Maxime Borgogno, Grameen Crédit Agricole Foundation

Spotlight on Maxime Borgogno's interview for FinDev. Maxime is an Investment Officer for the Asia and Central Europe region at the Grameen Crédit Agricole Foundation.

Since the beginning of the pandemic, the Grameen Crédit Agricole Foundation has been monitoring how the microfinance sector is responding to the Covid-19 crisis. One year later, what have you learned?

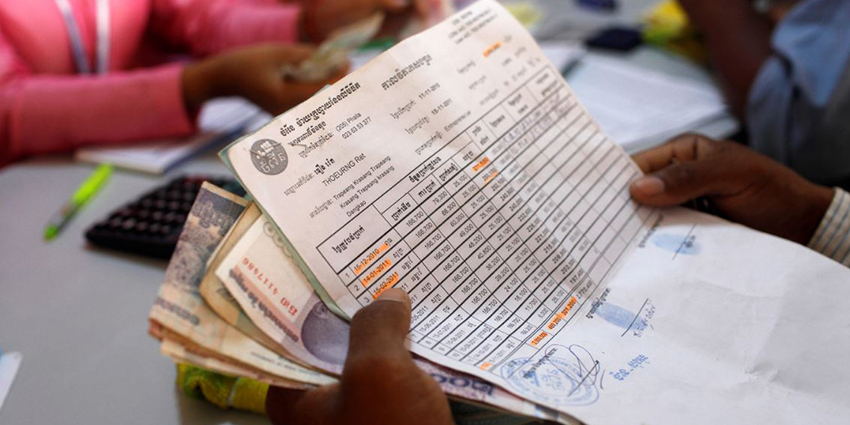

Maxime Borgogno: While the immediate consequences faced by microfinance institutions (MFIs) were an increase in their portfolio at risk and a reduction in their portfolio, the operational crisis did not lead to a total failure of the sector as initially feared. In fact, we saw many MFIs proactively adapt to the new context: they took adequate management measures while maintaining a responsible approach to their clients. Only a small proportion of the institutions surveyed had to lay off staff during the crisis, and those located in the most affected countries successfully transitioned to remote access systems. Most MFIs implemented loan restructuring to provide relief to affected clients. Some, particularly in Southeast Asia, provided clients with emergency kits (food, sanitation equipment, etc.). They even explored new opportunities such as digital loan repayment channels to adapt to the situation.

Overall, MFIs remain optimistic about the future, based on a good understanding of current challenges and the experience gained in 2020. While the crisis is not over and challenges remain, the sector has the capacity to address them.

What are the main challenges ahead? Why do you think the sector has the capacity to overcome them?

MB: The situation remains unpredictable and depends on each country. An MFI can very quickly face significant operational constraints, which will limit its activity. The latest data shows that nearly 75% of MFIs are facing a higher risk portfolio than before the crisis. Consequently, they will have to find a balance between prudently managing this risk and continuing to grant new loans to their clients. It is now clear that the Covid-19 crisis has disrupted certain sectors, business structures, and operating methods. MFIs will have to take these major changes into account in their strategy for the years to come.

Over the past year, we have seen MFIs remain fully committed to their social mission. They have proven their resilience and adaptability during an unprecedented crisis. With poverty levels rising as a result of the crisis, the mission of microfinance is more relevant than ever.

How have you been monitoring the situation over the past year?

MB: We launched the first monthly survey in March 2020 among the 75 MFIs we support. The objective was to gather initial impressions of the situation and the potential impact on their operations and clients. In June 2020, we partnered with ADA and Inpulse to expand the survey to more than 100 MFIs, including in Latin America and the Caribbean, where the Foundation does not have a presence. Since September, we have switched to a quarterly format to avoid overloading institutions as they resume operations. The next survey will take place during March.

The survey results, along with other articles related to the Covid-19 crisis, are available at the Covid-19 Observatory, a space created by the Foundation at the start of the pandemic.

Microfinance institutions often lack the capacity to respond to surveys, especially when they are facing a major crisis. What helped you continue collecting data from them?

MB: From the outset, we chose not to request detailed financial information from MFIs, but rather to gather their impressions and observations on the impact of the crisis. We deliberately limited the number of questions and ensured that they were as clear as possible. We also avoided requesting the same information they send us in their regular monthly reports.

We insist on a high level of communication with our partners, so we share survey results with them as soon as they are available and remain open to their feedback during this process. Our respondents' feedback helped us adapt the wording of the questions and the content of the questionnaire. We believe that their involvement in the process is a key motivation for our partner MFIs to continue participating in the survey.

How do you feel about how this crisis is shaping the future of microfinance? Are you worried about the future of the sector?

MB: 2020 was a historic year that demonstrated the resilience of the microfinance sector. MFIs innovated and strengthened their services to protect their clients. At the same time, donors and other stakeholders coordinated with each other to adopt the most appropriate measures to support MFIs. The latest survey we conducted on the impact of the Covid-19 crisis reveals that most institutions expect their activity to increase in 2021, in terms of portfolio volume and number of clients.

However, many of the hardest-hit institutions will need support from their shareholders and lenders. With credit risk gradually translating into losses in 2021, investor responsiveness will be critical and will be the next topic of the Foundation's Covid-19 Observatory.

The crisis is not yet behind us, but we are confident about the future of the sector. Digital transformation, coordination between stakeholders, and innovation will be essential to strengthening the resilience and impact of microfinance.