The Foundation receives the award for the best international organization for inclusive finance in 2023 – Europe

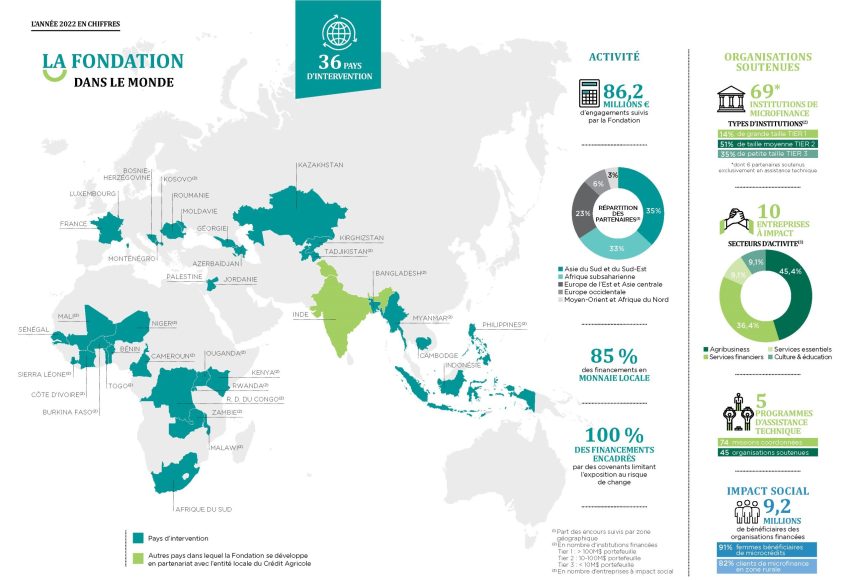

The Grameen Crédit Agricole Foundation is delighted to announce that it has been awarded Best International Organisation for Inclusive Finance – Europe 2023 at the 2023 Non-Profit Organisation Awards.International Acquisition.

This recognition reinforces our commitment to continue our mission to contribute to the fight against poverty and inequality by promoting financial inclusion and social impact entrepreneurship, empowering women entrepreneurs, encouraging collaborations and driving positive change in the entrepreneurial landscape.

All awards are based solely on merit and recognize the most deserving individuals for their ingenuity and hard work, distinguishing them from their competitors and proving to them that they deserve recognition.

Holly Blackwood, Awards Coordinator, took the time to comment on the success of this year's winners: "Hosting the Non-Profit Organisation Awards 2023 has been a pleasure. It's been great to see the diversity of organisations consistently offering help to people all over the world, and I wish them every success for the rest of 2023 – and beyond!"

Acquisition International is a monthly magazine published by AI Global Media Ltd, distributed to more than 85,000 professionals, investment, business advisors and service providers.

To learn more about all the winners.