ADA, Inpulse, and the Grameen Crédit Agricole Foundation have partnered to monitor and analyze the effects of the Covid-19 crisis on their partner microfinance institutions around the world. This monitoring was carried out periodically throughout 2020 to gain a better understanding of how the situation is evolving. With this regular and in-depth analysis, we hope to contribute, at our level, to the development of strategies and solutions tailored to the needs of our partners, as well as to the dissemination and exchange of information between the various stakeholders in the sector.

In summary

The results presented in this article come from the fifth survey in the joint series (1) of ADA, Inpulse and the Grameen Crédit Agricole Foundation. Responses were collected in the second half of December from 74 microfinance institutions (MFIs) located in 42 countries in Eastern Europe and Central Asia (EAC-28%), Sub-Saharan Africa (SSA-26%), Latin America and the Caribbean (LAC-23%), South Asia (14%) and the Middle East and North Africa (MENA-9%) (2).

Our latest work confirmed the gradual resumption of MFI activity in the summer of 2020, for which most of the operational difficulties encountered in the context of the COVID-19 crisis were fading. At the same time, the major constraint that remained was the difficulty in collecting loan repayments, and implied the increase in the portfolio at risk. This last point still holds at the end of the year, and three-quarters of respondents still note an increase in the PAR. Added to this is the deterioration of the epidemiological situation in the world in the fall of 2020, as evidenced by the responses collected in December 2020. The epidemic containment measures taken according to local contexts may once again have consequences for the activities of MFIs and their clients, and a return to normal is not yet on the agenda.

However, these new complications and their implications are not new. As such, they have little impact on MFIs' risk indicators. The stability of the PAR increase, as well as the recovery levels, does not reflect any major new worsening of the MFIs' financial situation. This relative balance also reflects the MFIs' state of mind as they approach 2021. Despite an unstable context and all the obstacles it brings, the vast majority of our partners anticipate growth in their business in this new year, both in terms of portfolio volume and the number of clients. This confidence, which was already evident in the surveys conducted over the summer, is a new sign of the resilience of these institutions.

1. MFIs always operate in unstable conditions

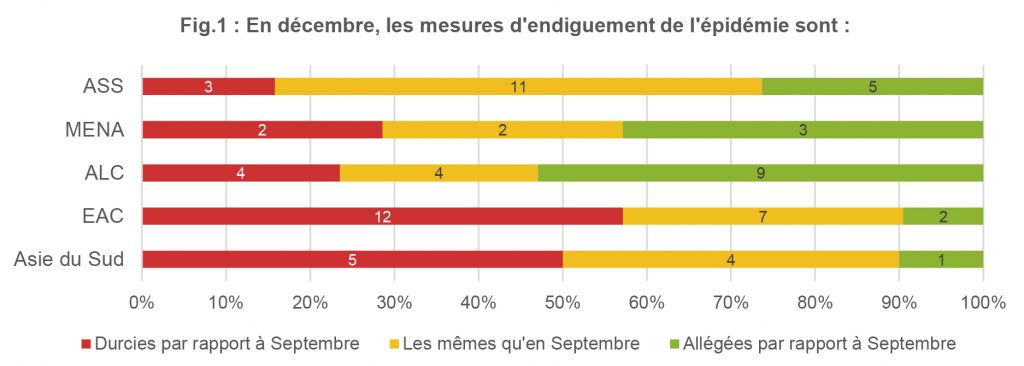

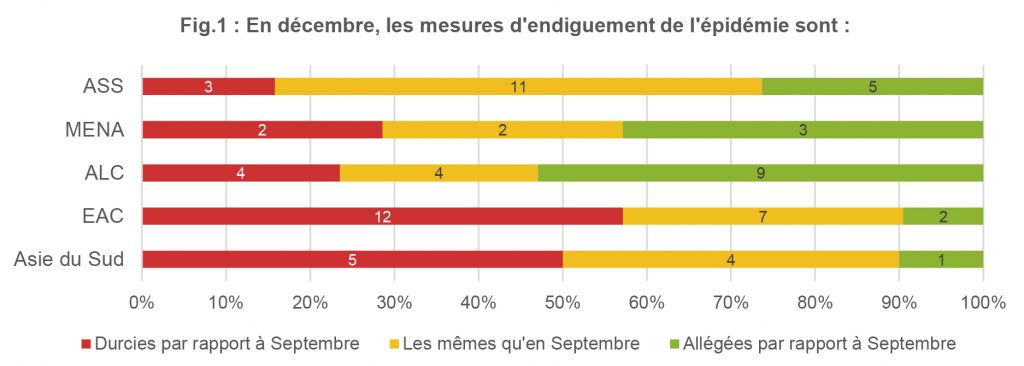

Our latest survey, conducted in October, demonstrated a significant improvement in the operating environment of MFIs and demonstrated the gradual resumption of their activities in all regions of the world. However, in a large number of countries, even those that appeared to be managing the spread of the virus well, new, more restrictive measures to contain the epidemic were taken in the last quarter of 2020 in response to the renewed rise in cases. This deterioration is particularly confirmed by our partners in Europe and Asia, while MFIs in South and Central America, Southern Africa, and North Africa report an improvement in the situation.

The comparison of the responses of our 38 partners who participated in the October and December surveys (3) in the following paragraphs confirms the observation of a return of certain difficulties for MFIs, and reflects the general results obtained at the end of the year.

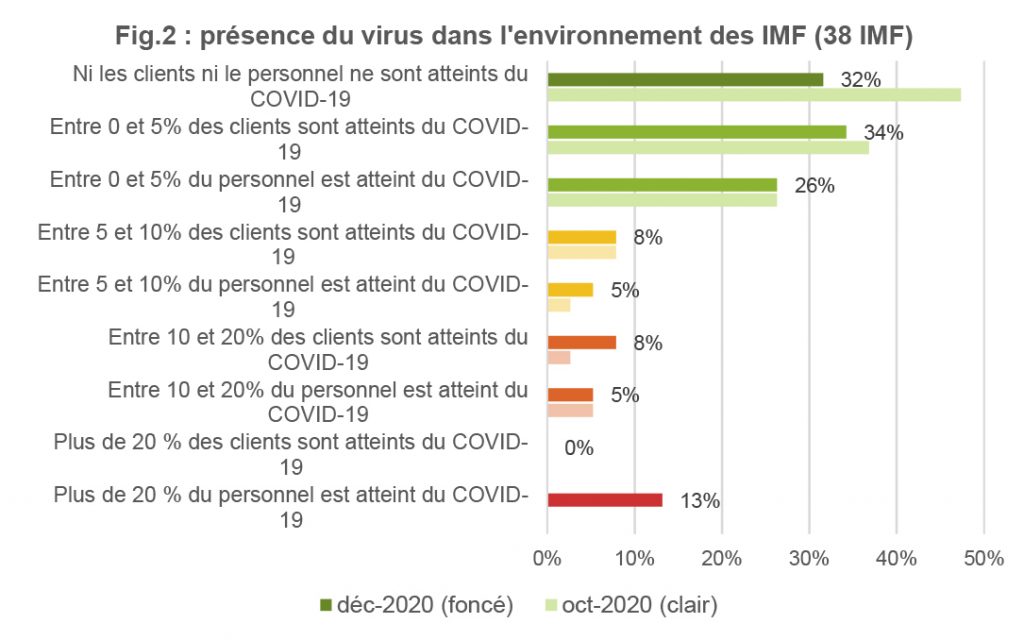

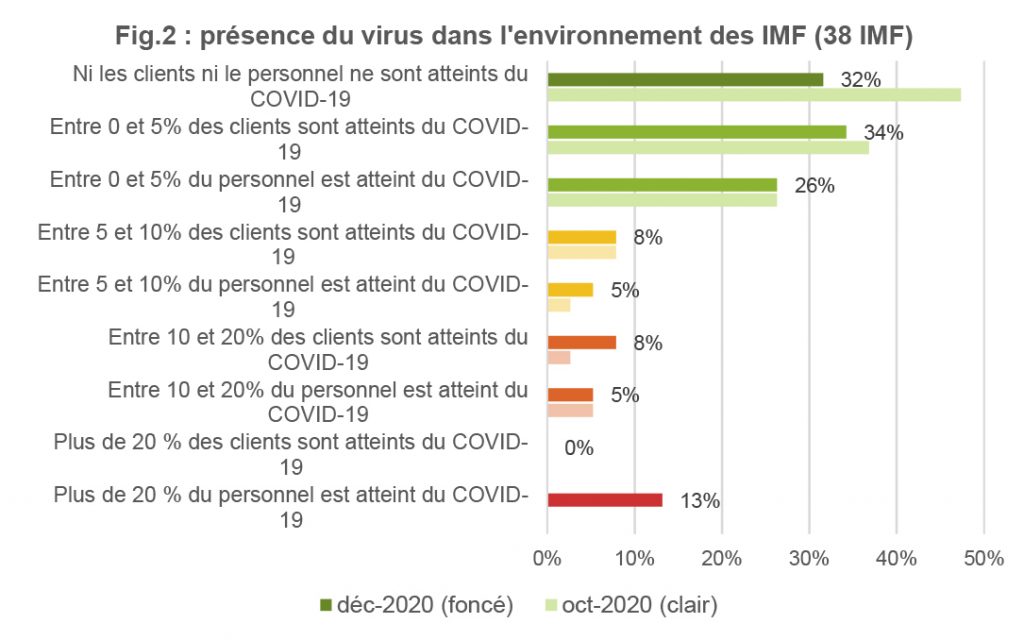

First, the virus continues to spread rapidly in some parts of the world, and MFIs are no exception. Thus, we can see an increase in the share of MFIs reporting that clients and staff have been infected with COVID-19. This is reflected in the decline from 47% to 32%, (17 to 12 MFIs) of MFIs whose clients and staff are not infected with COVID-19. In October, this category included two-thirds of MFIs in sub-Saharan Africa (10/15) and the vast majority of those in South Asia (5/6). In December, the share of MFIs in sub-Saharan Africa is almost stable (9/15), while those in Asia decline to 50% (3/6). Finally, the category “more than 20% of staff were infected” went from 0% to 13% (5 MFIs) over the period, the vast majority in the Europe and Central Asia region (4 MFIs).

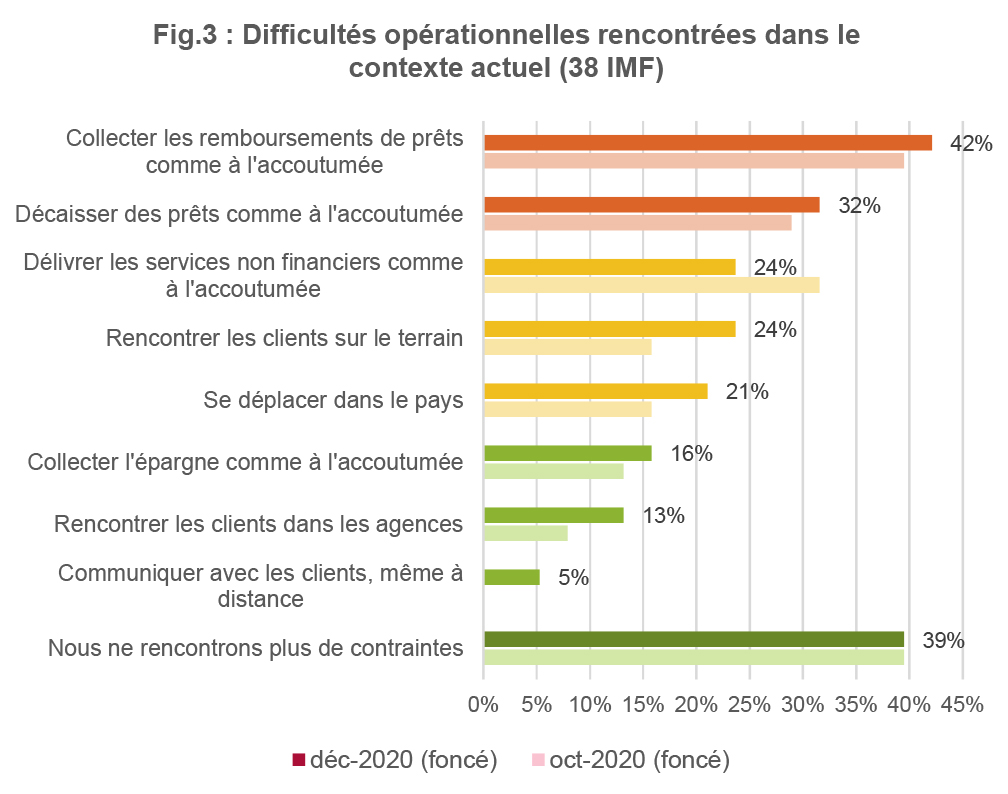

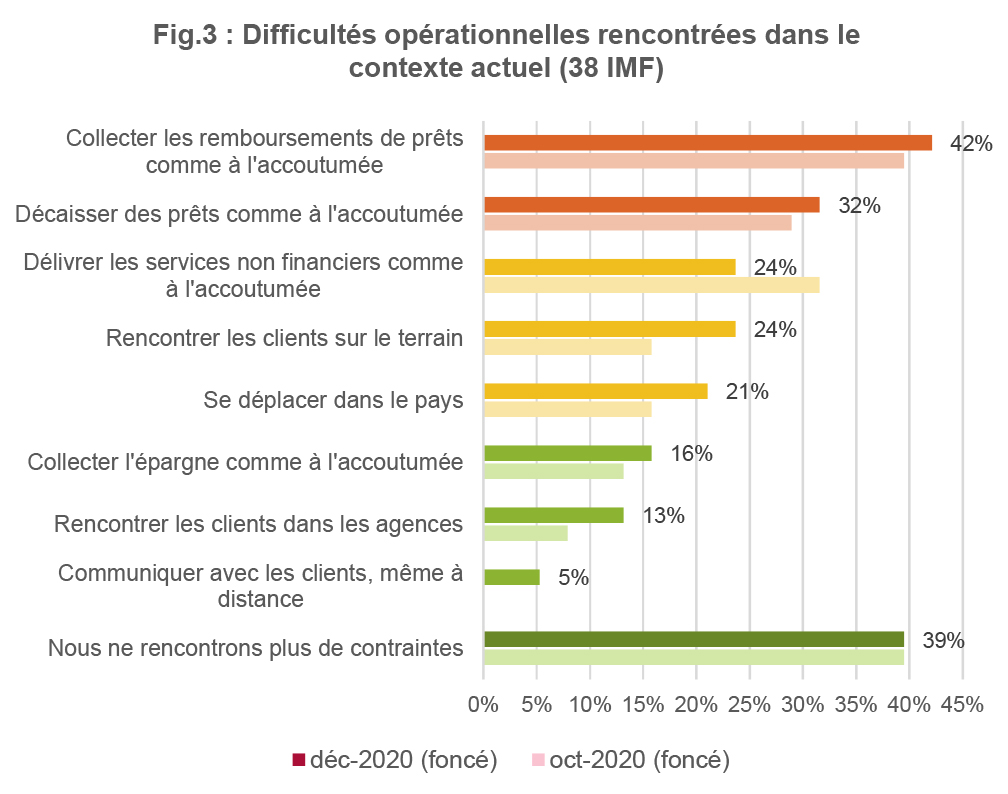

In terms of operational constraints, the results are relatively stable between the two periods. The list of MFIs that indicate they no longer face operational constraints remains essentially the same (39%), and is concentrated in Central Asia and West Africa. It should be added that collecting loan repayments (42% of the sample) and disbursing new loans (32%) remain the two main difficulties encountered by MFIs.

Difficulty in contacting clients, both in branches and in the field, was considered a consequence of the crisis by only 16% (6 MFIs) in this sample in October, and this figure increased in December (24%, 9 MFIs). In detail, it should be noted that the location of the MFIs highlighting this constraint has changed over the last two months. Thus, they were notably located in Latin America and the Caribbean and East Africa in October. In December, this point was raised by MFIs in Southeast Asia (3/6), Eastern Europe (2/5) and West Africa (2/8). At the overall level of the survey, it is ultimately 30% of the MFIs that specify that they are once again limited in their activities, despite a gradual recovery.

2. Customers therefore remain exposed

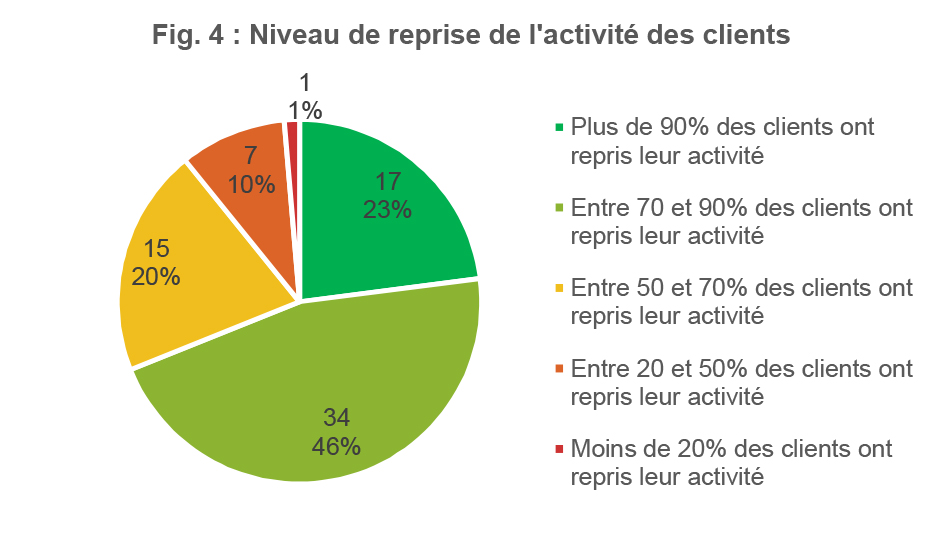

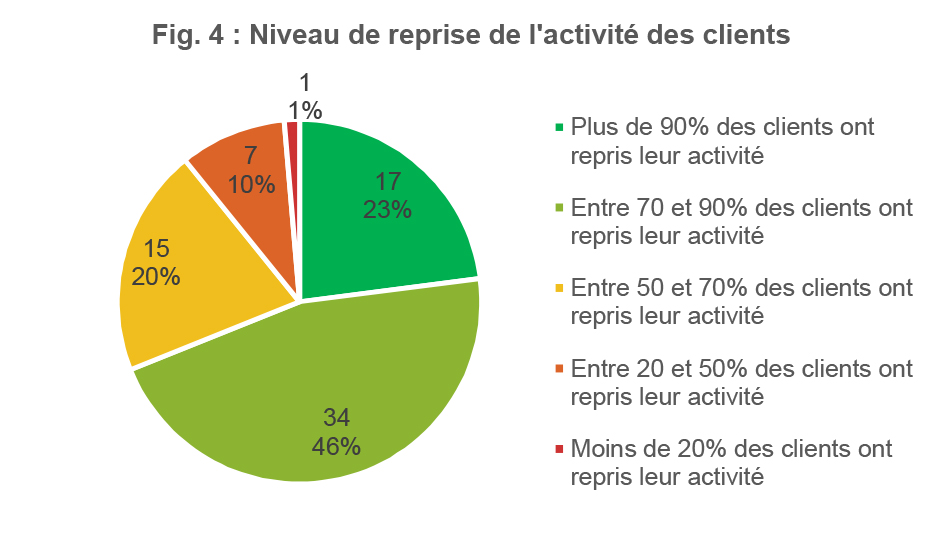

As the MFIs demonstrate through these surveys, the uncertain and particularly unstable context also weighs on MFI clients. And logically, the difficulty in collecting repayments for MFIs, for example, is closely linked to the difficulties encountered by the clients themselves. The activity of a large proportion of them has still not restarted or remains slowed down by the crisis context: our last survey highlighted in particular the tourism and trade sectors as being the most affected (4). As of December 2020, the proportion

of MFIs indicating that more than 90% of their clients have resumed their activity remains a minority (23%, 17 MFIs). However, 46% (34 MFIs) of the MFIs indicate that clients who have resumed their activity represent between 70% and 90% of their portfolio. And only 11% (8 MFIs) of the respondents indicate that less than 50% of their clients can resume work. However, there are some regional disparities in these results: in South Asia, Europe and Central Asia, and Sub-Saharan Africa, at least 80% of the respondents indicate that more than 70% of clients have resumed their activity. In the MENA and Latin America and the Caribbean regions, this share is reduced to 43% and 41% respectively.

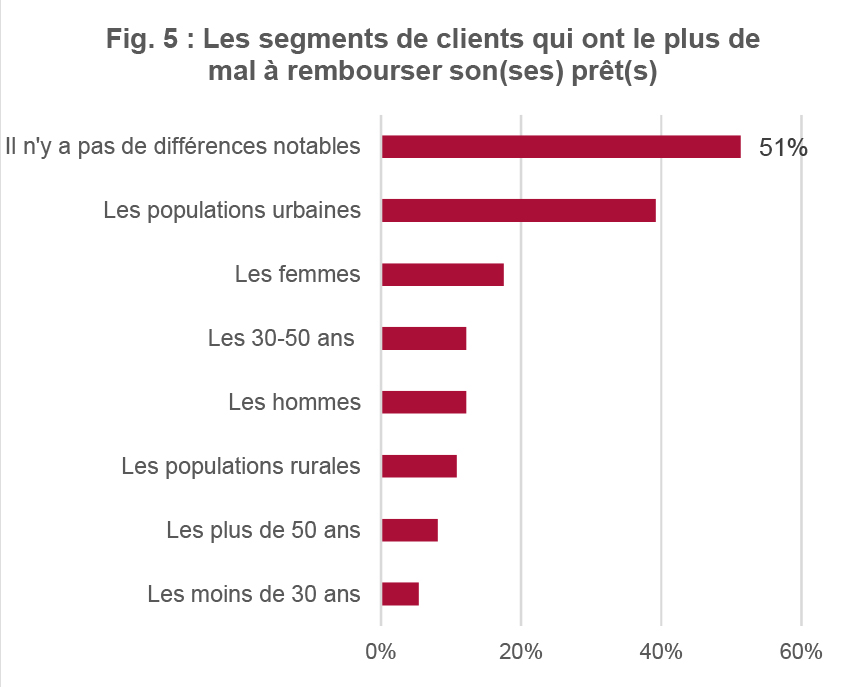

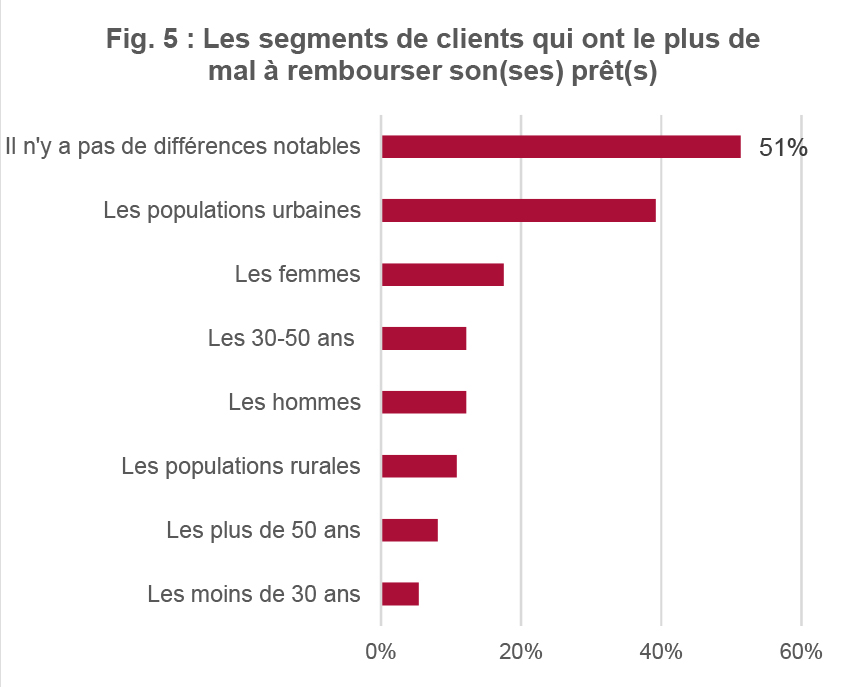

Our partners' responses also allow us to continue profiling the clients most impacted by the crisis. First, it should be noted that a large proportion of the MFIs surveyed exclude the possibility that there is a category of clients more affected than others, whether in terms of gender, location (urban or rural), or age. In detail, 42% (31 MFIs) of those surveyed believe that all their clients are impacted equally, and 51% (38 MFIs) indicate that there is no notable difference in repayments based on these criteria. Generally speaking, the idea that there is a difference in exposure to the impact of the crisis based on age is also dismissed. And while some MFIs say they see differences based on age categories (-30, 30-50, 50+), none of them stand out.

Our partners' responses also allow us to continue profiling the clients most impacted by the crisis. First, it should be noted that a large proportion of the MFIs surveyed exclude the possibility that there is a category of clients more affected than others, whether in terms of gender, location (urban or rural), or age. In detail, 42% (31 MFIs) of those surveyed believe that all their clients are impacted equally, and 51% (38 MFIs) indicate that there is no notable difference in repayments based on these criteria. Generally speaking, the idea that there is a difference in exposure to the impact of the crisis based on age is also dismissed. And while some MFIs say they see differences based on age categories (-30, 30-50, 50+), none of them stand out.

Among the MFIs that perceive a difference in the impact of the crisis on their clients (36 MFIs), one criterion stands out most: 76% (27 MFIs) believe that the most impacted populations are urban populations. The same proportion states that this difference is felt in loan repayments. These responses confirm the previous results we obtained concerning the most affected sectors, decidedly urban. The fact that the rurality criterion is rarely mentioned points in the same direction, and echoes the agriculture sector, revealed over the course of the surveys by our partners as a sector less affected by the Covid-19 crisis than the others, and towards which a certain number of MFIs imagined wanting to move. Finally, one last characteristic is mentioned by the MFIs noting disparities in the impact of the crisis: 36% (13 MFIs) perceive that women are more affected than men and therefore by default could have more difficulty repaying their loans. Note that some of the respondents only serve female clients, which logically makes them the most affected population in the sector.

3. Challenges now well known to MFIs

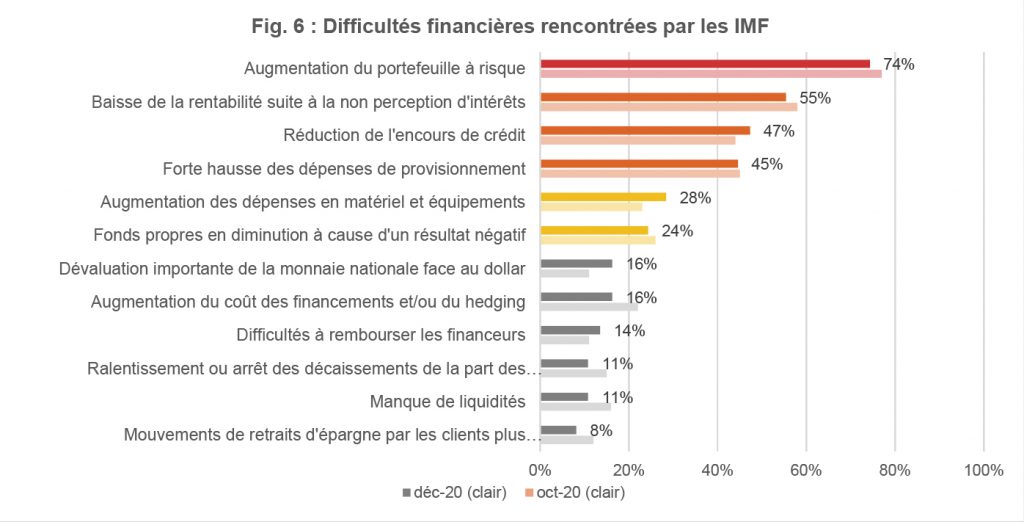

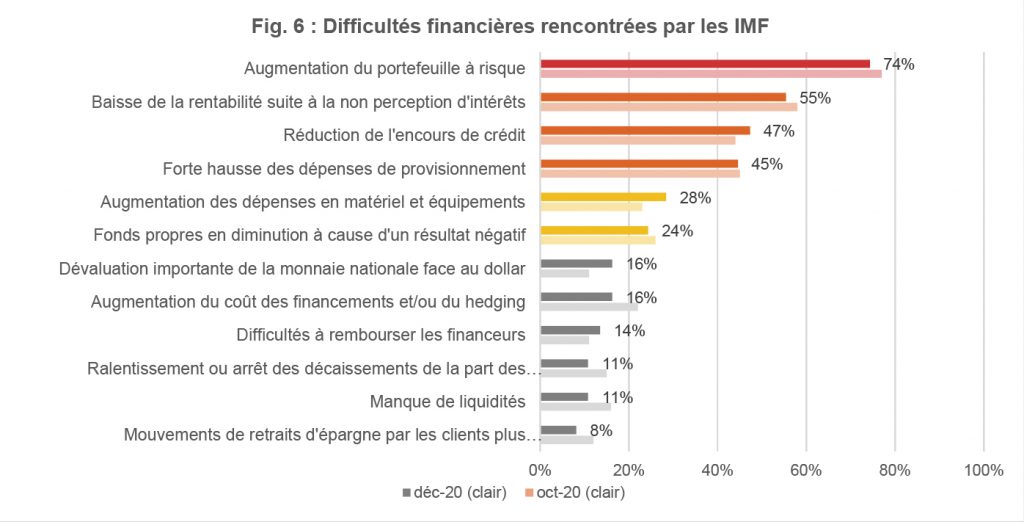

Continued low activity levels and COVID-19 containment measures implemented by local authorities are now factors that MFIs are aware of. And to which they are adapting. Thus, the financial difficulties mentioned by MFIs were very stable from October to December 2020, and did not reveal any new trends. Two of the four most cited difficulties remain linked to the decline in MFI profitability, due to the increase in provisioning expenses (45% of respondents, 33 MFIs) and the non-collection of interest (55%, 41 MFIs). These two points are closely linked to the most significant difficulty of the crisis for MFIs during this period: the increase in the portfolio at risk (74%, 55 MFIs).

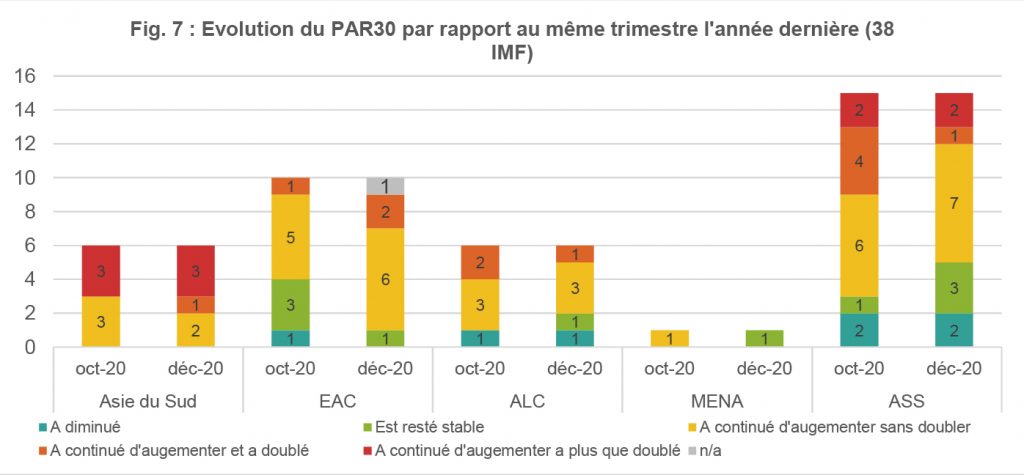

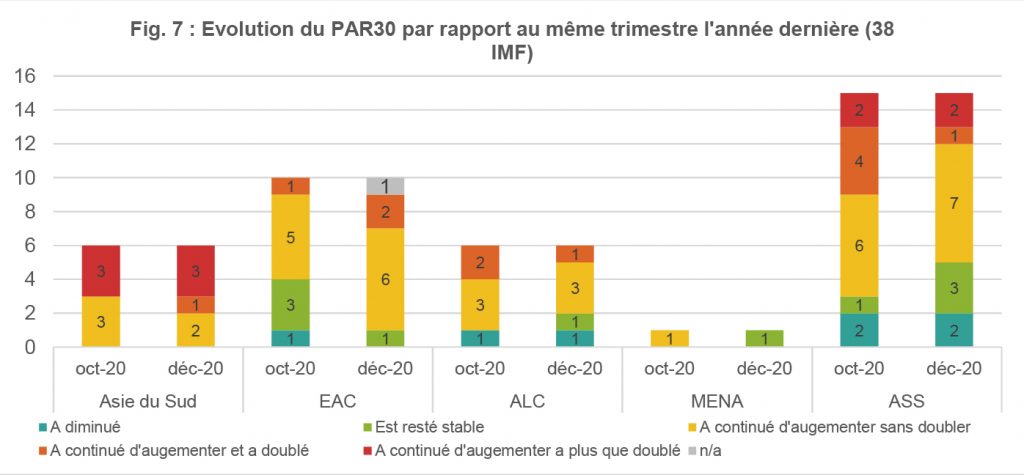

As of December 2020, 74% (55 MFIs) of respondents indicate that more than 70% of clients are repaying their loans, and 37% report a client repayment level above 90%. On the other hand, only 9% report that less than 50% of clients are managing to repay their loans, which coincides with the levels of client activity recovery. These levels are reflected in the MFIs' portfolio at risk level: as of December 2020, 47% of respondents (35 MFIs) indicate that PAR 30 has increased without doubling, 16% that it has doubled, and 12% that it has more than doubled.

Nevertheless, this risk configuration appears to have generally stabilized in the last quarter of 2020, despite the additional constraints presented previously (see Fig. 7). In the sample common to the October and December surveys, we still find a quarter of MFIs that are not affected by this increase in the portfolio at risk. At the same time, no MFI is added to the list of MFIs whose PAR 30 has more than doubled. The vast majority of transfers from one category to another over the October-December period are made between a stable PAR and a PAR that is increasing without doubling. This is therefore a sign that the deteriorations in local contexts presented previously would not affect all clients, thus having only a moderate impact on the MFIs' risk indicators.

This stability coincides with the MFIs' new objectives at the start of the new year. The crisis has disrupted their operations and inevitably impacted their projections. Thus, 58% of the MFIs report having updated their business plan and growth objectives for the coming months and years. Armed with these lessons learned from the crisis and a better understanding of the context, the vast majority of MFIs still plan to continue growing in 2021. Thus, 80% of the respondents expect their portfolio volume to increase this year, while 15% expect it to stagnate and 5% anticipate a decline. Moreover, this increase in the portfolio should also be accompanied by an increase in the number of clients for 75% of the MFIs that anticipate growth in this new year. A new sign of hope, therefore, but also of ambition on the part of institutions determined to continue moving forward in 2021.

_____________________________________________________________________________________

(1) The results of the first four surveys of ADA partners, Inpulse and the Grameen Agricultural Foundation are available here: https://www.gca-foundation.org/observatoire-covid-19/, https://www.ada-microfinance.org/fr/crise-du-covid-19 And https://www.in-pulse.coop/news-and-media/

(2) The number of responding MFIs per region is as follows: SSA 19 MFIs; LAC 17 MFIs; EAC 21 MFIs, South Asia 10 MFIs; MENA: 7 MFIs.

(3) The sample is 38 MFIs: 6 in South Asia, 10 in Eastern Europe and Central Asia, 6 in Latin America and the Caribbean, 1 in MENA and 15 in sub-Saharan Africa.

(4) https://www.gca-foundation.org/espace-medias/#covid-19-une-reprise-des-imf-progressive-au-rythme-de-celle-de-leurs-clients

Our partners' responses also allow us to continue profiling the clients most impacted by the crisis. First, it should be noted that a large proportion of the MFIs surveyed exclude the possibility that there is a category of clients more affected than others, whether in terms of gender, location (urban or rural), or age. In detail, 42% (31 MFIs) of those surveyed believe that all their clients are impacted equally, and 51% (38 MFIs) indicate that there is no notable difference in repayments based on these criteria. Generally speaking, the idea that there is a difference in exposure to the impact of the crisis based on age is also dismissed. And while some MFIs say they see differences based on age categories (-30, 30-50, 50+), none of them stand out.

Our partners' responses also allow us to continue profiling the clients most impacted by the crisis. First, it should be noted that a large proportion of the MFIs surveyed exclude the possibility that there is a category of clients more affected than others, whether in terms of gender, location (urban or rural), or age. In detail, 42% (31 MFIs) of those surveyed believe that all their clients are impacted equally, and 51% (38 MFIs) indicate that there is no notable difference in repayments based on these criteria. Generally speaking, the idea that there is a difference in exposure to the impact of the crisis based on age is also dismissed. And while some MFIs say they see differences based on age categories (-30, 30-50, 50+), none of them stand out.