ADA, Inpulse, and the Grameen Crédit Agricole Foundation have partnered to monitor and analyze the effects of the Covid-19 crisis on their partner microfinance institutions around the world. This monitoring is carried out periodically and will continue throughout 2020 to gain a better understanding of how the situation is evolving. With this regular and in-depth analysis, we hope to contribute, at our level, to the development of strategies and solutions tailored to the needs of our partners, as well as to the dissemination and exchange of information between the various stakeholders in the sector.

In summary

The results presented in this article come from a fourth survey [1] in a series jointly conducted by ADA and the Grameen Crédit Agricole Foundation, with Inpulse choosing to join the initiative every other year. Responses were collected between October 1 and 20 from 73 microfinance institutions (MFIs) in 38 countries in sub-Saharan Africa (SSA-37%), Latin America and the Caribbean (LAC-25%), Eastern Europe and Central Asia (EAC-18%), Asia (15%) and the Middle East and North Africa (MENA-4%) [2].

As previous surveys revealed that the main financial challenge for MFIs was the increase in their portfolio at risk (PAR), the new survey focused more closely on the situation of MFI clients and the recovery of their activities. Indeed, this is the main basis on which MFIs' activities depend. Above all, the results of this survey confirm the gradual recovery of MFI activity, with a reduction in most of the operational constraints initially encountered. The major remaining constraint concerns the collection of loan repayments, which explains the increase in PAR as the main financial challenge for MFIs.

This difficulty in collecting loans may be due to external constraints, mobility or moratorium imposed by the authorities, or to difficulties encountered by the clients themselves, for whom activity cannot always restart or is slowed down by the crisis context. Indeed, if the peak of the health crisis has passed and if it has less affected certain regions such as sub-Saharan Africa or Southeast Asia, which has allowed a certain number of sectors of activity to restart, the time has not yet come to return to normal. In particular, the restrictive measures and the overall economic situation have had and still have negative impacts on activity in a certain number of sectors, and therefore on the sources of income of the populations. This consequently affects MFIs and their financial situation, which is why it seems essential to closely monitor how the crisis is experienced by their clients, in order to adapt to their needs in a reactive manner by proposing solutions that will allow everyone, clients and MFIs alike, to survive this crisis.

1. A RECOVERY OF MFIS STILL CONSTRAINED BY THE DIFFICULTY IN COLLECTING LOAN REPAYMENTS

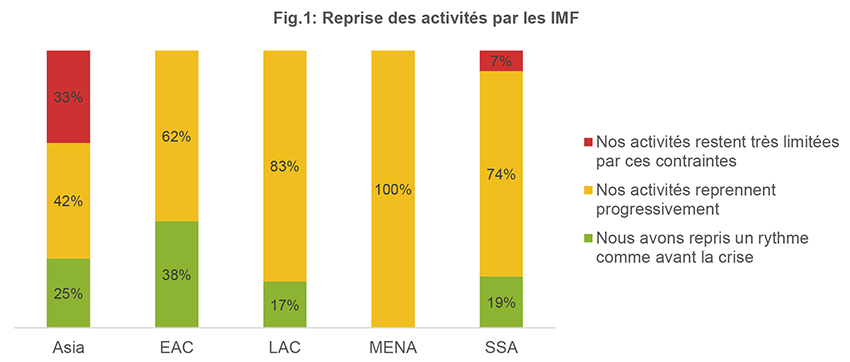

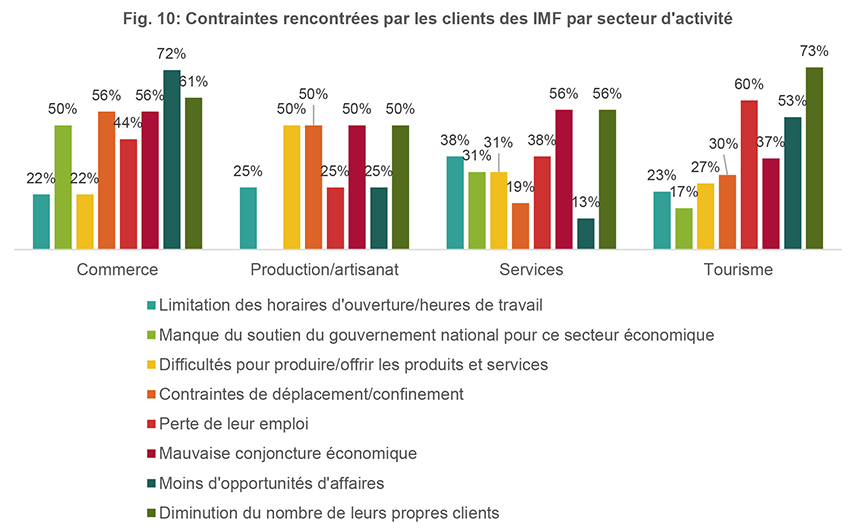

The responses collected during this month of October show that most MFIs are gradually resuming their activities (Fig. 1). Only some MFIs in Myanmar remain very limited in their activities due to the constraints encountered following the containment measures currently in force in the country, as well as those of a minority of MFIs in sub-Saharan Africa (one MFI in Mali and one in Malawi). The proportion of MFIs having returned to a normal pace of activity is highest in the Europe and Central Asia region.

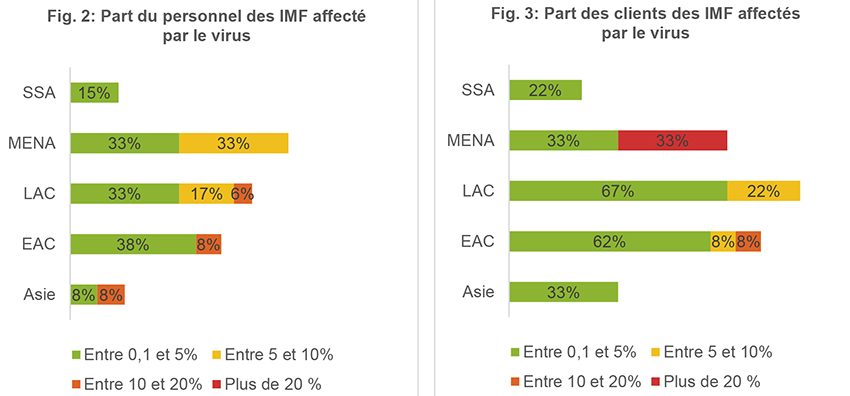

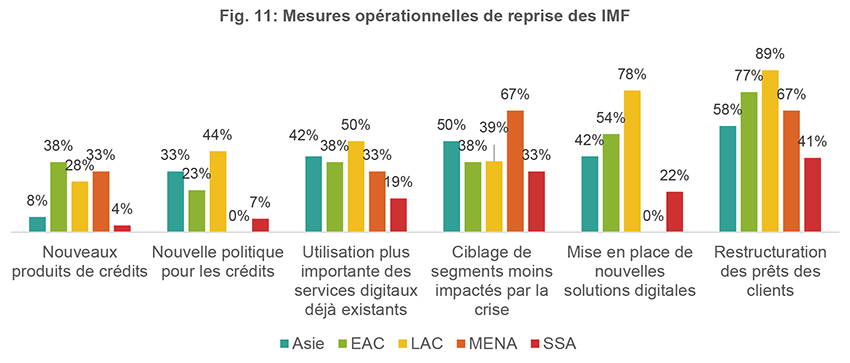

One of the constraints faced by MFIs revealed in previous surveys was the fact that some of their staff and clients were infected with COVID-19. Therefore, we were interested in the prevalence of Covid-19 disease among staff and clients (Figs. 2 and 3).

The situation is contrasting from this point of view: the sub-Saharan Africa region appears to be the least affected, with a low proportion of MFIs reporting that some of their staff (15%) or their clients (22%) are affected. This proportion also remains very low (between 0.1 and 5%), and 70% of the MFIs in the region report that neither their clients nor their staff are affected by the virus. The Latin America and Caribbean region is, on the contrary, the most affected [3], followed by Europe and Central Asia, with a greater proportion of MFIs concerned (only 11% of the MFIs in the LAC region report that neither their clients nor their staff are affected), and higher prevalence rates for some of these MFIs. Nevertheless, while the health situation is more problematic in these regions, it remains for the moment a relatively minor constraint for MFIs.

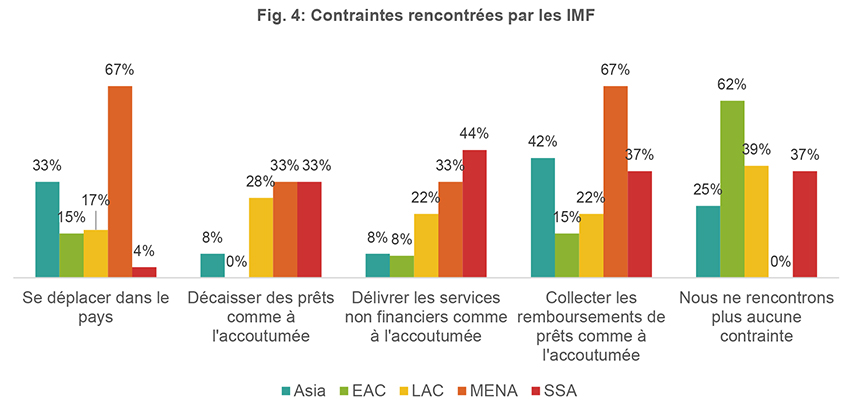

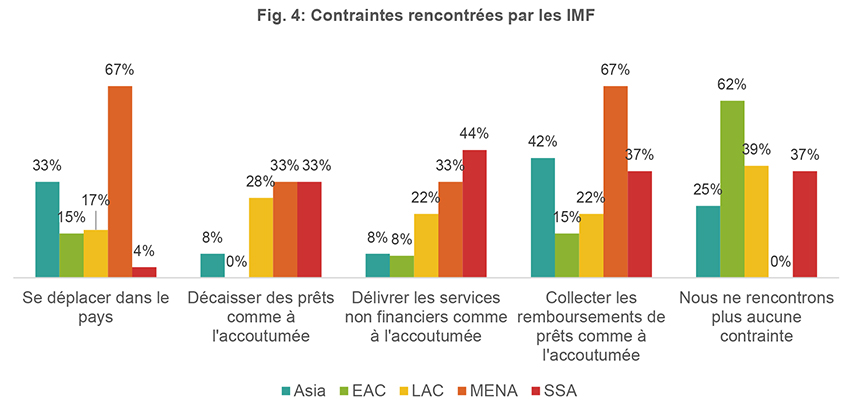

Moreover, overall, a relatively large proportion of MFIs even report no longer facing any constraints (Fig. 4), particularly in the Europe and Central Asia region (62%), while those that continue to face a certain number of them are increasingly fewer in number over the surveys, which reflects the trend towards gradual recovery.

The main remaining constraint, cited by 32% of the MFIs in the total sample, is the difficulty in collecting loan repayments. This has resulted in an increase in the portfolio at risk, which is still the primary financial difficulty encountered by MFIs in all regions, and cited as such by 77% of them, while other difficulties tend to be cited less and less over the course of the surveys.

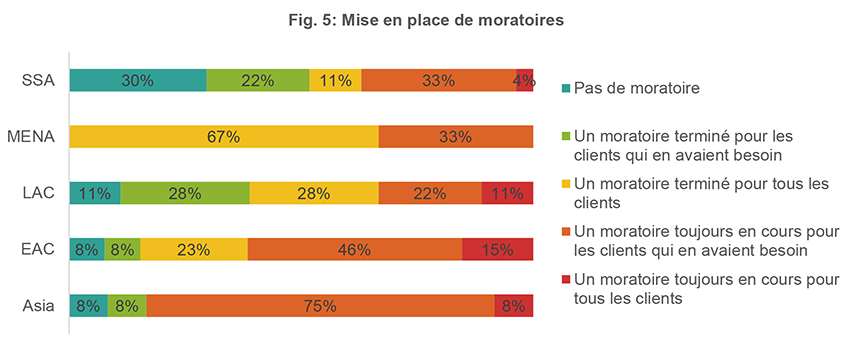

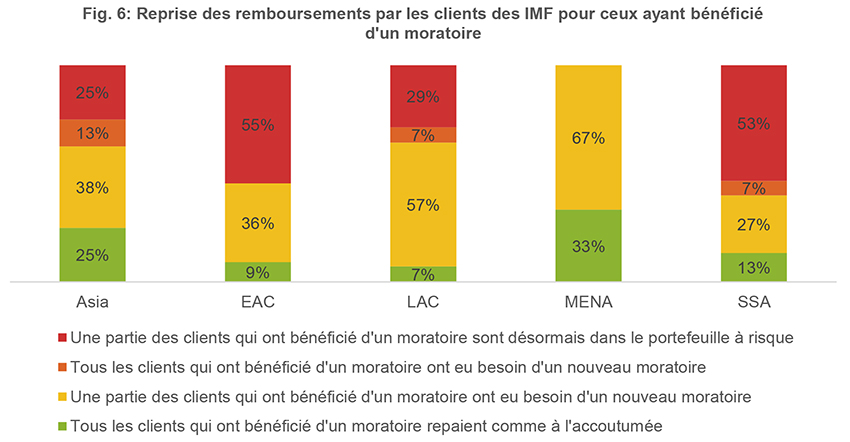

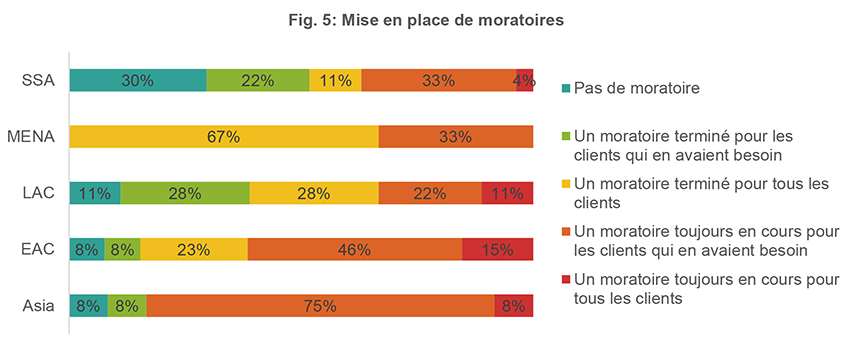

This difficulty or impossibility in collecting loan repayments can be explained by mobility constraints, particularly in countries or regions where restrictive measures are still in force, but also by the implementation of moratoria, whether by the authorities or by the MFIs themselves if clients needed them. Indeed, the implementation of a moratorium concerned the majority (84%) of the MFIs in the sample surveyed (Fig. 5), and a moratorium is even still in force for at least some of the clients for 48% of the MFIs in total, Asia being the region where this situation is most frequent (83% of the MFIs in the region present in the sample).

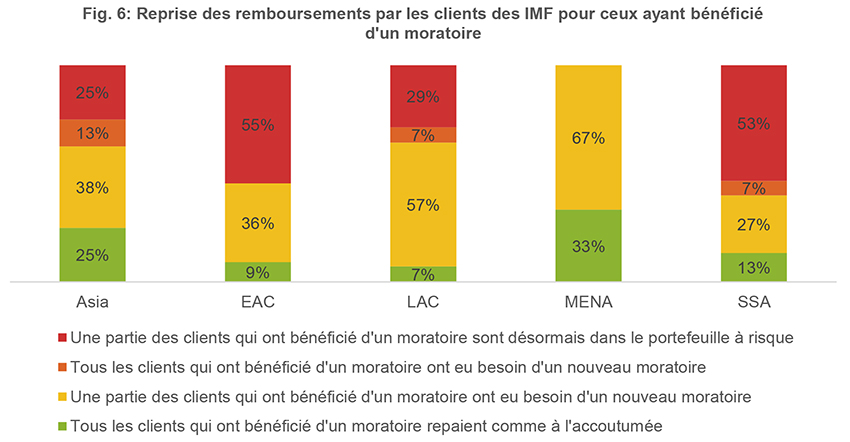

Among clients who benefited from a moratorium, those who are now repaying their loans as usual represent a minority (Fig. 6). The majority of MFIs (86% in the sample) report that some or all of their clients needed a new moratorium, or are now even in the risk portfolio, with 39% of the MFIs in the sample being affected by this latter situation. In Europe and Central Asia and in sub-Saharan Africa, more than half of the MFIs even mention the transfer to the risk portfolio of some of the clients who benefited from a moratorium.

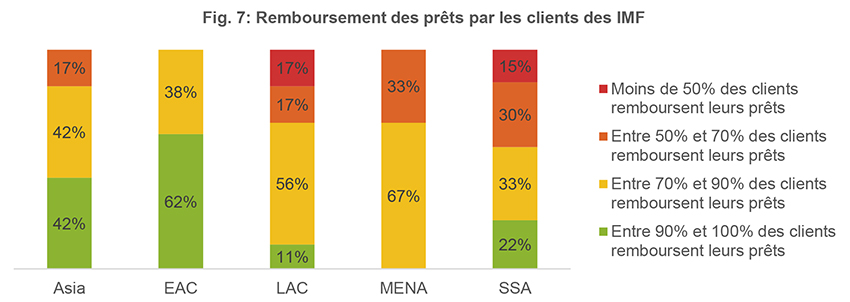

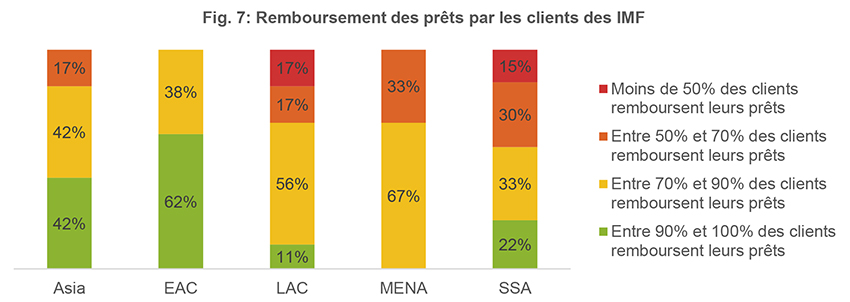

However, overall, the majority of MFIs in each region report that at least 70% of their clients repay their loans (Fig. 7). In South and Central Asia and Europe, more than 80% of respondents have repayment levels above 70%. In contrast, the situation is worst in Latin America and the Caribbean and Sub-Saharan Africa, where 34% and 45% of MFIs have fewer than 70% of clients repay their loans, and 17% and 15% have this proportion below 50%.

2. MFI CLIENTS THEMSELVES FORCED IN THEIR RECOVERY

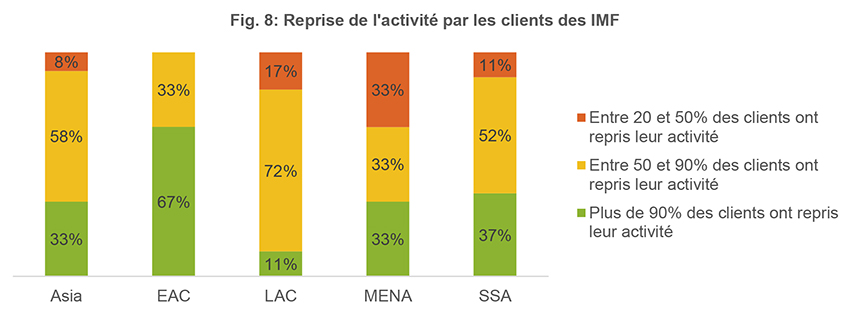

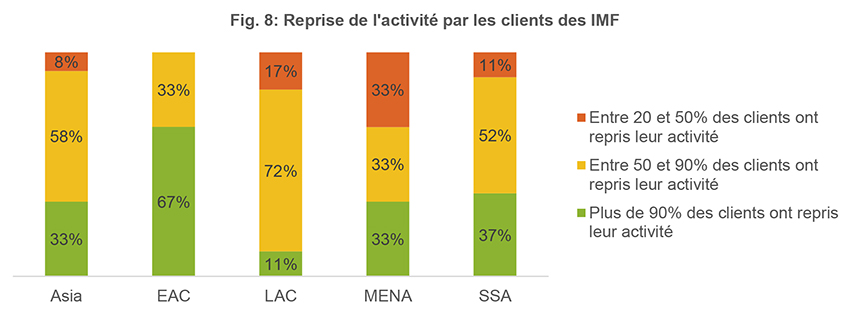

These volatile repayment levels, which are lower than pre-crisis habits, are explained in particular by the fact that not all clients are still able to resume their activities: except in the Europe and Central Asia region once again, MFIs reporting that 90% of their clients or more have resumed their activities are in the minority. However, for the majority of MFIs in the sample (54% in total), between 50 and 90% of clients have resumed their activities. The overall trend is therefore one of gradual recovery.

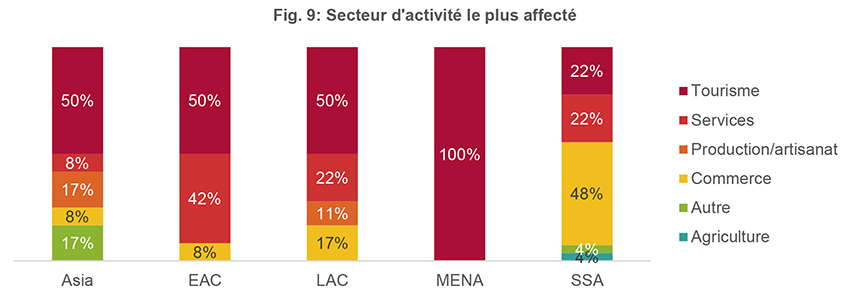

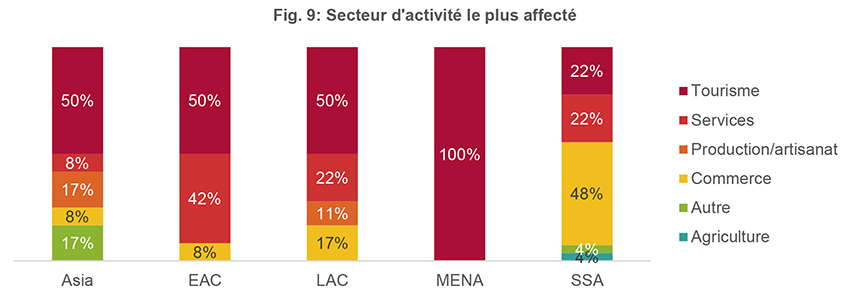

However, even if clients resume their activities, some sectors are more affected than others by the crisis. For example, the sector of activity most frequently mentioned as being the most affected is tourism in all regions outside of sub-Saharan Africa, where it is trade (cited as such by 48% of the region's MFIs). The services sector comes second in most regions except Asia, where the production and crafts sector is more affected. Conversely, agriculture is only mentioned once. Overall, the agriculture sector appears to have been less affected than other sectors by the Covid-19 crisis, as revealed in our previous work where a number of MFIs stated that they wanted to target agriculture more, as a sector less affected by the crisis.

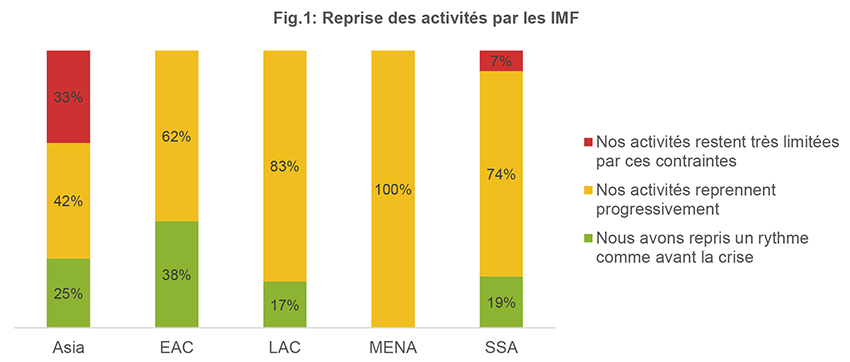

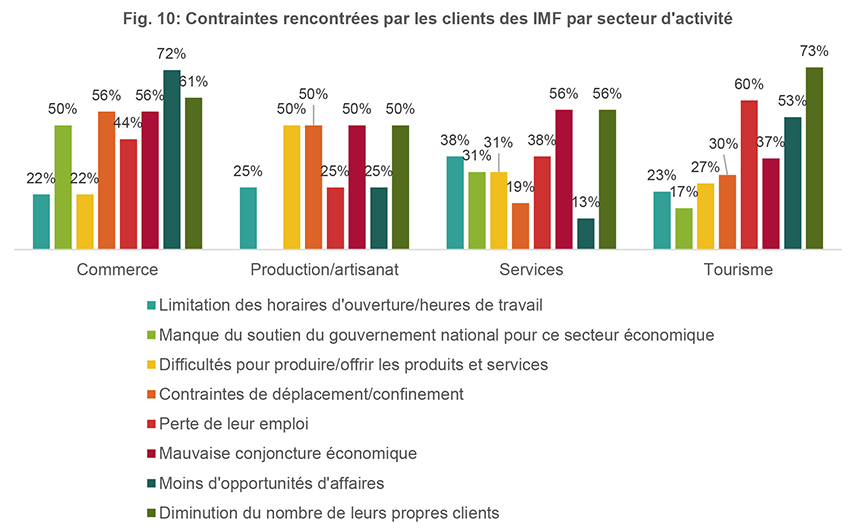

When we look at the constraints faced by clients by sector, it appears that these constraints are specific to each of them (Fig. 10). Regarding the tourism sector, the decrease in the number of clients of entrepreneurs working in this sector is cited as the main source of difficulties, followed closely by the loss of employment, mentioned by 60% of the MFIs that identified tourism as the most affected sector. On the other hand, in the other sectors, the loss of their employment by clients does not appear among the first constraints identified. The decrease in the number of clients remains one of the major constraints, both for the trade sector, as well as for services or production and crafts, a result that is also found in other surveys carried out directly with MFI clients, such as those using the tool developed by the SPTF where the decrease in demand is identified as the main reason for the drop in income [4]. Finally, the lack of business opportunities is the first constraint for the trade sector (cited by 72% of MFIs having identified this sector as being the most affected), while the difficulty in producing or offering products is specific to that of production and crafts.

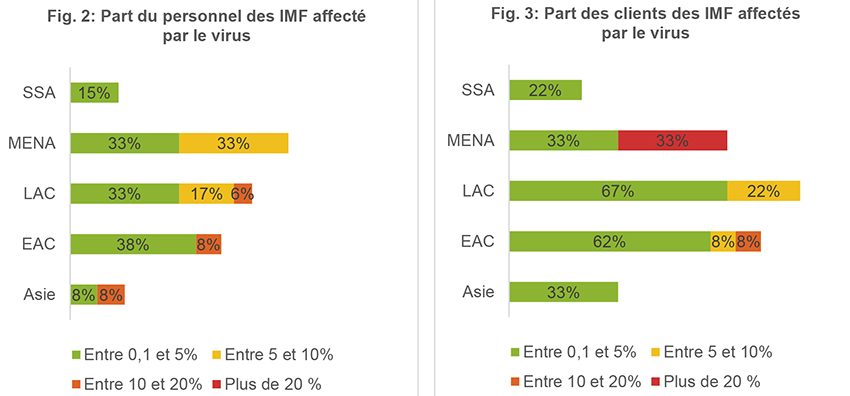

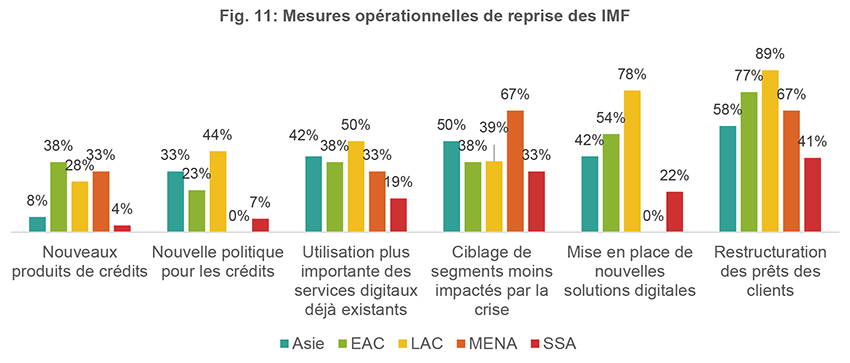

By focusing in this way on the specific constraints encountered by their clients depending on their sector of activity but also probably other factors, MFIs could thus better anticipate their short-term financial situation, and find the answers adapted to the needs of their different client segments, which will allow them all to better get through this crisis. This responsiveness also seems to have already been adopted by certain MFIs, to the extent that, beyond the priority given to the repayment of loans or their restructuring, some of them have set up not only new communication and distribution channels via digital, but also new credit policies or new products (Fig. 11).

____________________________________________________

[1] The results of the first three surveys of ADA partners, Inpulse and the Grameen Agricultural Foundation are available here: https://www.ada-microfinance.org/fr/crise-du-covid-19 and https://www.gca-foundation.org/observatoire-covid-19/

[2] The number of responding MFIs per region is as follows: SSA: 27 MFIs; LAC: 18 MFIs; EAC: 13 MFIs, Asia: 12 MFIs; MENA: 3 MFIs. Despite the low number of responding MFIs in the MENA region, we felt it was important to share the feedback from those MFIs who take the time to respond to these surveys. However, we urge caution when interpreting the results in this region, whose representativeness cannot be stated.

[3] As the MENA region is represented by only 3 MFIs in the surveyed sample, the high figures in this region should be considered with caution.

[4] The results of these surveys are available here: https://app.60decibels.com/covid-19/financial-inclusion#explore