By Flora Helard & Mathilde Thonon, In venture

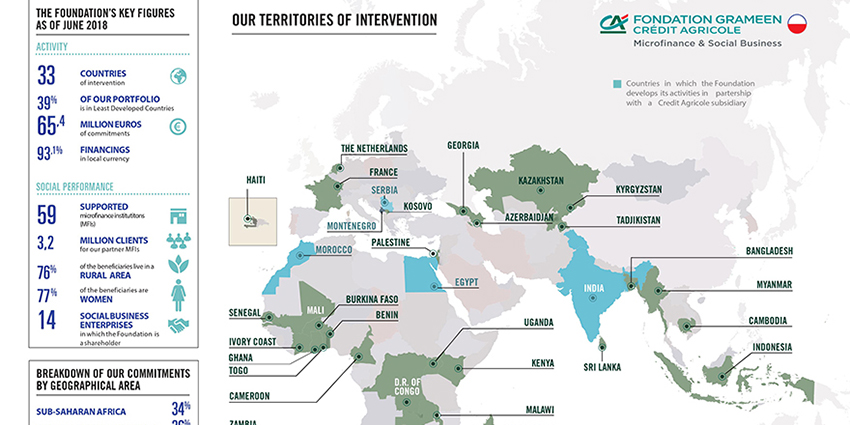

For 10 years, the Grameen Credit Agricole Foundation has been encouraging the development of local microfinance initiatives and social enterprises in the more than 30 developing countries where it operates. We interviewed Philippe Guichandut, who spoke to us about the Foundation's commitments and results.

Socially responsible, the Grameen Crédit Agricole Foundation was created in 2008 under the joint leadership of Crédit Agricole executives and Professor Muhammad Yunus, 2006 Nobel Peace Prize winner and founder of the Grameen microcredit bank (see his interview here). The Foundation encourages the development of local microfinance initiatives and social enterprises in the 32 developing countries where it operates. In 2017, €49 million was granted to partner microfinance institutions and social enterprises.

We interviewed Philippe Guichandut, Director of Development and Technical Assistance, who told us about the Foundation's commitments and results.

1. The partnership between Crédit Agricole and Grameen will celebrate its 10th anniversary. Based on the Foundation's experience, can Professor Yunus's assertion that the poor are solvent be confirmed?

Indeed, we realized that the beneficiaries of microfinance institutions generally repay their loans well, at better repayment rates than those of traditional banks for this type of client. However, the definition of "poor" must be qualified. To reach the poorest populations, microfinance is not enough. It is necessary to provide complementary non-financial services and personalized support, so that clients do not find themselves in situations of over-indebtedness. MFIs that target the poorest populations thus first offer information sessions as well as individual assistance, then credit intervenes at a later stage when the person is more ready and better equipped to develop their economic activity. So I would say that yes, under certain conditions, the poor are solvent. However, I do not believe that everyone is a potential entrepreneur; many microfinance borrowers are in a survival logic, especially among the poorest. We must carefully select individuals who will know how to use credit wisely, so as not to worsen their situation.

2. Why do you think banks have a leading role to play in solving social and environmental problems?

Banks certainly have a role to play, just like NGOs, the state, and businesses. It is important that they integrate a social dimension into their activities and evolve towards a more inclusive and responsible way of operating, so as not to leave part of the population behind. However, the social problem cannot be entirely the responsibility of banks; we need a real paradigm shift in public opinion. If microfinance emerged, it was to address a market failure that did not meet the needs of the entire population, particularly in rural areas and among populations excluded from traditional banking systems. Unfortunately, I believe that microfinance still has a bright future ahead of it.

3. Like Grameen, you specifically target women for your microfinance activities. Do you see any differences in credit use by gender?

Of course, we know that women are more likely to reinvest the profits from their activities in the family, particularly the education of children, food, housing, health, etc. This does not mean that men do not do it, but we generally see that family awareness is more present among women, which makes it possible to reach a greater number of people with microfinance and participate in improving the living conditions of the targeted people.

4. Is it possible to concretely measure the impact of microfinance on community well-being? What indicators do you use, and do you think impact measurement should be universalized?

Measuring impact is a very complex issue, and for this reason, microfinance has been heavily criticized. We face a methodology problem; there are different schools of thought regarding impact measurement. However, depending on the methodology adopted, we can find very different results. We have therefore chosen to measure the social performance of our projects, working with the SPI4-ALINUS rating tool, developed by CERISE for due diligence and monitoring of social investors. I think it would be too complex and risky to universalize impact measurement because we must take into account local specificities (religion, culture, isolation, level of development, etc.), and these vary enormously from one region to another.

5. Do you think that the MFI models you support can be exported to France, or is microfinance reserved for developing countries?

Absolutely, microfinance is growing in France and Europe. It's not just for developing countries. These are different markets and different costs, but many people who want to develop an economic activity and cannot obtain a loan from a traditional bank are now turning to this solution. The European Microfinance Network (EMN) brings together institutions operating in Europe and seeks to improve the legislative frameworks of Europe and its member states.

6. With this partnership between Crédit Agricole and Grameen, you seem to be reaffirming your commitment to the inclusion of rural areas. What is your agenda for furthering the social inclusion of rural and isolated areas?

There is a huge amount that needs to be done to strengthen the inclusion of rural people, particularly farmers. There are very few microfinance institutions that specialize in this sector because it is very risky and highly dependent on climatic hazards. Microfinance is generally urban or peri-urban, and when it is rural, it is rarely agricultural. Understanding and financing agricultural value chains is a real challenge for us. Crédit Agricole's experience in this area in France is very useful for us. 771,300 of our beneficiaries are from rural areas, and between 20 and 301,300 work in agriculture.

7. The Foundation also invests in social enterprises. What are your selection criteria for the ones you fund? Do you invest in early-stage social businesses or those at a more advanced stage?

We don't invest in startups, but rather in already developed social enterprises, not necessarily economically sustainable but with real growth potential. For us, the most important thing is that the company's main mission is truly social. We have entrepreneurs and shareholders sign a social charter to ensure that social impact is indeed the driving force behind their company's development. Secondly, we study their business plan, the required capital, market relevance, and social indicators. We also place particular importance on the entrepreneurs' personalities because they are the ones who will make the company work or not, and trust is the basis of any partnership.

8. In your advocacy activities, do you feel that there is still a lot of work to be done to reconcile the world of finance with that of social assistance and environmental protection in the eyes of the public?

I had a long career in the non-profit world before joining the Grameen Crédit Agricole Foundation. There is a real cultural difference, but the traditional opposition between these sectors stems mainly from a lack of mutual understanding and a lot of prejudice. The private and social sectors have never been so close, more and more joint initiatives are developing, and the private sector has acquired a real awareness of social and environmental issues. It's also a generational issue; young people today have a different sensibility, and we are only at the beginning of this rapprochement.

9. As Crédit Agricole savers, what can we do at the individual level to participate in the inclusive finance movement?

There are many opportunities to participate in this movement on an individual basis, but most people are unaware of them. A lot of awareness-raising work is needed to make this information accessible. You can subscribe to Finansol-certified products, invest in social enterprises, and purchase goods or services provided by social and solidarity economy (SSE) companies. If you work for a large company, you can choose to use employee savings plans. Also, contact your bank to find out about your options.

___________________________________________________________

Source

https://www.in-venture.org/fondation-grameen-credit-agricole-1