@Designed by pikisuperstar / Freepik

ADA, Inpulse, and the Grameen Crédit Agricole Foundation have partnered to monitor and analyze the effects of the Covid-19 crisis on their partner microfinance institutions around the world. This monitoring is carried out periodically and will continue throughout 2020 to gain a better understanding of how the situation is evolving. With this regular and in-depth analysis, we hope to contribute, at our level, to the development of strategies and solutions tailored to the needs of our partners, as well as to the dissemination and exchange of information between the various stakeholders in the sector.

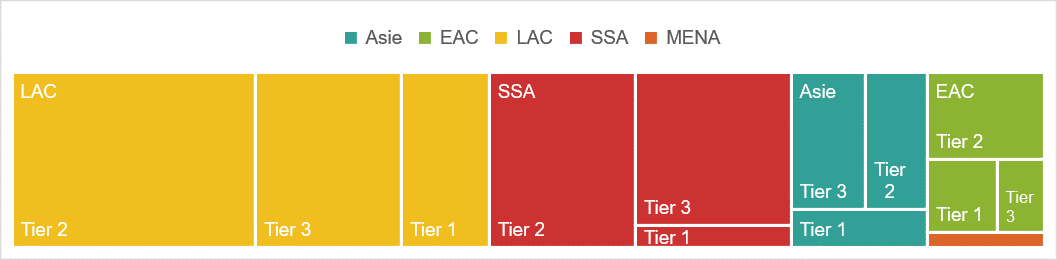

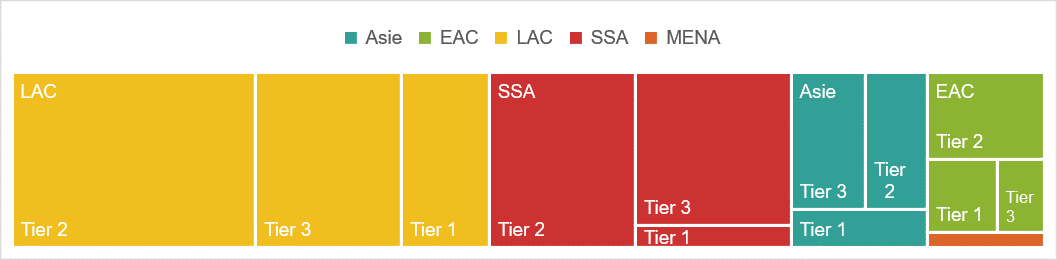

The results presented in this article come from a second wave of surveys (1) jointly conducted by ADA and the Grameen Crédit Agricole Foundation, with Inpulse choosing to join the initiative every other time. The responses were collected between June 18 and 1er July from 108 microfinance institutions (MFIs) mainly from the Latin America and the Caribbean (LAC-46%), Sub-Saharan Africa (SSA-29%), Asia (14%) and Eastern Europe and Central Asia (EAC-10%) regions, with only one MFI from the Middle East and North Africa (MENA) region being represented. This panel of responding MFIs is relatively diverse in terms of size, with 49% Tier 2 MFIs (2), 35% Tier 3 MFIs and 16% Tier 1 MFIs, distributed by region as shown in Figure 1.

Figure 1. Distribution of responding MFIs by region and by Tier

MENA Tier 2

MENA Tier 2

In summary:

This new wave of surveys shows that the crisis currently facing MFIs reveals their structural strengths and weaknesses specific to their size: the largest MFIs (Tier 1s) appear better equipped to withstand the financial difficulties caused by the health crisis and the epidemic containment measures, to take crisis management measures and to rely on the specific measures put in place by their local authorities. In contrast, smaller MFIs (Tier 2 & 3) are better able to offer non-financial services to their clients on their own to help them cope with the situation, and are keen to further develop non-financial services in the future. More generally, if they plan to launch new products or services, it is above all to meet the needs of their clients more than to remain in line with their strategy or reduce risks. Thus, while the largest MFIs seem more resilient in times of crisis, the smaller ones are not far behind and remain faithful to their strong social mission. It is also a real strength for these institutions, which must not be forgotten in favor of more autonomous structures in this period of crisis.

Larger MFIs are less prone to financial difficulties…

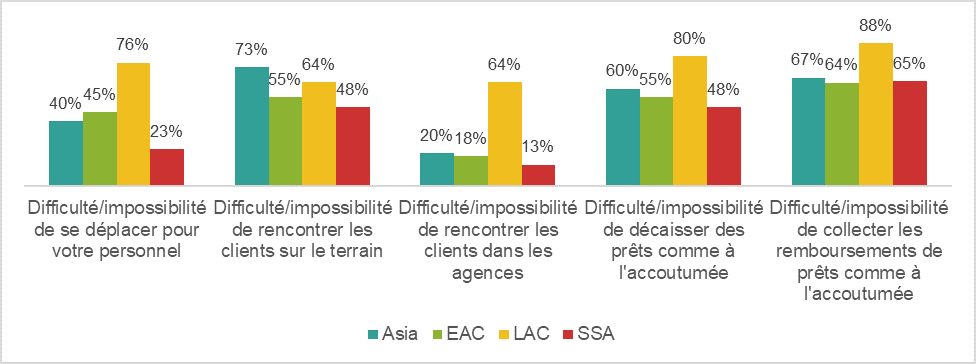

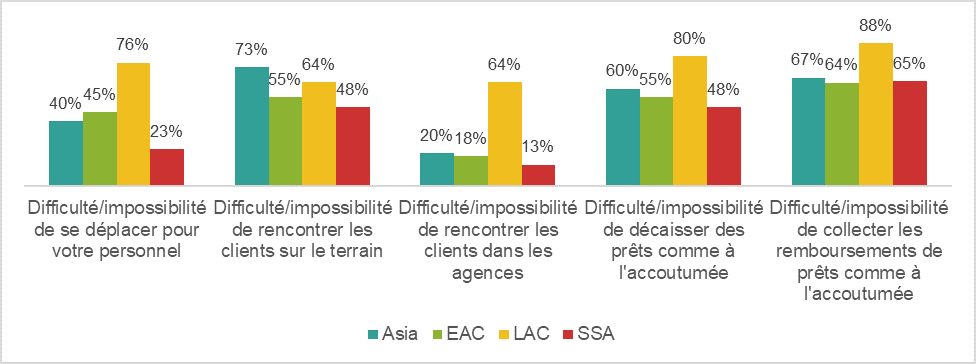

Since June, containment measures have been easing in some regions, including Eastern Europe, Central Asia, and Sub-Saharan Africa. As a result, operational challenges for microfinance institutions have decreased in these regions compared to May (3), while they continue to be felt in the Latin America and Caribbean region, where containment measures are still in place, and a larger proportion of MFIs therefore still face difficulties in traveling, meeting clients in branches, and thus disbursing loans and collecting repayments, as shown in Figure 2. For example, 76% of MFIs in the Latin America and Caribbean region report that their staff are experiencing difficulties traveling, compared to 23% of MFIs in Sub-Saharan Africa.

Figure 2. Operational difficulties encountered by MFIs by region

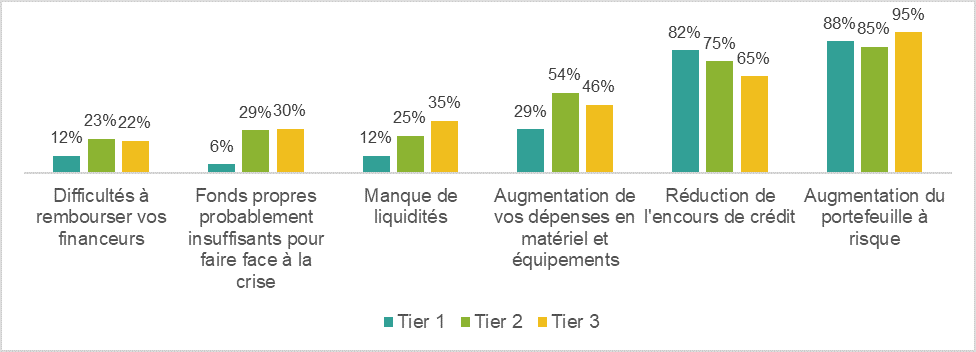

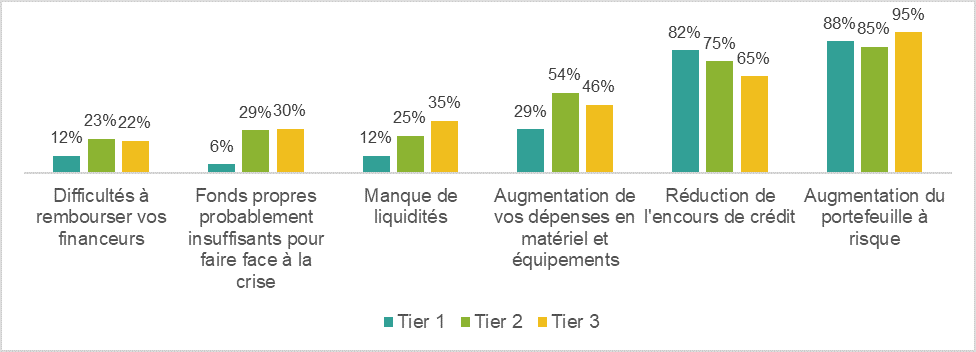

As explained in our previous article, these operational difficulties have repercussions on the portfolio and its quality for all MFIs. However, the financial difficulties they entail are not felt in the same way depending on the size of the MFIs. Indeed, the largest MFIs appear to be less confronted with this type of problem overall, with smaller proportions of Tier 1 MFIs reporting having difficulties repaying their financiers (12% compared to 22.5% for Tier 2 and 3 MFIs), having insufficient capital to cope with the crisis (6% compared to 29% for Tier 2 and 3 MFIs) or facing a lack of liquidity (12% compared to 29% on average for Tier 2 and 3 MFIs), as shown in Figure 3. Tier 1 MFIs thus appear better equipped than others to withstand the consequences of the crisis on their financial situation.

Figure 3. Financial difficulties encountered by MFIs according to their size

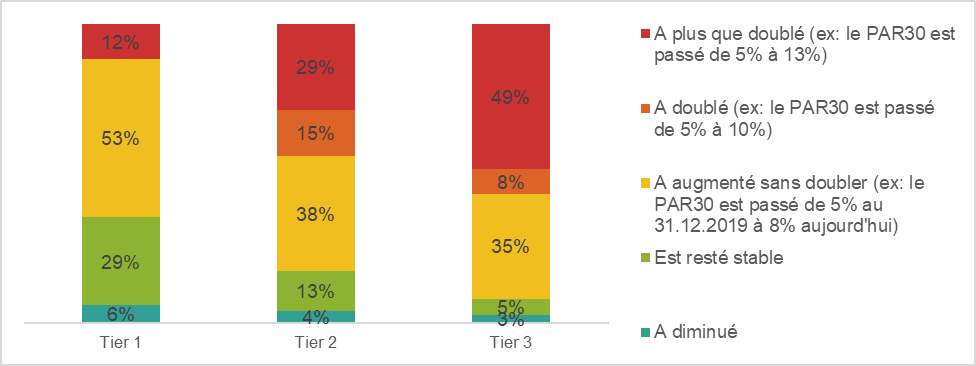

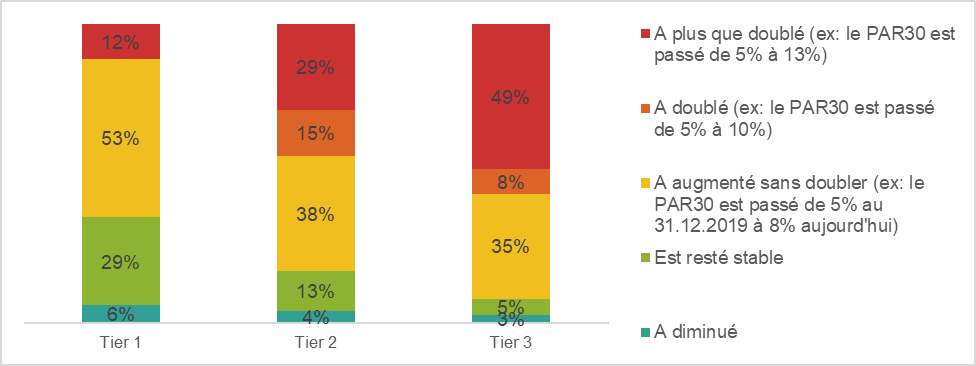

While the increase in the portfolio at risk remains the primary challenge for all MFIs, this increase materializes differently depending on their size. Thus, it appears less significant for Tier 1 MFIs than for others, as shown in Figure 4: only 12% of Tier 1 MFIs report that their 30-day portfolio at risk has doubled or more than doubled compared to the end of 2019, compared to 44% of Tier 2 MFIs and 57% of Tier 3 MFIs. Conversely, 35% of Tier 1 MFIs report that this indicator has remained stable or decreased, compared to 17% of Tier 2 MFIs and 8% of Tier 3 MFIs.

Figure 4. Evolution of the PAR30 of MFIs compared to the end of 2019 according to their size

…and more able to implement crisis management solutions…

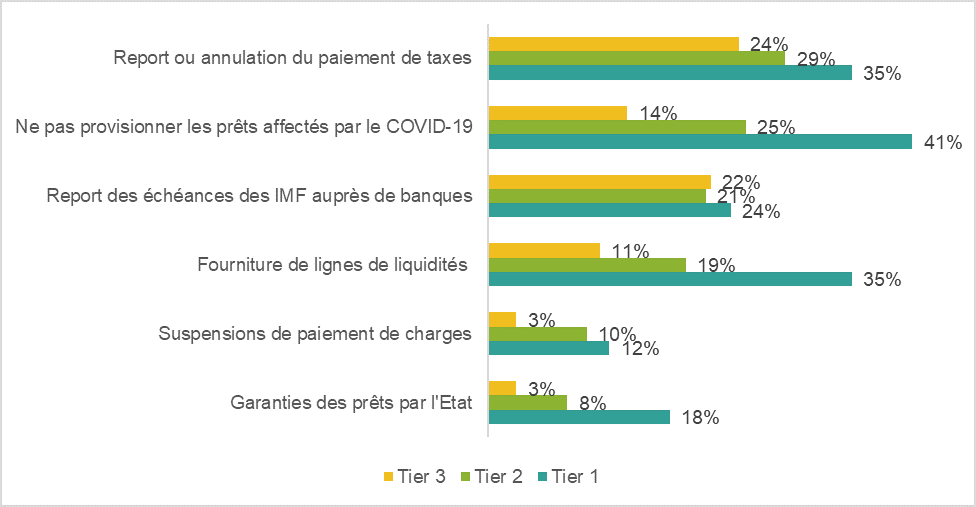

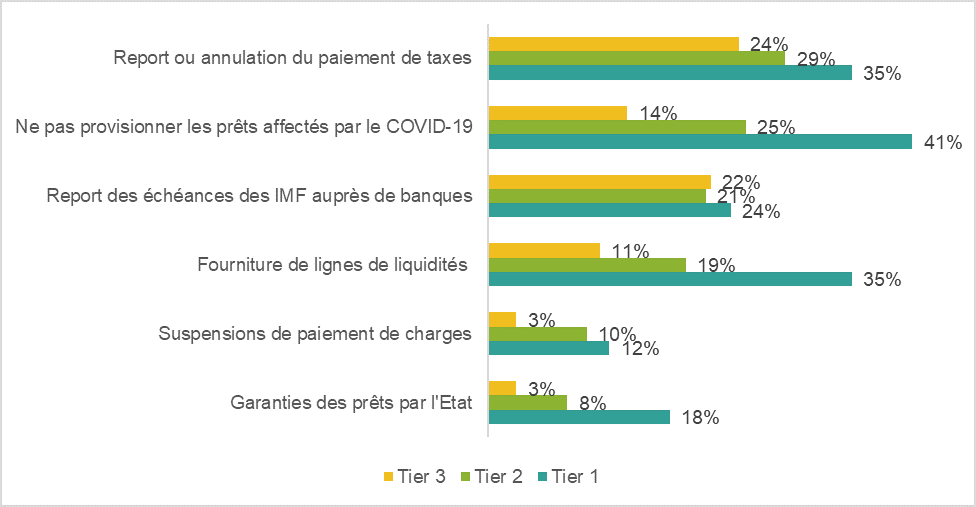

In most countries, government measures have been put in place to help microfinance institutions better cope with the crisis. However, not all MFIs report benefiting from them. While the use of these measures varies by region, most likely due to varying communication and implementation across countries (for example, MFIs in the Asian region are relatively more likely to report benefiting from a number of measures), geographic location does not appear to be the only factor determining the benefit of certain government measures: larger MFIs are also more likely to benefit from them, as shown in Figure 5.

Figure 5. Government measures that MFIs report benefiting from, by size

This "size" effect is real insofar as it cannot be explained by a specific distribution of MFIs by region. For example, regarding the deferral or cancellation of tax payments and the non-provision of loans affected by Covid-19, analysis by region shows that MFIs in Asia are relatively more numerous in reporting benefiting from them, while Tier 1 MFIs are in the minority in the region. Similarly, regarding the provision of liquidity lines, MFIs in sub-Saharan Africa are among the most numerous to report benefiting from them, while Tier 1 MFIs are very poorly represented.

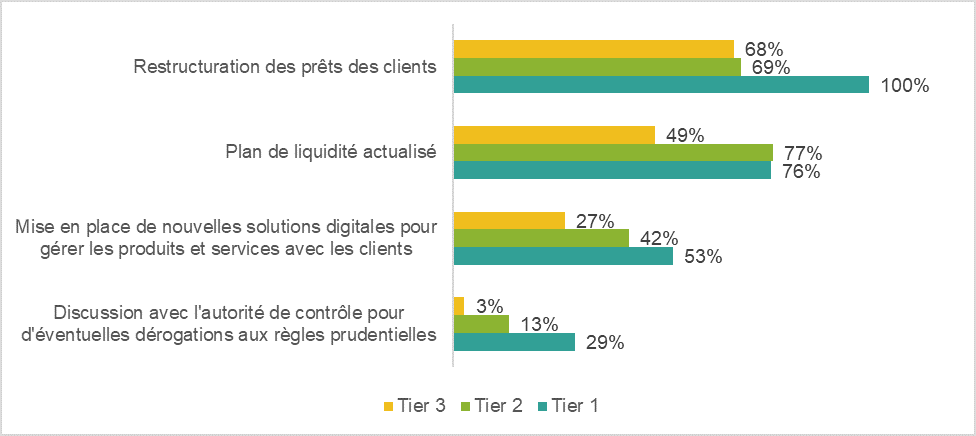

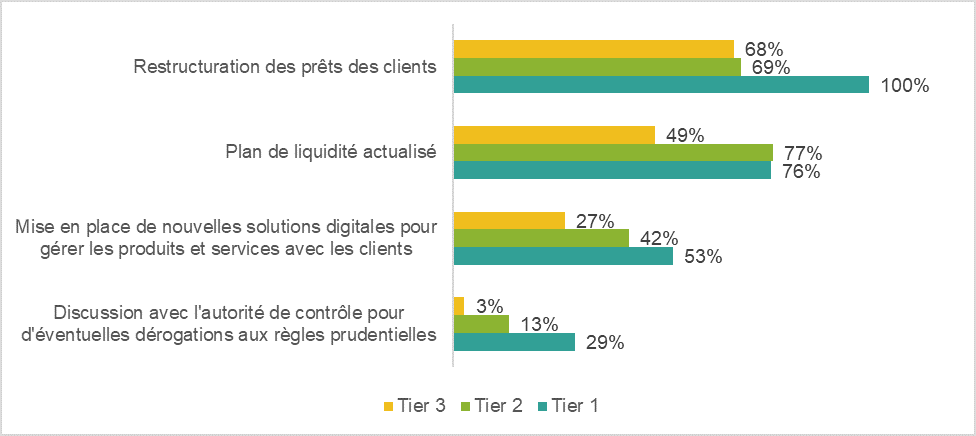

Regarding operational and crisis management measures implemented, again the type of measure taken varies depending on the size of the MFIs (Figure 6): for example, 1,00% of the Tier 1 MFIs in the sample report restructuring client loans, compared to an average of 69% of other MFIs. They are also relatively more likely to have discussed with the supervisory authority the possibility of deviating from prudential rules during the crisis. Conversely, Tier 3 MFIs are less likely to have updated their liquidity plan or to have implemented new digital solutions.

Figure 6. Operational and crisis management measures taken by MFIs according to their size

…but small MFIs remain attentive to the needs of their clients

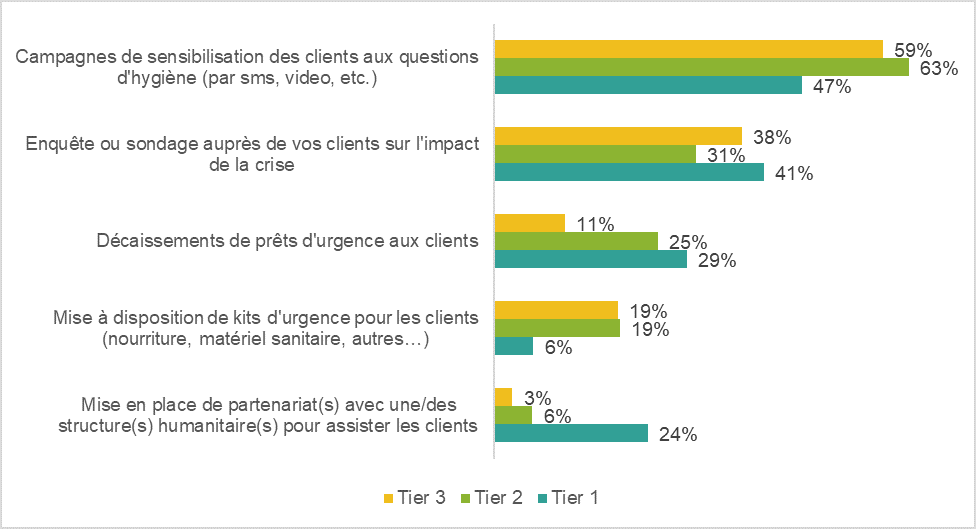

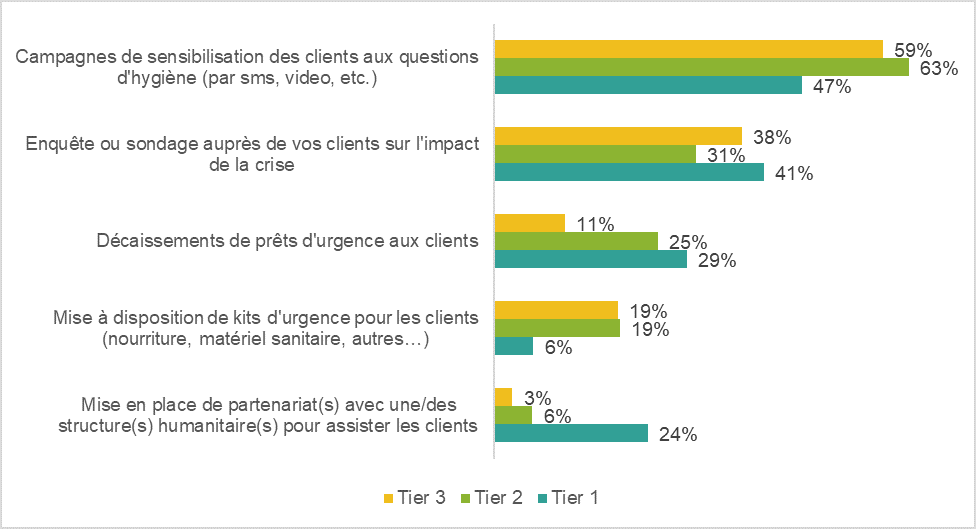

On the other hand, despite the challenges they face, smaller MFIs remain attentive to their clients' needs: for example, as many of them as Tier 1 MFIs have launched client surveys to better understand the impact of the crisis (Figure 7). On the other hand, while they have been less able to disburse emergency loans to their clients, they have, however, implemented more measures going beyond their core business to better meet their clients' needs in the face of the health crisis. For example, relatively more of them have launched awareness campaigns on hygiene issues or have made emergency kits available to clients. Larger MFIs appear to have been less inclined to establish these types of direct client services themselves and have relied more on partnerships with specialized structures.

Figure 7. Crisis response measures for clients by MFI size

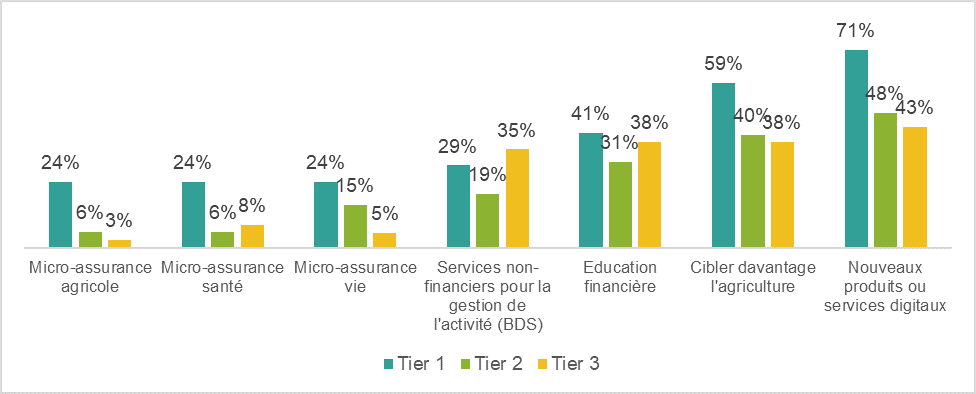

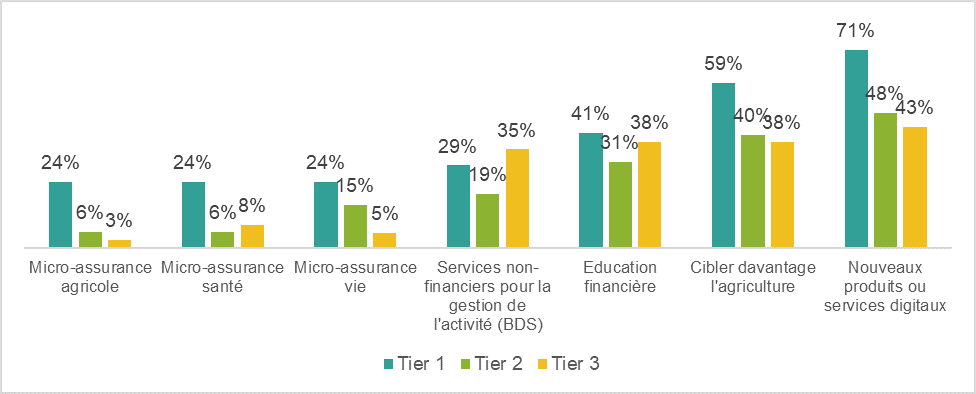

Tier 1 MFIs are generally more likely to report planning to launch new products or services in the medium term; with less financial constraints as shown above, these MFIs likely have more room to maneuver in this direction (Figure 8). In particular, while overall few MFIs plan to launch microinsurance products in the future, Tier 1 MFIs are most likely to do so. They are also more likely to want to focus more on agriculture or launch new digital products and services. In contrast, smaller MFIs are just as likely to plan to implement non-financial services, whether financial education or business development services.

Figure 8. New products, services or markets that MFIs plan to move into in the medium term, by size

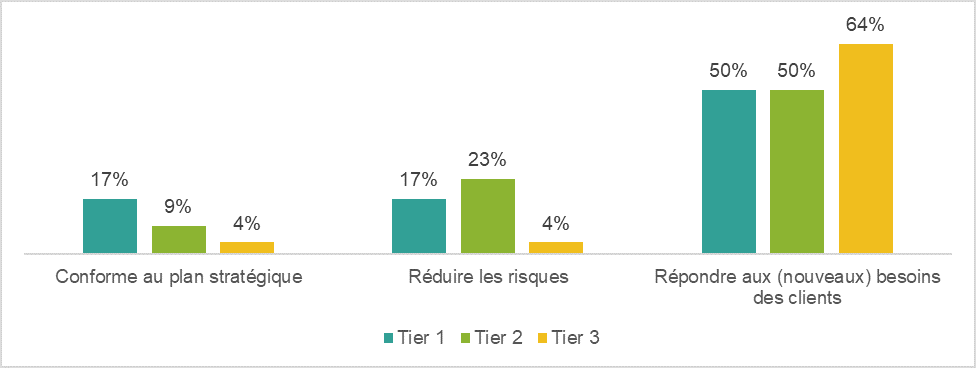

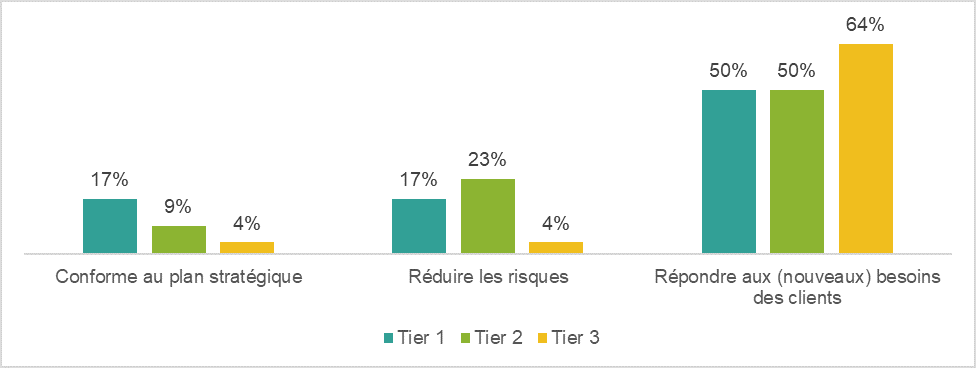

Variations between MFIs of different sizes emerge again when we look at the motivations of MFIs to move into new markets or develop new products or services (Figure 9). For example, among those that stated they wanted to launch at least one new product or service and specified their motivations (76 MFIs out of 108 survey respondents), the desire to meet new client needs and/or follow new market trends is cited relatively more often by Tier 3 MFIs than by others; conversely, fewer of them justify this choice by the fact that it is in line with their strategic plan or by the desire to reduce risks. The attention paid by smaller MFIs to the needs of their clients will probably be one of their strengths during this period of crisis.

Figure 9. Main motivations of MFIs to move into new markets, products or services, by their size

_____________________________________________________________________________

(1) The results of the first wave of surveys with ADA partners, Inpulse and the Grameen Agricultural Foundation are available here: https://www.findevgateway.org/paper/2020/06/beyond-difficulties-posed-covid-19-crisis-new-opportunities-are-emerging-microfinance

(2) Tiers are defined based on the value of total assets, with a total asset value greater than USD 50 million for Tier 1 MFIs, between USD 5 million and USD 50 million for Tier 2 MFIs, and less than USD 5 million for Tier 3 MFIs.

(3) See the results of the first wave of survey accessible via the link cited above.