ADA, Inpulse, and the Grameen Crédit Agricole Foundation partnered in 2020 to monitor and analyze the effects of the Covid-19 crisis on their partner microfinance institutions (MFIs) around the world. This monitoring was carried out periodically in 2020 and 2021 to gain a better understanding of the crisis's evolution internationally. The findings presented in this article follow the latest study conducted in November 2021. With this regular analysis, we hope to contribute, at our level, to the development of strategies and solutions tailored to the needs of our partners, as well as to the dissemination and exchange of information between the various stakeholders in the sector.

The results presented come from the 8th survey of the joint series (1) of ADA, Inpulse and the Grameen Crédit Agricole Foundation. The 70 responding institutions are located in 39 countries in Eastern Europe and Central Asia (EAC-24%), Sub-Saharan Africa (SSA-38%), Latin America and the Caribbean (LAC-20%), South and Southeast Asia (ASSE-9%) and the Middle East and North Africa (MENA-9%) (2).

1. Despite the resumption of operations, growth is limited by weak demand

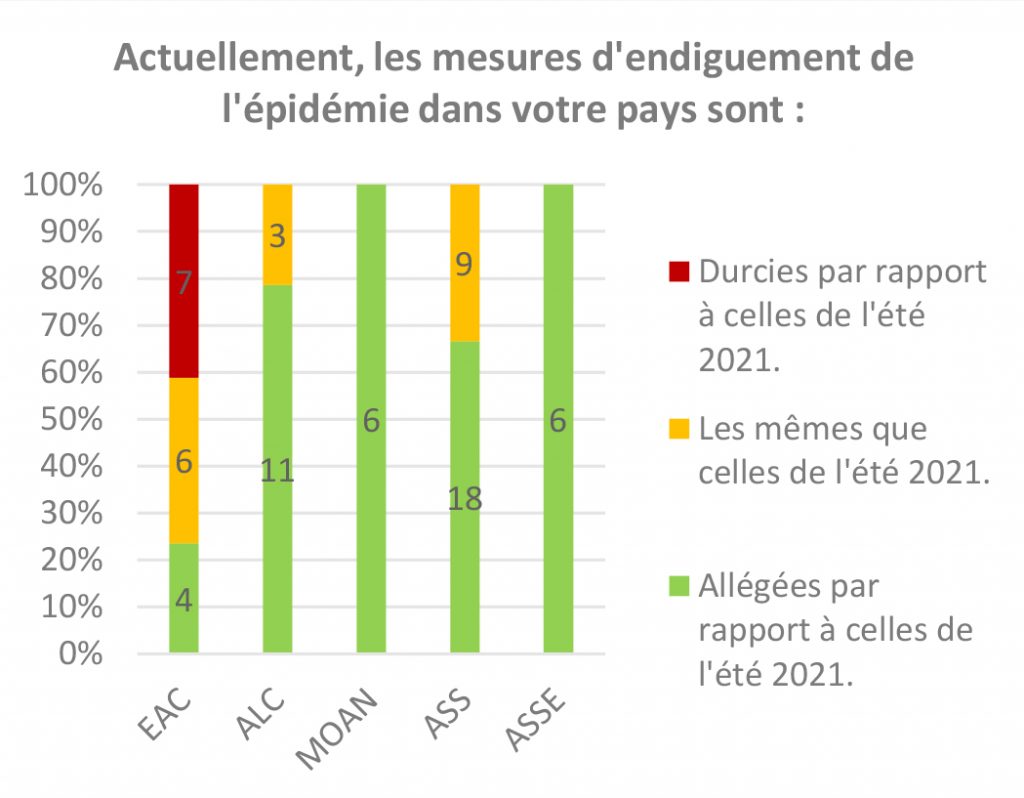

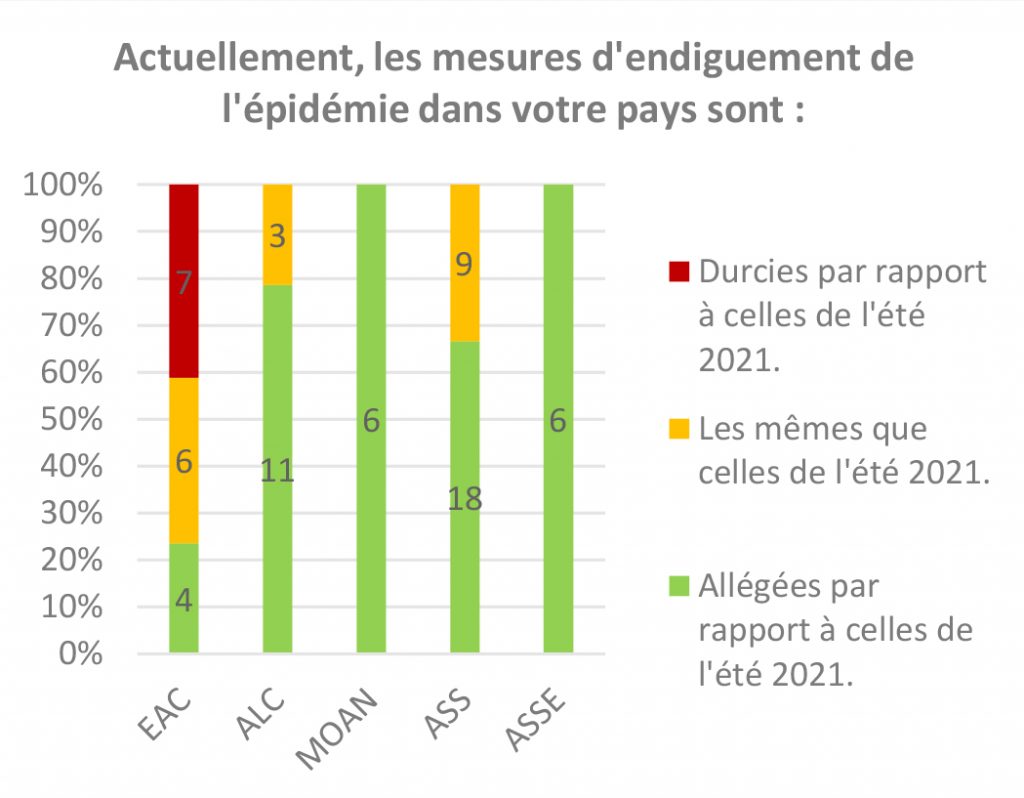

During the second half of 2021, the Covid-19 context significantly improved for our partner microfinance institutions. Indeed, in November 2021, 64% of them indicated that epidemic containment measures in their countries had eased compared to those experienced in the summer and 70% of the respondents (49 MFIs) no longer faced Covid-19-related constraints in their activities.

Eastern European MFIs (Bulgaria, Lithuania, Moldova, and Romania) stand out as an exception to this dynamic, as some of them (7 out of 13 MFIs in this sub-region) are experiencing a more difficult context during this period, linked to the resurgence of the epidemic in the region in the last quarter. This is reflected in particular by difficulties in meeting clients in the field or in branches and therefore in carrying out activities in general (collection and disbursement of loans).

Eastern European MFIs (Bulgaria, Lithuania, Moldova, and Romania) stand out as an exception to this dynamic, as some of them (7 out of 13 MFIs in this sub-region) are experiencing a more difficult context during this period, linked to the resurgence of the epidemic in the region in the last quarter. This is reflected in particular by difficulties in meeting clients in the field or in branches and therefore in carrying out activities in general (collection and disbursement of loans).

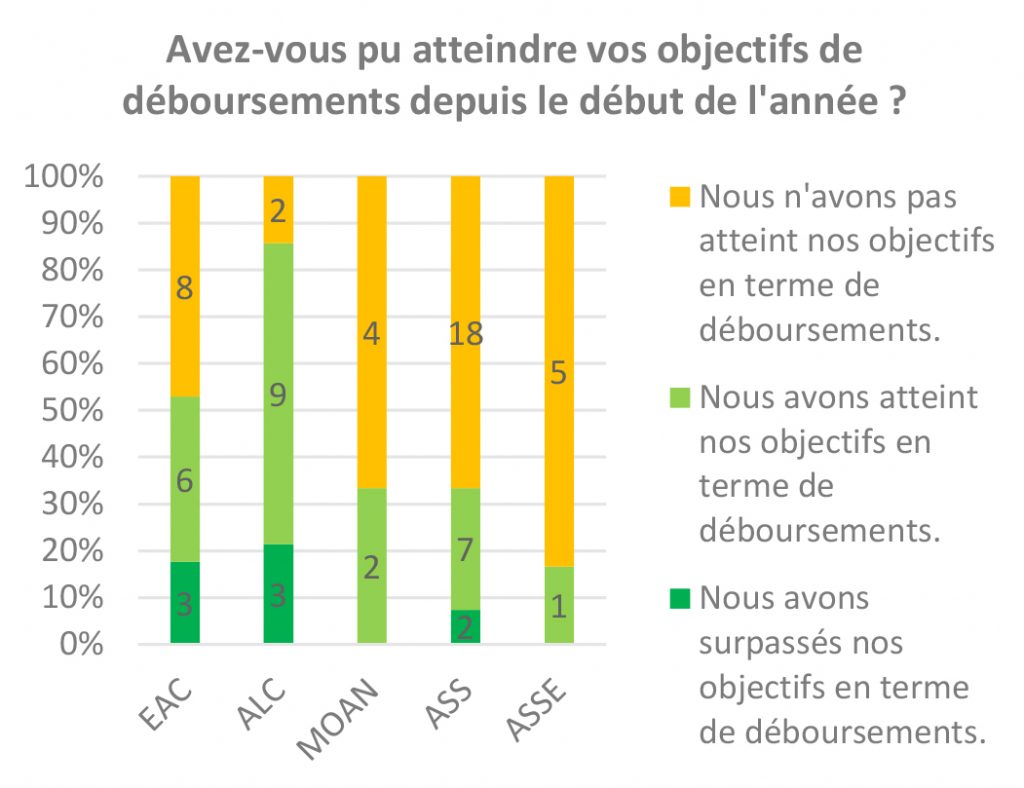

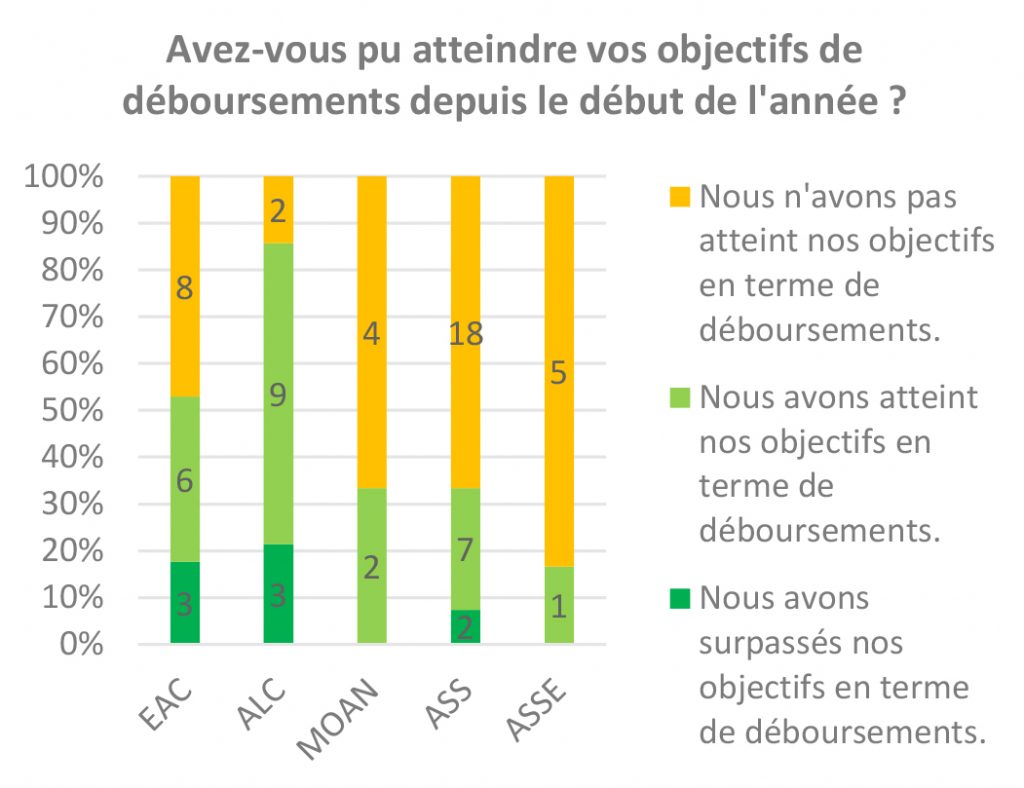

It is in this changing context that MFIs have been operating for nearly two years now. Although the trend is toward improving conditions, operational performance remains below expectations as the surveys progress: 53% of respondents (37 MFIs) report not having met their disbursement targets since the beginning of the year. This phenomenon is found across all regions, with the exception of the LAC region (where most of the partners are located in Central America).

The low disbursement levels are primarily linked to the difficulties experienced by MFI clients. Among the MFIs that are not achieving the expected growth levels this year, the two most cited reasons (54% and 49% respectively) are the deteriorated risk profile of the clientele and the reluctance of clients to take out new loans. This justification is also confirmed by the fact that 53% of the respondents still have a higher-risk portfolio than before the crisis. This persistent increase in risk and the situation of a portion of MFI clients whose needs are low or even nonexistent, therefore limits the development possibilities of MFIs.

The low disbursement levels are primarily linked to the difficulties experienced by MFI clients. Among the MFIs that are not achieving the expected growth levels this year, the two most cited reasons (54% and 49% respectively) are the deteriorated risk profile of the clientele and the reluctance of clients to take out new loans. This justification is also confirmed by the fact that 53% of the respondents still have a higher-risk portfolio than before the crisis. This persistent increase in risk and the situation of a portion of MFI clients whose needs are low or even nonexistent, therefore limits the development possibilities of MFIs.

2. Digitalization remains the top priority for microfinance institutions

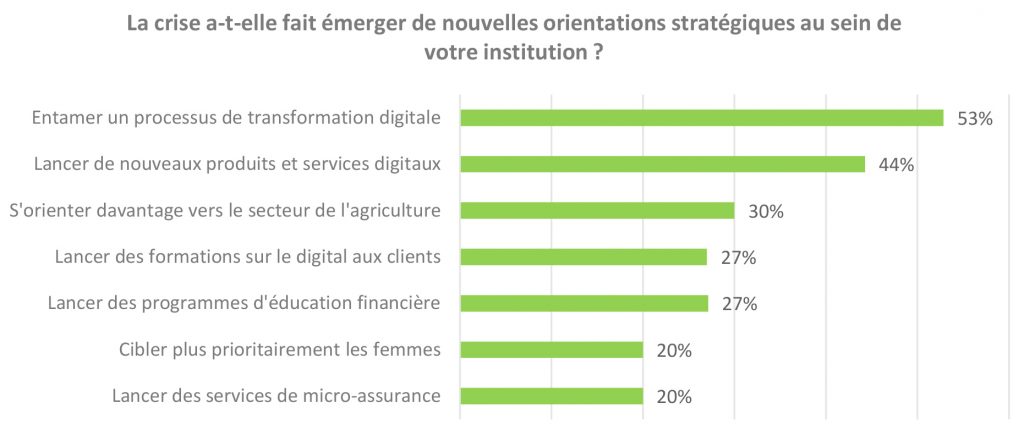

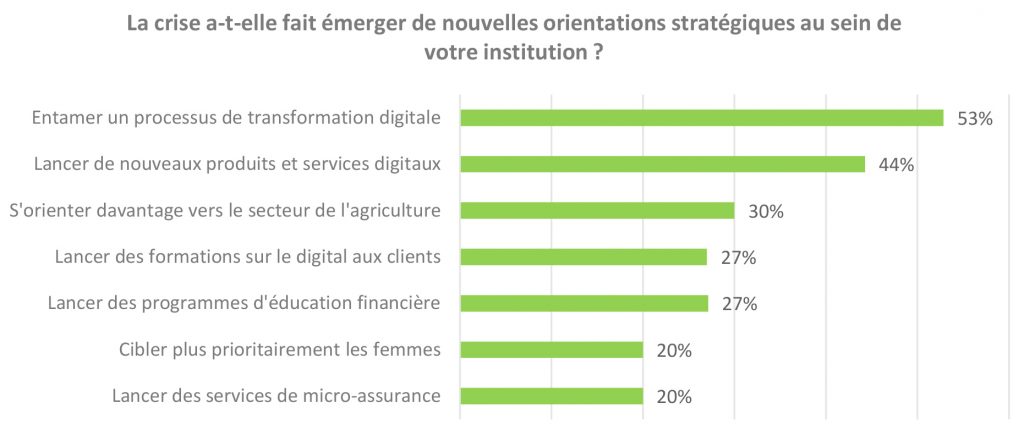

Despite a gradual yet uneven economic recovery, the proactivity of MFIs in adapting to current and future challenges continues to be evident over the months. From the beginning of the crisis, we noted that the crisis had fueled reflection on strategic issues. At the end of 2021, 47% of MFIs confirmed that important avenues of work for the coming years had emerged with the crisis. Above all, the themes most mentioned at the start of the pandemic (developing agricultural products, adapting offerings, digitalization) remain at the heart of the directions that partner institutions should take.

The implementation of digital solutions (internal and external) emerges as the main area of development. Digitalization is indeed essential to overcome the difficulties of direct contact with borrowers, a subject highlighted from the start of the pandemic. We also note that the attraction to digital is found in all regions but that it is more or less pronounced depending on the size of the MFIs: 69% (9 MFIs) of Tier 1 (3) institutions are planning to launch new digital products and services, while this only concerns 47% (15 MFIs) of Tier 2 and 24% (5 MFIs) of Tier 3.

The other strategic axes mentioned are mentioned to a lesser extent. However, 30% of respondents plan to move more towards the agricultural sector. The responses on this subject do not reveal a marked correlation either in terms of MFI size or location; only the ASSE region shows particular interest (67%). This avenue echoes the testimonies we collected a year and a half ago: this sector then appeared to be one of the least affected by the Covid-19 crisis. This intention to invest more in the agricultural sector is particularly positive as this sector represents an economic, social and environmental challenge for the years to come.

Finally, another highlight among our partners' responses is client training and awareness on various topics: the use of digital solutions (27%), financial education (27%), health (11%) or environmental protection (11%). While these topics are less popular, they are linked to the MFI development areas mentioned above and highlight the need to support clients so that they adapt to these changes.

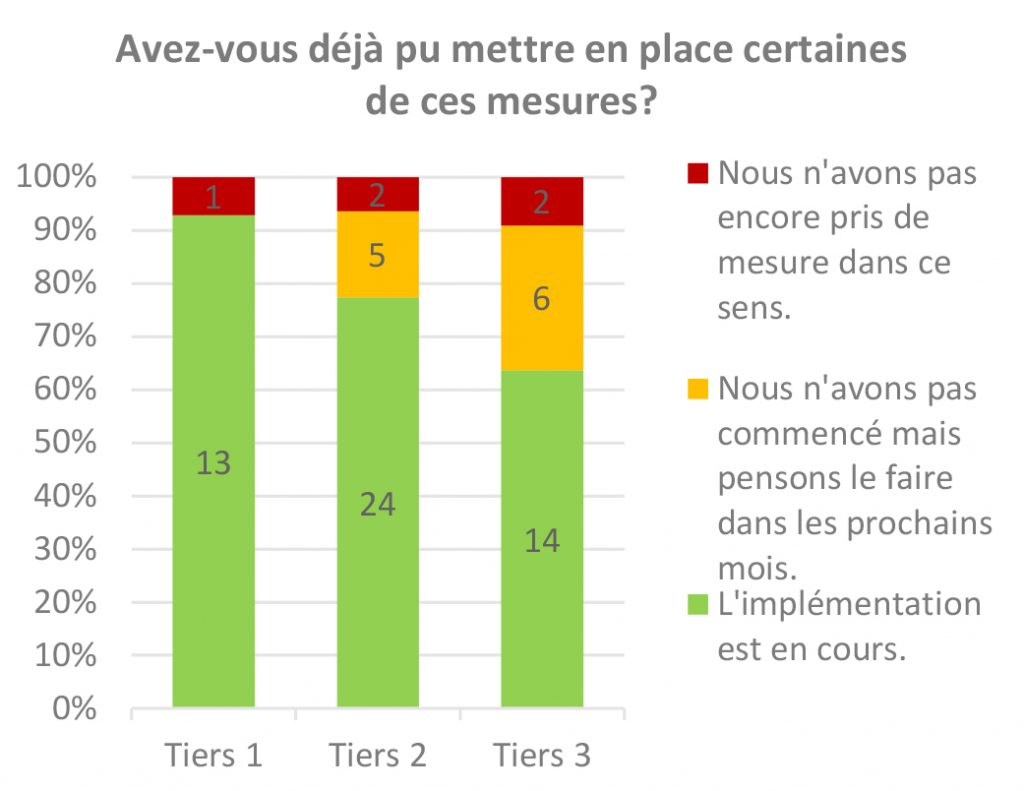

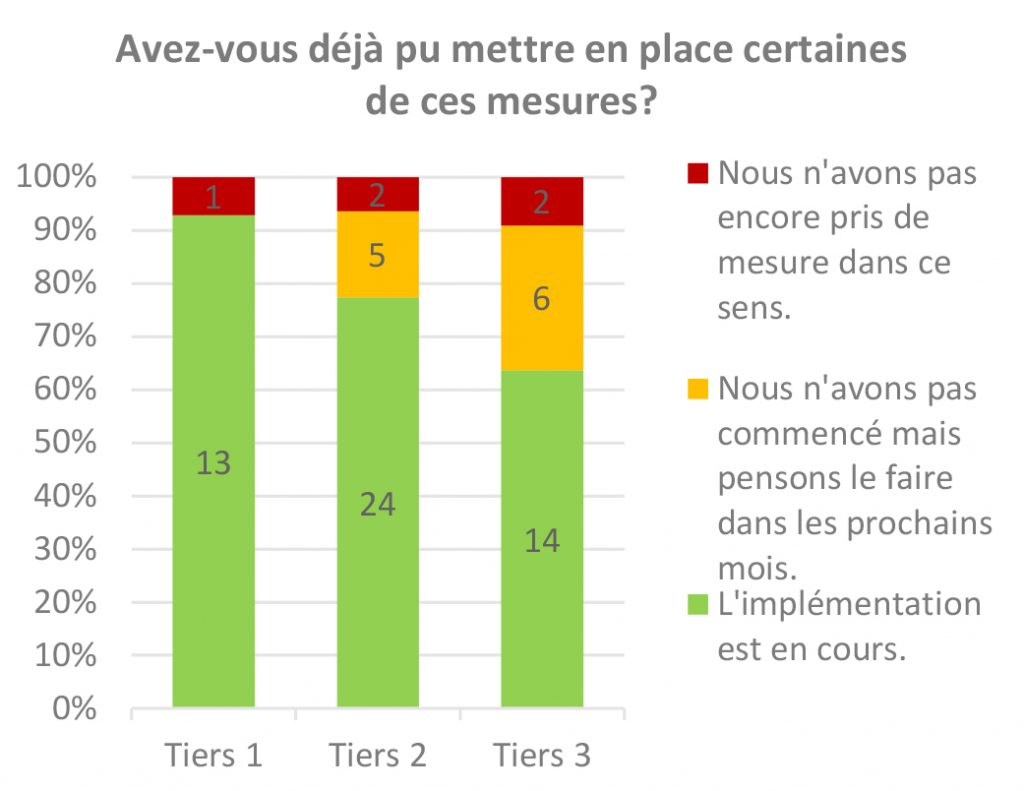

3. The capacity to implement these strategies varies depending on the size of the MFIs

We note that 76% of the MFIs have already started implementing measures related to these strategic axes and 16% plan to launch actions in this direction in the coming months. Thus, only 7% of the sample presents less obvious prospects on this point. A certain gap in the implementation of these measures emerges, however, depending on the size of the institutions: the vast majority of Tier 1 MFIs (93%) have already implemented such measures while this proportion drops to 77% for Tier 2 and 64% for Tier 3 MFIs.

We note that 76% of the MFIs have already started implementing measures related to these strategic axes and 16% plan to launch actions in this direction in the coming months. Thus, only 7% of the sample presents less obvious prospects on this point. A certain gap in the implementation of these measures emerges, however, depending on the size of the institutions: the vast majority of Tier 1 MFIs (93%) have already implemented such measures while this proportion drops to 77% for Tier 2 and 64% for Tier 3 MFIs.

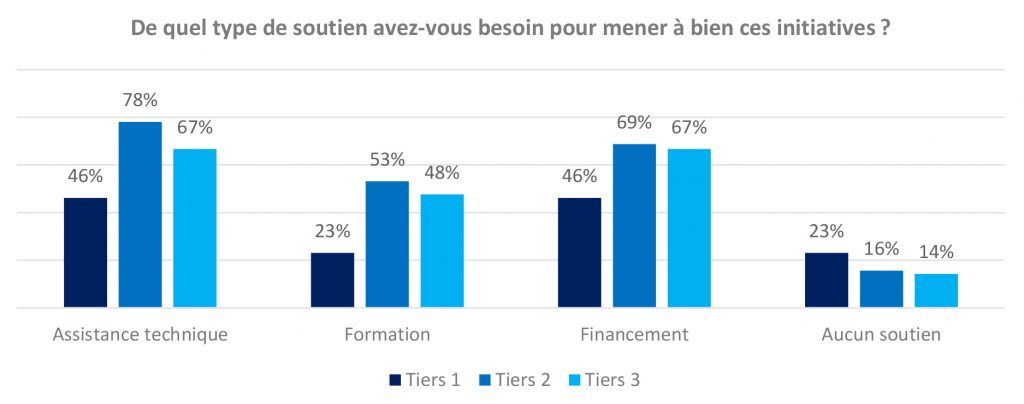

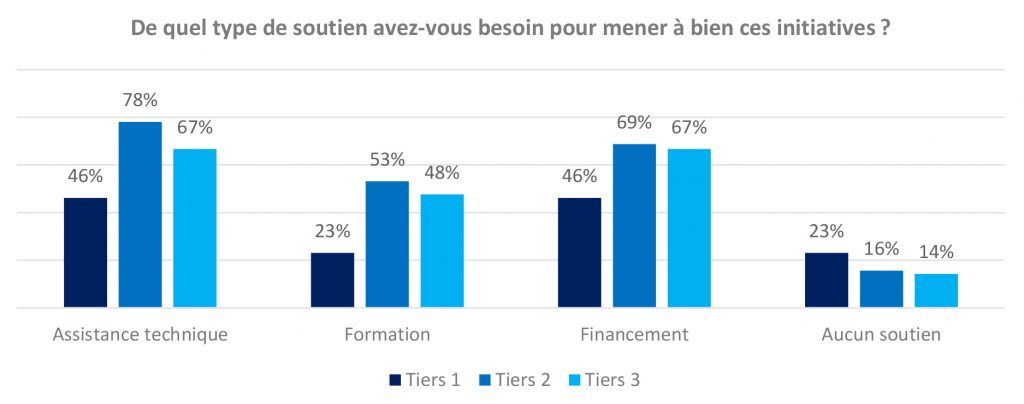

These differences by MFI size (which we already noted in 2020 work on the direct consequences of the crisis on MFIs (4)) are also reflected in the level of support expected from external stakeholders (investors, donors, etc.). While technical assistance (69% of responses) and dedicated financing (66%) are the two components that stand out most for moving forward on these issues, they are much more requested by Tier 2 and 3 MFIs. Similarly, MFIs in the EAC zone are the only ones to show a certain independence on this subject, with a third of respondents in the zone not highlighting any need for support.

Larger MFIs therefore appear more equipped and autonomous after the crisis to meet their future challenges, as they were at the peak of the crisis. At the same time, albeit to a lesser extent, some smaller MFIs also confirm strong orientations for the years to come. Despite their fewer resources, they are nonetheless no less ambitious.

___________________________________________________

Eastern European MFIs (Bulgaria, Lithuania, Moldova, and Romania) stand out as an exception to this dynamic, as some of them (7 out of 13 MFIs in this sub-region) are experiencing a more difficult context during this period, linked to the resurgence of the epidemic in the region in the last quarter. This is reflected in particular by difficulties in meeting clients in the field or in branches and therefore in carrying out activities in general (collection and disbursement of loans).

Eastern European MFIs (Bulgaria, Lithuania, Moldova, and Romania) stand out as an exception to this dynamic, as some of them (7 out of 13 MFIs in this sub-region) are experiencing a more difficult context during this period, linked to the resurgence of the epidemic in the region in the last quarter. This is reflected in particular by difficulties in meeting clients in the field or in branches and therefore in carrying out activities in general (collection and disbursement of loans). The low disbursement levels are primarily linked to the difficulties experienced by MFI clients. Among the MFIs that are not achieving the expected growth levels this year, the two most cited reasons (54% and 49% respectively) are the deteriorated risk profile of the clientele and the reluctance of clients to take out new loans. This justification is also confirmed by the fact that 53% of the respondents still have a higher-risk portfolio than before the crisis. This persistent increase in risk and the situation of a portion of MFI clients whose needs are low or even nonexistent, therefore limits the development possibilities of MFIs.

The low disbursement levels are primarily linked to the difficulties experienced by MFI clients. Among the MFIs that are not achieving the expected growth levels this year, the two most cited reasons (54% and 49% respectively) are the deteriorated risk profile of the clientele and the reluctance of clients to take out new loans. This justification is also confirmed by the fact that 53% of the respondents still have a higher-risk portfolio than before the crisis. This persistent increase in risk and the situation of a portion of MFI clients whose needs are low or even nonexistent, therefore limits the development possibilities of MFIs.

We note that 76% of the MFIs have already started implementing measures related to these strategic axes and 16% plan to launch actions in this direction in the coming months. Thus, only 7% of the sample presents less obvious prospects on this point. A certain gap in the implementation of these measures emerges, however, depending on the size of the institutions: the vast majority of Tier 1 MFIs (93%) have already implemented such measures while this proportion drops to 77% for Tier 2 and 64% for Tier 3 MFIs.

We note that 76% of the MFIs have already started implementing measures related to these strategic axes and 16% plan to launch actions in this direction in the coming months. Thus, only 7% of the sample presents less obvious prospects on this point. A certain gap in the implementation of these measures emerges, however, depending on the size of the institutions: the vast majority of Tier 1 MFIs (93%) have already implemented such measures while this proportion drops to 77% for Tier 2 and 64% for Tier 3 MFIs.