The latest visit of the financial inclusion program for refugees in Uganda

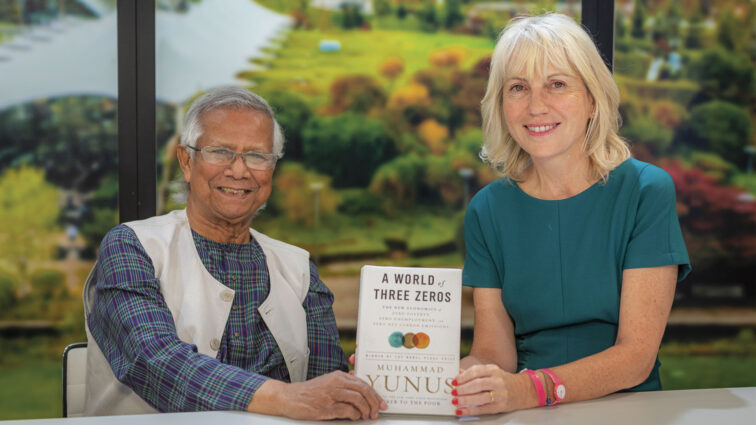

Philippe Guichandut recently went on a mission to Uganda to evaluate the financial inclusion program for refugees implemented in partnership with UGAFODE.

A financial inclusion program for refugees:

With the Swedish International Development Cooperation Agency (AIDS)* and the United Nations High Commissioner for Refugees (UNHCR)*, the Foundation launched a program to promote access to financial and non-financial services for refugees and host communities in Uganda. The program provided debt financing and technical assistance to selected financial service providers, which will enable them to expand their lending operations and access to entrepreneurship training and basic financial literacy to more than 100,000 refugees and host communities, including 75% of women.

This program ended in October 2023.

UGAFODE a key partner:

Since its creation in 1994, UGAFODE mobilizes resources to provide affordable primary financial services to its clients. UGAFODE's mission is to transform the lives of Ugandans, economically and socially. The institution played a crucial role in the program's success, demonstrating proven expertise in providing financial services to refugees.

Learn more about the program Financial Inclusion of Refugees.

_____________________________________

To find out more

*The Swedish International Development Cooperation Agency (Sida) is an agency working on behalf of the Swedish parliament and government with the mission of reducing global poverty. Through its activities and in cooperation with other stakeholders, it contributes to the implementation of Swedish international development policy. The agency is present in 46 countries in Africa, Asia, Europe, and Latin America.

www.sida.se / @Sida

*The United Nations High Commissioner for Refugees (UNHCR) is mandated by the United Nations to coordinate international action for the protection of refugees. The organization provides essential assistance, helps guarantee fundamental rights, and develops solutions aimed at the well-being of its target populations. UNHCR works in 135 countries on behalf of 108.4 million people.

http://www.unhcr.org/ @Refugees