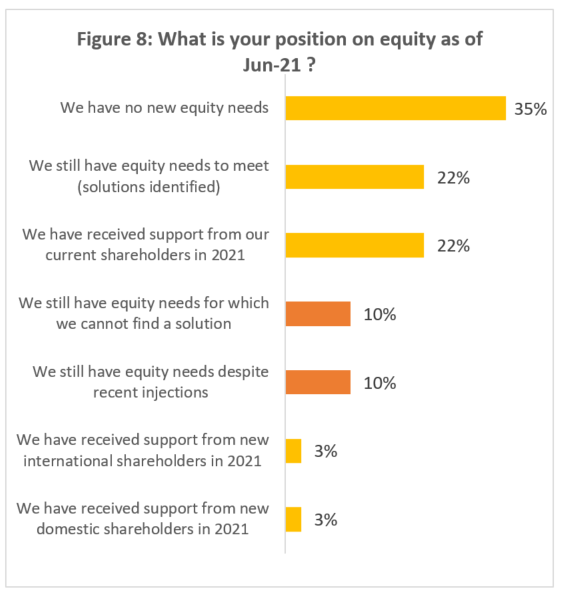

Given the difficulties faced by some of the clients, whom are up against new waves of complications related to COVID-19 or other factors, potential losses could affect the solvency of microfinance institutions. Some of them already require the intervention of their shareholders or investors. In our last study, we learned that the type of shareholder that institutions want to turn to depends on the reason why this support is needed (to cover losses or to grow). This survey shows that 20% of the respondents are already confronted by this issue: needs may arise despite recent capital support, but some MFIs are also without a solution in this regard (10%). These cases show that the impact of the crisis will still be felt by institutions already hard hit by this unprecedented period, but also by less robust MFIs. Vigilance on capital need remains necessary as the long-term impact of credit risk could turn the tables on other organisations if the overall situation does not improve, for example with the arrival of new epidemic waves.

[1] The results of the first five surveys are available here : //www.gca-foundation.org/en/covid-19-observatory/, //www.ada-microfinance.org/en/covid-19-crisis/ and //www.inpulse.coop/news-and-media/

[2] Number of responding MFIs per region: ECA 17 MFIs; SSA 25 MFIs; LAC 24 MFIs; SSEA 5 MFIs; MENA: 7 MFIs.