Interview with Vaselina PETROVA, Accounting Standards Analyst, CACIB

and Ali LHAF, Credit Risk Analyst, CACIB

Produced by: Mireille de Kerleau, Communications Manager, CACEIS

Launched by the Grameen Crédit Agricole Foundation and Crédit Agricole SA in 2018, Solidarity Bankers is a skills volunteering program open to all Crédit Agricole Group employees in support of microfinance institutions and impact businesses supported by the Foundation. This is the third episode of the podcast series dedicated to Solidarity Bankers, the skills volunteering program supported by the Grameen Crédit Agricole Foundation and Crédit Agricole SA. The first episode featured Carolina Viguet, Director of Communications & Partnerships at the Foundation and co-initiator of this program, and the second featured Andreas Brunner, Inspection Supervisor at Amundi in Paris, a Solidarity Banker on assignment in Kyrgyzstan. In this third episode, we will share the experience of Veselina PETROVA, Accounting Standards Analyst, and Ali LHAF, Credit Risk Analyst, both at CACIB.

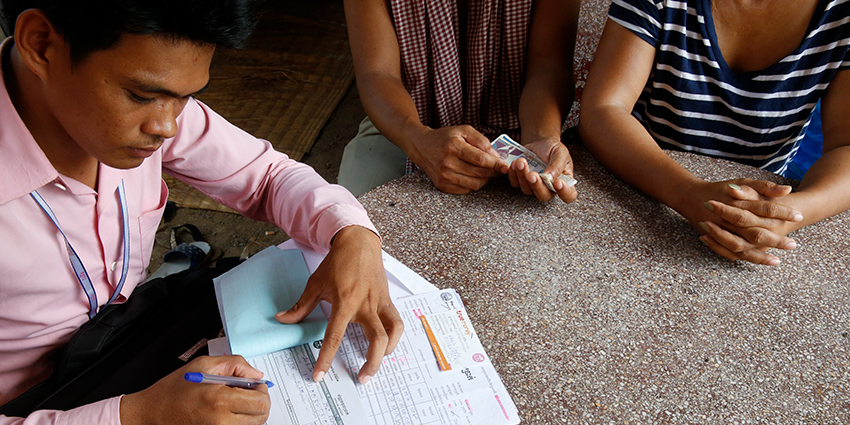

They conducted a field mission in tandem for Faten, a microfinance institution established in 1999 and supervised by the Palestinian Monetary Authority. Faten's mission is to meet the financial services needs of low- and middle-income Palestinian entrepreneurs and individuals. It operates throughout Palestine, the West Bank, and Gaza, through a network of 37 branches and 277 employees.

Before giving the floor to our speakers, let me briefly review the economic and social situation in Palestine.

In a context marked by conflicts and geopolitical tensions, access to essential services in Palestine is a major issue. With a banking rate of just over 25% and an economy heavily dependent on agriculture, microfinance plays a vital role in supporting income-generating activities and rural development. Faten is a key player in financial inclusion in the Palestinian territories by financing economic and agricultural activities and home improvement with its approximately 26,000 clients. Now a significant institution with nearly $140 million in portfolio, Faten is engaged in a process of structuring and transforming itself into a multi-channel, multi-product bank requiring cutting-edge expertise. To support this transformation, Veselina and Ali, specialists in risk assessment, reporting standards, and accounting standardization at CACIB, are supporting it as part of a Solidarity Bankers in tandem mission.

Hello Veselina, hello Ali. So to begin this interview, I would like you to introduce yourself to our listeners.

Veselina : My name is Veselina and I have been working in the accounting analysis team at CACIB for five years now. I am originally from Bulgaria and come from Varna, a city on the Black Sea, where I did part of my studies. I finished my studies in France and have been working here ever since. I am also the mother of two young boys. I love learning and sharing, and this assignment is an opportunity for me to immerse myself in a new environment: microfinance, with issues that have nothing to do with those of a bank like CACIB.

Ali : My name is Ali Lhaf. I arrived in France in 2005 for my studies and since 2010 I have been working at CACIB where I have been a credit risk analyst since 2017. At the same time, I am also a professor. I give finance courses at the CNAM in Paris. For my part, it is extremely important to reach out to others, to really try to share what we have and this type of mission allows me to use my technical skills to help others.

Did you know each other before the mission, given that you work in the same company, or did you meet on this occasion?

Ali : We actually met on this mission and for this mission in particular, we needed someone with a bit of an IFRS expertise, which is Veselina's case, and someone who has more of a credit analyst profile and who speaks Arabic, which is my case. Veselina and I have complementary work.

You are located in the same buildings, are you both in Paris, in Montrouge?

Yes, we are in Montrouge

So you met physically.

Veselina : Yes, we met during the presentation of the mission. Ali, I believe you were the first to contact the Grameen Crédit Agricole Foundation for the mission because when I contacted them, they told me that there was already someone, an Arabic speaker, who had offered to take on the mission, and so they were waiting for someone who had knowledge of IFRS accounting standards.

Ali : Indeed, I have a former colleague who is now in communications, and it was she who actually told me about this mission. She told me that the Grameen Crédit Agricole Foundation was looking for someone who spoke Arabic and who knew a little about the context of credit. And so, I told her, if I can do anything, it would be with great pleasure, and that's how it started.

And you, Veselina, how did it go for you?

Veselina : So I had attended a video conference presentation of the current missions of the Grameen Crédit Agricole Foundation and so I saw that there was this mission for which they were looking for someone who matched my profile. This mission was the only one where they asked for skills that I had and I found that interesting. So I contacted the Foundation and that's it. That's how it happened.

So you each went through a selection process and then you were selected.

Veselina : As for me, when I contacted the Foundation and expressed my interest, they asked me to send my CV, with a brief description of what I could bring to the table, and then they confirmed that my CV corresponded to some of the skills they were looking for. It could be complementary to Ali's profile, and I met them. And I met Ali afterwards.

And from that moment on, did you immediately start working on this mission?

Ali : Actually, the mission was remote. It's not easy to start right away. So we took stock with Faten and they explained what they do. Afterwards, we received a good portion of their documents. We spent a lot of time with Veselina to really understand what the institution does and try to detail their mission so that we could really get a fairly comprehensive idea of their accounts, their business model. And that's how it started. And we also translated because there are documents in Arabic, in English, so we had to understand their documents. And then little by little, we had two or three meetings with Faten and then we started to get into the IFRS / NAF technical part and it was Veselina who brought her skills in this area.

Have you communicated with several people in Faten, or do you have a specific pen pal? Who are your pen pals there?

Veselina : We currently have two main contacts. There were three or four of them at the presentation meetings, if I'm not mistaken. So we have the financial manager of the microfinance institution, one of her colleagues who is competent in the IFRS accounting section and the credit risk models they want us to review. So, there you have it, two main contacts, and then we'll see if we have other people for the other topics we need to review.

Do these people speak mainly Arabic or do they also speak English?

Ali : They speak English too.

This also allows Veselina to follow, I imagine.

Veselina : Yes, in English it's easier for me, indeed.

I was wondering if you have any idea about the culture of the country or not at all? Or do you learn as you go by interacting with these people?

Ali : Personally, I know them a little. I come from Lebanon. Lebanon is not very far from the Palestinian territories, indeed. It's not identical to 100%, but there are a lot of points in common. It's the Orient, ... I know them a little. That does indeed facilitate communication. Honestly, for the moment, things have gone well with them. They were very available ... I don't know, Veselina, what your feeling is, but ...

Veselina : Yes, yes, they are responsive. In my case, I don't really know the cultural environment or anything else there. They are very responsive, they communicate in a natural and professional way like us, so I don't see any obstacles in that regard.

I see the mission will take place one day a week for 15 weeks. Is that more or less the idea?

Veselina : Yes, that's a general framework, it's for guidance only. And then we also adjust it based on our own workload every day at CACIB.

Ali : Indeed. I note that it's a fairly technical mission, honestly, which requires a bit of personal work on our part as well. These aren't necessarily topics that are 100% of our daily life because we work in an investment bank. Here we're really talking about microfinance, so it's not the same kind of work. On our side, it takes a bit of time.

Veselina : Yes, that's it. We have our knowledge, the general framework, well, not just general. We also have specific knowledge that can be useful for the mission. But on the other hand, due to the entity's activity, there are actually very specific points that require other additional expertise. And for example, we're trying to solicit someone at Crédit Agricole more for the retail banking part. Finally, we need additional expertise. So there are pros and cons. The cons are that they can't directly work on the subject for us from the start. But the advantage is that it will allow us to learn other things and also to exchange with other teams at Crédit Agricole, and we hope that people will be able to provide us with what we're lacking.

Ali : The first part is really the technical part on accounting standards and the second part is more the organization between their holding company in Ramallah and the surrounding subsidiaries. So it's the communication between the holding company and the small subsidiaries. So I think these are the two big topics to work on with Faten.

And when you have meetings with them, are you always both there, or are you sometimes alternated, once one, once the other?

Veselina : For now, we've tried to be both. Afterwards, there's no obligation per se, but at the beginning it's important that there are two of us. If there's a need to switch to Arabic, Ali can do it, not me.

When the mission is over, I imagine you will do some follow-up on what is happening and how it is being implemented?

Veselina Yes, yes. That's what the Foundation told us. That the mission generally ends with a meeting that concludes with the achievement of objectives. And we can always keep in touch with the achievement of objectives.

And perhaps one last question that comes to mind. I wanted to talk more generally about the mission of skill donations. Do you already feel that this is a gift of your skills and that you will be useful, that it makes you happy? What does it bring you to do this?

Veselina : We already hope that we will be useful. But once again, we are not even halfway through the mission yet. So we really hope that we will be able to end up with a result that will be useful to Faten. As far as I'm concerned, I was initially interested in being able to participate in a mission like this, a volunteer mission. I think it will be really rewarding in the end, once we see that the result of what we were able to produce corresponds to the expectations, I hope, of our interlocutors.

Ali, maybe you have a feeling about this too?

Ali : While waiting for the result, I hope that we will bring beautiful things to Faten. But on a personal level, giving and sharing is something that touches me a lot, so I really try, on quite a few levels, to do it, either as a teacher if I give classes, or I do interpretation for refugees here in Paris, … I think that if you have something, you must above all share it with others.

Veselina : Yes, and we too will surely learn a lot of things.

Ali : In fact, on a personal and also technical level, yes, really.

Well, thank you very much for this exchange. Thank you for listening to this podcast and I look forward to seeing you for the fourth episode, which will focus, this time, on a field mission in Senegal, carried out by two Solidarity Bankers from Crédit Agricole SA and EFL in Poland. See you soon!

Listen to the podcast here