The Grameen Crédit Agricole Foundation posted a good performance in 2017

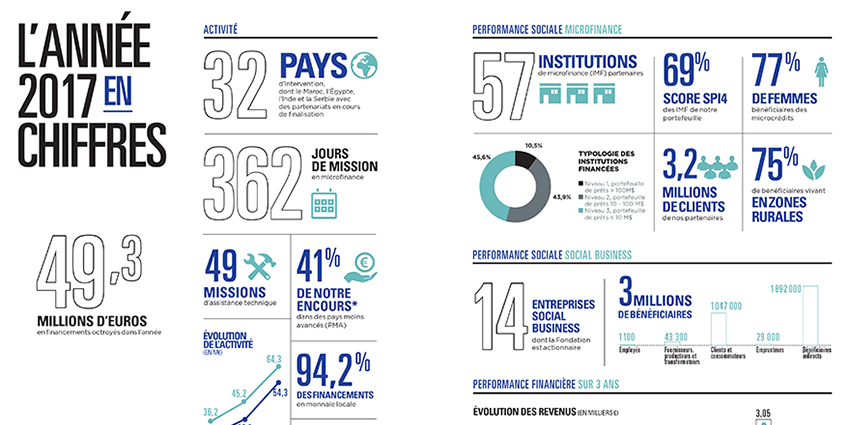

Since its creation in 2008, the Foundation has committed nearly €200 million in financing. It works with 70 microfinance institutions and social businesses in 28 countries. Women and rural populations represent 76% and 81% of the more than 3 million clients of the institutions that the Foundation supports both in financing and technical assistance. In this support component, the Foundation's teams have led 50 technical assistance missions for 16 partner institutions.

2017 was a year of growth, with positive operating income and a net profit that was also positive, while maintaining a risk profile with no adverse trends. The Foundation thus demonstrated its ability to combine social performance and economic balance. During this year, we refocused on our core business while increasing our capacity to act. In 2017, 44 financing applications were presented to the Investment Committee, for an additional amount of nearly €50 million.

The Foundation has expanded its scope of operations with new partnerships in Montenegro, Kazakhstan, and Burma. 86% of our countries of operation are among the poorest in the world. 48% of funding applications are concentrated in sub-Saharan Africa and 23% in South and Southeast Asia; these two geographic areas each represent 35% of the Foundation's commitments at the end of the year.

Meeting on March 6 and 7 in Luxembourg, the Foundation's directors expressed their satisfaction and congratulated the Foundation's teams for these results, which honor the Institution. The Board of Directors meeting was also an opportunity to outline the avenues for the next medium-term plan for 2019-2023 and to launch a project to create an Investment Fund designed to improve the operational excellence and resilience of our partners.

Committing alongside microfinance institutions, participating in the growth of rural economies, seeing further, acting together for a better shared economy, the Grameen Crédit Agricole Foundation remains focused, humble but active and bold in the service of its founding mission of fighting poverty.