Grameen Family Gathering

Grameen Family, Paris, February 11, 2026, ©Philippe Lissac

THE February 11 and 12 was held in Paris the very First Meeting of the Grameen Family, marking a historic moment in the collective journey towards a world Three zeros: Zero poverty, Zero unemployment And Net zero carbon emissions.

The event brought together more than 60 participants from 25 organizations of 18 countries to strengthen their ties and amplify their collective impact. Participants shared diverse experiences from around the world focusing on financial inclusion, women's empowerment, digital technology, climate action strategies, etc.

This meeting represents the first step towards a more interconnected Grameen ecosystem that honors its shared heritage of Prof. Muhammad Yunus while embracing the innovation needed to meet the challenges of the 21st century. The workshops and discussions highlighted that cooperation is essential to addressing complex global problems, with participants recognizing that their diversity is also their strength.

The event reinforced Grameen's fundamental conviction: When you trust people, they live up to your expectations.. This principle also extends to institutions, with the meeting serving as a call to transform shared values into common actions.

→ Video Message from Professor Yunus

→ Opening speech by Mr. Md. Ashraful Hassan

→ Opening speech by Mr. Raphaël Appert

→ Key Note Speech by Abdul Hai Khan

→ Closing remarks for the first day by Ms. Véronique Faujour

→ Closing remarks by Mr. Md. Ashraful Hassan

→ Photos

Listening to women leaders in the field of financial inclusion

A fundamental issue for the Grameen Crédit Agricole Foundation

Since its creation in 2008, the Grameen Crédit Agricole Foundation (GCA Foundation) has pursued Professor Muhammad Yunus's vision that women's financial inclusion is a powerful lever for empowerment. Despite significant progress, 742 million women remain excluded from the global financial system, and women-owned SMEs face a credit gap of $320 billion, even though they have lower non-performing loan rates than men.

Improving women's access to financial services generates a triple impact: strengthening women's control over resources and decision-making, stimulating sustainable economic growth, and improving household financial stability and community well-being.

Understanding the challenges by listening to women leaders

During a side event at the African Financial Inclusion Week 2025 in Nairobi, the GCA Foundation organized a roundtable with women leaders from partner institutions: Susan Chibanga (CEO of Agora Microfinance Zambia), Josephine Namugga and Florence Mutonerwa (respectively Finance Manager and Product Development Manager at UGAFODE Uganda).

Structural and cultural obstacles

Women face multiple barriers: lack of guarantees, limited financial and digital literacy, and a lack of confidence. In rural areas, these obstacles are compounded by restricted mobility and limited property rights. The digital divide exacerbates these difficulties, with women being 81% less likely to own a mobile phone and 141% less likely to use mobile internet in low- and middle-income countries.

Susan Chibanga emphasized the crucial importance of the support system: "If the support system is not supportive, a woman can succeed while feeling excluded. We must certainly make equal access possible, but this will not work for women if we do not make that access desirable for them."«

Effective approaches to empowerment

The participants advocated for inclusive approaches rather than those reserved solely for women. Digital transformation represents a strategic imperative, enabling women to manage their transactions from home while juggling their other responsibilities.

Florence emphasized the importance of having women in decision-making positions: "When a woman holds a leadership role, it brings considerable added value to our clients, because a woman is better positioned to understand the needs of another woman." UGAFODE's objective is to increase the proportion of female clients to 401% by the end of 2027.

Local initiatives and partnerships

The progress made by AMZ and UGAFODE is supported by enabling local environments. In Zambia, the National Financial Education Strategy 2019-2024 and the National Financial Inclusion Strategy 2024-2028 specifically target women from vulnerable groups. In Uganda, the National Financial Inclusion Strategy 2023-2028 includes a strategic objective focused on women's inclusion.

Partnerships are essential for developing innovative approaches. UGAFODE, with the support of the GCA Foundation, is launching a study on female clients to increase their proportion in its portfolio. Since Women's World Banking became a shareholder, UGAFODE has also implemented a gender-focused action plan.

The experience of these female leaders reveals that women's empowerment requires a holistic approach that considers not only access to financial services, but also cultural dynamics and support systems. The GCA Foundation continues its mission to make financial inclusion a powerful lever for empowering women and their communities worldwide.

For more details, discover the full article by clicking here.

The Grameen Crédit Agricole Foundation and Proparco are joining forces to develop microfinance in rural African areas.

A strengthened commitment to financial inclusion

The Grameen Crédit Agricole Foundation and Proparco are proud to announce the signing of a new loan agreement for €15 million. This significant financing is part of the Grameen Crédit Agricole Foundation's strategy to support microfinance institutions operating primarily in rural areas of the African continent.

This collaboration demonstrates the shared commitment of our two institutions to actively contribute to the development of inclusive and sustainable financial services in regions where access to traditional banking services remains limited.

Clear objectives to support development

This new financial partnership pursues three main objectives:

Supporting rural populations

The funding will facilitate access to credit in areas where traditional banking services are often absent, thereby helping to reduce financial inequality and stimulate local economic development.

Promoting women's empowerment

Women's economic empowerment is a strategic pillar for both our institutions. This loan will particularly support initiatives aimed at strengthening women's entrepreneurship and financial independence in rural areas.

Strengthening a partnership of trust

This new milestone strengthens the close and long-standing partnership between Proparco and the Grameen Crédit Agricole Foundation. This collaboration also benefits from ARIZ guarantees and technical assistance funds, enabling the partners to be supported over the long term with a comprehensive and integrated approach.

"Financial Inclusion for Refugees" Programme in Uganda: From Concept to Market Development

The Grameen Crédit Agricole Foundation (FGCA), alongside its partner Proparco, is embarking on a new strategic phase of its program dedicated to Financial Inclusion for Refugees in Uganda (2025-2027). This three-year program builds on the lessons learned from a pilot program (2019-2023, co-financed by SIDA) which demonstrated the existence of a viable economic model (or business case) for the financial inclusion of refugees.

Based on Proven Results

The pilot program demonstrated that refugees have consumption patterns similar to other populations and engage in sustainable economic activities, thus contradicting the idea that they are "unbankable." Based on these results, GCA and Proparco are now aiming to develop this emerging market.

Programme Objectives

The main objective is to build on promising results to refine interventions and prepare for broader market expansion by identifying other financial service providers (FSPs) that could be candidates for private sector investment. The programme aims to improve sustainable livelihoods and market viability for refugees and host communities.

Approach and Implementation

The FGCA uses a blended finance approach (debt and technical assistance, or TA) with its two implementing partners: UGAFODE Microfinance Limited and Vision Fund Uganda (VFU). These institutions bring essential local expertise and proven experience working with vulnerable populations.

Technical assistance is structured around three main areas:

- Training and capacity building for PSF staff and clients.

- Development of digital/ICT products and distribution channels to reduce costs and improve access.

- Learning and knowledge sharing (regional and international forums) to advocate for refugee financing as a viable market.

The essence of this approach is to demonstrate the commercial/economic viability of the refugee segment in order to unlock commercial investment and institutionalize this market. This requires patient, low-cost capital, flexible, risk-reducing capital, and catalytic financing.

Towards a Sustainable Financial Inclusion Ecosystem

This project aims to trigger a sustainable financial inclusion ecosystem for this underserved segment, including not only humanitarian partners, but also other actors in the financial sector and private investors. The objective is to integrate the refugee market into the global financial inclusion ecosystem, thereby shifting the focus towards the Development component of the Humanitarian-Development-Peace (HDP) nexus.

For more details, discover the full article by clicking here.

A new paradigm for international aid: how are financial service providers adapting to budget cuts?

The global landscape of’international aid is currently undergoing a profound transformation. With a reduction of 7.4 % in 2024 and with even sharper cuts expected in 2025, many development sectors are under strain — but few as much as that of the’financial inclusion.

A new field investigation, led by the Grameen Crédit Agricole Foundation in partnership with CHERRY+SPTF and the Financial Inclusion Equity Council (FIEC), sheds new light on the repercussions of these aid cuts. Based on responses from 86 organizations operating in 58 countries, The study highlights both the immediate consequences for Financial Service Providers (FSPs) and the broader impacts on the vulnerable populations that they accompany.

Although the inclusive finance sector was designed to be self-sufficient, The data shows that 58 % of the FSPs still depend — directly or indirectly — on programs or funding supported by international aid. These results mark a turning point for the sector, which now calls for strategic adaptation and strengthened cooperation between stakeholders.

Budget cuts hit rural and small institutions the hardest.

According to the investigation, 60 % of the FSPs declare that they are directly affected by the aid cuts. The most affected areas concern the partnerships (70 %), financial resources (53 %) and the quality of the customer portfolio (57 %). Small institutions (Level 3 FSPs) and those operating in fragile countries are the most vulnerable, as are the actors involved in the agricultural and rural finance — a segment heavily dependent on guarantees and programs supported by donors. A worrying fact, 67 % of respondents expect the situation to deteriorate in 2025–2026.

The most vulnerable customers suffer the consequences

The investigation highlights that the vulnerable customers are the first to be affected by these disruptions. Access to agricultural financing, green and climate finance, as well as to services intended for the poorest populations is among the most threatened areas. Near the half of the FSPs (49 %) They finance agricultural and livestock activities, sectors essential to rural economies but still heavily dependent on aid programs. The cascading effects on food security, gender inclusion, and community resilience could be considerable.

Strategic shifts and resilience test

Despite a challenging environment, the survey paints a picture of a sector of remarkable resilience. 57 % of respondents believe that inclusive finance remains generally sound. 44 % of the FSPs have already adapted their strategies, placing greater emphasis on the quality of the wallet, strategic alliances And customer protection.

The results also reveal a evolution of mentalities : 43 % of institutions are now focusing more on the sustainability, local partnerships And innovation. However, respondents point out that if the impact investors appear as key players in filling the funding gap, their expectations may not always align with the market reality.

A call to strengthen cooperation and innovation

The study concludes with a call to action to all stakeholders to:

1️⃣ Strengthen the local cooperation between public and private actors; ;

2️⃣ Promote mechanisms of mixed finance (blended finance) to optimize public and private resources; ;

3️⃣ Develop synergies between FSPs thanks to the pooling of resources and networks; ;

4️⃣ Prioritize the customer protection through the design of innovative and inclusive products; ;

5️⃣ Investing in the impact measurement in order to improve accountability and attract more private investors.

As one respondent — the financial director of a bank in the Dominican Republic — summarized:

" The inclusive finance sector is like a rock in the middle of a global storm. Despite aid cuts and geopolitical tensions, it remains incredibly strong because it focuses on what matters most: the financial needs of people in their communities. »

This new reality calls for greater innovation, cooperation, and collective resilience. The study's findings confirm that inclusive finance, deeply rooted in local economies and human needs, remains one of the most resilient and meaningful in the changing context of international aid.

Read THE report complete For explore how THE FSPs navigate In This new landscape And This that the future reserve has inclusion financial.

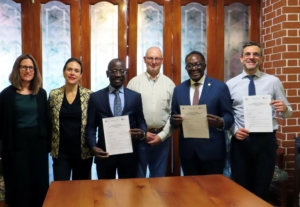

Strategic collaboration to strengthen agricultural financing in Africa

The Grameen Crédit Agricole Foundation, ACRE Africa, and ZEP-RE (PTA Reinsurance) have signed a strategic collaboration aimed at strengthening access to finance and insurance for smallholder farmers across the African continent.

This collaboration brings together three organizations with complementary expertise:

ACRE Africa, a leading agricultural insurance broker specializing in the design of innovative risk management products; ;

ZEP-RE, a regional reinsurance company with extensive experience in agricultural and weather insurance solutions; ;

The Grameen Crédit Agricole Foundation, an impact investment vehicle committed to financing microfinance institutions and promoting inclusive agriculture.

A long-standing partner and shareholder of ACRE Africa since 2014, the Foundation has been actively involved for many years in promoting agricultural microinsurance for smallholder farmers.

As part of this collaboration, the three organizations have committed to:

✅ Conduct joint fundraising initiatives to support agricultural financing programs; ;

✅ Explore equity investment opportunities to strengthen their collective impact; ;

✅ Sharing technical expertise to develop and evolve agri-credit and group insurance solutions.

The common goal is clear: to strengthen the resilience, productivity and financial inclusion of farmers through better access to credit supported by effective risk mitigation tools.

This strategic alliance reflects the shared commitment of the three partners to work together in good faith to stimulate sustainable and inclusive agricultural development in Africa, creating a lasting positive impact for smallholder farmers and their communities.

Watch the video to learn more. this link.

The Grameen Crédit Agricole Foundation at the World Forum on the Social and Solidarity Economy in Bordeaux

From October 29 to 31, 2025, the city of Bordeaux hosted for the first time in France the World Forum on the Social and Solidarity Economy (GSEF). This major international event brought together more than 10,000 participants came from five continents elected officials, leaders, experts, field actors, representatives of development agencies and international organizations, all mobilized to promote more sustainable, equitable and inclusive economic models.

The Grameen Crédit Agricole Foundation was represented there by Veronique Faujour, General Delegate, and Philippe Guichandut, Secretary General. Their participation helped to highlight the Foundation's role in financing the social and solidarity economy and its commitment to inclusive finance in the service of sustainable development.

Two presentations particularly highlighted the Foundation's presence during this 7th edition of the Forum:

- During the plenary session dedicated to financing the social and solidarity economy, Véronique Faujour presented the Foundation's mission, strategic priorities, and action tools. She notably highlighted the launch of the fund Women Empowerment for Climate, An impact fund dedicated to women's economic empowerment and climate adaptation. This fund targets three key sectors in which women play a vital role: access to clean water, access to renewable energy, and the promotion of sustainable agricultural techniques. These initiatives aim to strengthen the resilience of local communities to climate change, while fostering greater economic inclusion for women.

- During a workshop on financial inclusion and women's leadership, Véronique Faujour emphasized that successful transitions are built from the ground up, closely aligned with community needs. She highlighted the importance of a leadership exercised by women, for women and with women, an essential condition according to her, for local solutions to inspire and guide global development policies.

This edition of the GSEF, placed under the sign of dialogue, of the cooperation and of the sharing experiences, This has enabled the creation of new bridges between public, private, and civil society actors. The fruitful discussions throughout the forum have given rise to concrete perspectives for strengthening the collective impact of the social and solidarity economy in the years to come.

The meeting concluded with a final declaration that will define a common roadmap for the next two years, confirming the global momentum towards a fairer, more inclusive and resilient economy.

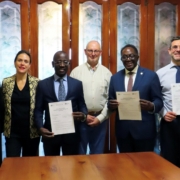

Strengthening financial inclusion in Malawi: a new partnership between the Grameen Crédit Agricole Foundation and Centenary Bank Malawi

On October 13, 2025, in Nairobi (Kenya), the Grameen Crédit Agricole Foundation and Centenary Bank Malawi (CBLM), member of the Centenary Group, signed a Statement of intent marking an important step in the development of inclusive finance in Malawi.

This partnership is part of the shared mission of both institutions. to promote inclusive financial services, innovative And durable, with particular attention paid to women entrepreneurs and rural populations.

This future collaboration is based on three major pillars:

- Technical assistance : the Foundation and CBLM will work together to identify and implement technical support in key areas such as inclusive finance, risk management, digitalization and agricultural finance.

- Financial support : The Foundation aims to become CBLM’s first private international lender, thereby helping to strengthen its financial base and expand its financing capacity.

- Catalytic effect By supporting this partnership, the Foundation aims to encourage the attraction of additional investments and stimulate the development of the Malawian financial sector.

This new commitment builds on the vision and successes of the Centenary Group, particularly through Centenary Bank Uganda, and is in line with the Foundation's strong historical roots in Malawi.

The Foundation extends its sincere thanks to Mr. Godfrey Helewala, Managing Director of CBLM, and Mr. John DeLuca, Executive Chairman of the Centenary Group, for their trust and commitment. Together, they are laying the foundations for a more inclusive and resilient financial future for Malawi.

Grameen Crédit Agricole Foundation at the African Inclusive Finance Week (SAM 2025)

The Foundation participated in African Inclusive Finance Week (SAT 2025), which was held in Nairobi from October 7 to 11. This major industry event brought together more than 1,200 inclusive finance actors from across the continent to discuss the challenges and the sector innovations.

SAM 2025 Nairobi, Kenya ©Philippe Lissac/GODONG

Present alongside numerous partners, the Foundation took part in several panels and workshops devoted to essential themes:

On the first day, the Foundation organized a workshop on the ’ Climate emergency and economic vulnerability : Spotlight on inclusive finance and insurance», with the participation of the MicroInsurance Network (MIN) and hosted by Hanadi TUTUNJI.

Later in the day, Edouard SERS and Philippe GUICHANDUT spoke and moderated a session on « Impact Bridges : Connecting Europe and Africa for a Sustainable Future», organized by Financing Innovation Tool (FIT).

On the second day, Khady FALL spoke in the workshop « When regulations change, who is left behind? – How are new regulations redefining inclusive finance in Africa? The case of UMOA», and Philippe GUICHANDUT spoke in the workshop « Prospective : mixed models and non-traditional financing possibilities».

Finally, on Thursday, the Foundation organized a workshop on the ’ Financial inclusion of forcibly displaced persons : what economic opportunities for displaced people, PSF and investors? », led by Hanadi TUTUNJI who also spoke later in the workshop « Climate Risk Coverage for Impact Investors »", organized by the MicroInsurance Network.

And finally, the Foundation organized a final workshop on the « Techno-Human : AI & Digital for Inclusive and Human Finance in Africa».

The discussions highlighted several strong trends:

- Digital transformation, which opens new perspectives for reaching rural populations, while highlighting the importance of the human connection in customer relations.

- Climate finance, which has become an essential lever for strengthening the resilience of vulnerable communities in the face of environmental shocks.

- Blended finance, combining public and private capital, as a key driver of sustainable financing and attracting responsible investments.

For the Foundation, committed to supporting microfinance institutions and social enterprises in Africa—which represent more than 50 % of its partners and 40 % of its portfolio—this edition of the SAM was an opportunity to strengthen ties, listen to the needs on the ground and reaffirm its commitment to more inclusive and resilient finance.