By Killian Grippon & Chloé Liquard, Grameen Crédit Agricole Foundation

© FGCA

On June 8, the Grameen Crédit Agricole Foundation welcomed partners and entities of the Crédit Agricole group to present the Foundation's activities and discuss its actions for a better shared economy.

The day was rich in discussions and lessons learned, with presentations from the team and talks by Jean-Marie Sander, President of the Foundation, Jean-Michel Severino, Administrator of the Foundation and Sébastien Duquet, Director of OXUS, a network of microfinance institutions supported by the Foundation.

The open day served as an opportunity to reaffirm the Foundation's commitment to excellence, commitment, and sharing in support of inclusive finance. Participating in this day allowed us to fully immerse ourselves in the world of the Foundation from the very first days of our internship.

The world of finance shaken by global challenges

Climate change, security, migration… The world of finance is influenced by a complex collection of interdependent attributes. Climate change will continue to transform politics, security and the socio-economic context. Access to resources is becoming more complicated, exacerbating tensions, inequalities and conflicts. The number of refugees is increasing: the International Organization for Migration (IOM) predicts that there will be 200 million refugees by 2050[1]. The world population is growing: several studies predict around 10 billion people on Earth by 2050[2]. Faced with such demographic growth, many questions arise about the capacity to feed, house and guarantee the economic and social integration of these billions of people.

Faced with this worrying situation, what can be done? There is an urgent need to mobilize resources, act in partnership, and integrate these social and environmental challenges into the economy of today and tomorrow. This integrated approach is at the heart of inclusive finance and the work of the Grameen Crédit Agricole Foundation. By joining the Foundation's team, we discovered its approach of partnership, adaptability, and responsibility to better meet the needs of marginalized populations. For us, this is the finance of the future, one that captures the diversity of present and future challenges and adapts to a changing world.

The Foundation, a key player in inclusive finance

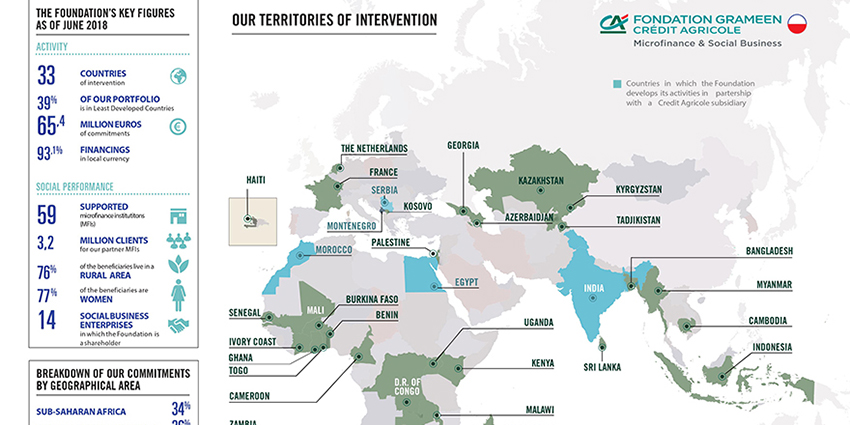

Since its creation in 2008, the Foundation has been working to promote the development of inclusive finance by supporting microfinance institutions (MFIs) and social businesses around the world. Foundation President Jean-Marie Sander opened the day by confirming this strong and shared commitment to a more inclusive economy. Throughout the day, all of the Foundation's teams presented the Foundation's businesses, projects, and initiatives. As newcomers to the world of microfinance and social business, we shared the same observation at the end of the day: the sector is far more complex than one might imagine.

For example, the range of financing tools and services offered and developed is very broad and adapted to the specific needs of microfinance institutions. The African Facility, an initiative set up with the French Development Agency (AFD), is an example of the evolution of the Foundation's offering towards more comprehensive support for MFIs. Also, after a first phase which supported 16 rural MFIs in Sub-Saharan Africa, the second phase of the program will be carried out between 2017 and 2020 and will not only finance but also provide technical assistance to more than twenty institutions.

The Foundation has also strengthened its ties with Crédit Agricole entities. Guarantee schemes with the Group's international entities in Egypt, Morocco, Serbia, and India are also being developed. Long-term financing of €14 million from Crédit Agricole Corporate Investment Bank will enable the Foundation to strengthen its work in the coming years. Crédit Agricole Indosuez Wealth (Asset Management) will manage the investment funds for which the Foundation has an advisory mandate. And to name a final partnership, the "Solidarity Banker" skills volunteer program between Crédit Agricole SA and the Foundation was launched just a week before the Open Day. As part of the program, Group employees will be able to go on assignment to support MFIs and social enterprises supported by the Foundation. This is the first time in the history of Crédit Agricole and the Foundation that such a partnership has been launched.

Promoting inclusive finance also requires raising awareness of the challenges posed by climate change in rural areas. Improving the resilience of rural producers is just as necessary as facilitating access to financing to ensure the sustainability of the agricultural sector. The Foundation adopts this approach, not only through technical assistance, but also through its agricultural microinsurance activities. The Foundation launched a microinsurance pilot project in Mali to support RMCR, one of its partner MFIs, in offering drought risk insurance to its borrowers. The project faces several challenges, but it will continue to evolve to make the product more affordable and appropriate.

Our discussion with Sébastien Duquet, Director of OXUS, a network of MFIs operating in post-conflict areas, allowed us to better understand the synergies between financial inclusion and humanitarian action. Access to microcredit services remains essential in a context of economic recovery. However, disparities in social performance persist, particularly with regard to gender and rural issues, which represents a major challenge.

Perspectives: multiplying impact and working in partnership

What conclusions did we draw from this day? First and foremost, the Open Day allowed us to better understand the Foundation's role and how it is committed to a more inclusive and responsible economy. Similarly, several strategic areas stand out for the coming years: partnerships, support for the agricultural sector, and a responsible approach.

First, the Foundation's work strongly follows a partnership approach. Fighting poverty is a responsibility that must be shared by various stakeholders. The Foundation will continue to work with private, public, and solidarity-based actors to multiply its impact and expand its geographic presence. The development of the agricultural sector will remain a priority for the Foundation, both through support for microfinance in rural areas and through support for socially beneficial entrepreneurship. Finally, the Foundation will continue to promote a responsible approach in all of its activities.

To conclude the day, Jean-Michel Severino, Foundation Administrator, delivered a powerful speech on Africa's development challenges. Food insecurity, rampant population growth, and shifting markets—the African continent will face several major challenges, and the Foundation and its partners have a major role to play.

This Open Day was the first in a series of events that the Foundation will organize throughout the year. These "Meetings for a Shared Economy" will be a platform for exchange and sharing experiences with the Foundation's partners, and we look forward to being part of them.

___________________________________________________________

Source

[1] http://www.unhcr.org/4df9cc309.pdf

[2] https://www.un.org/development/desa/fr/news/population/world-population-prospects-2017.html