Strategic collaboration to strengthen agricultural financing in Africa

The Grameen Crédit Agricole Foundation, ACRE Africa, and ZEP-RE (PTA Reinsurance) have signed a strategic collaboration aimed at strengthening access to finance and insurance for smallholder farmers across the African continent.

This collaboration brings together three organizations with complementary expertise:

ACRE Africa, a leading agricultural insurance broker specializing in the design of innovative risk management products; ;

ZEP-RE, a regional reinsurance company with extensive experience in agricultural and weather insurance solutions; ;

The Grameen Crédit Agricole Foundation, an impact investment vehicle committed to financing microfinance institutions and promoting inclusive agriculture.

A long-standing partner and shareholder of ACRE Africa since 2014, the Foundation has been actively involved for many years in promoting agricultural microinsurance for smallholder farmers.

As part of this collaboration, the three organizations have committed to:

✅ Conduct joint fundraising initiatives to support agricultural financing programs; ;

✅ Explore equity investment opportunities to strengthen their collective impact; ;

✅ Sharing technical expertise to develop and evolve agri-credit and group insurance solutions.

The common goal is clear: to strengthen the resilience, productivity and financial inclusion of farmers through better access to credit supported by effective risk mitigation tools.

This strategic alliance reflects the shared commitment of the three partners to work together in good faith to stimulate sustainable and inclusive agricultural development in Africa, creating a lasting positive impact for smallholder farmers and their communities.

Watch the video to learn more. this link.

The Grameen Crédit Agricole Foundation at the World Forum on the Social and Solidarity Economy in Bordeaux

From October 29 to 31, 2025, the city of Bordeaux hosted for the first time in France the World Forum on the Social and Solidarity Economy (GSEF). This major international event brought together more than 10,000 participants came from five continents elected officials, leaders, experts, field actors, representatives of development agencies and international organizations, all mobilized to promote more sustainable, equitable and inclusive economic models.

The Grameen Crédit Agricole Foundation was represented there by Veronique Faujour, General Delegate, and Philippe Guichandut, Secretary General. Their participation helped to highlight the Foundation's role in financing the social and solidarity economy and its commitment to inclusive finance in the service of sustainable development.

Two presentations particularly highlighted the Foundation's presence during this 7th edition of the Forum:

- During the plenary session dedicated to financing the social and solidarity economy, Véronique Faujour presented the Foundation's mission, strategic priorities, and action tools. She notably highlighted the launch of the fund Women Empowerment for Climate, An impact fund dedicated to women's economic empowerment and climate adaptation. This fund targets three key sectors in which women play a vital role: access to clean water, access to renewable energy, and the promotion of sustainable agricultural techniques. These initiatives aim to strengthen the resilience of local communities to climate change, while fostering greater economic inclusion for women.

- During a workshop on financial inclusion and women's leadership, Véronique Faujour emphasized that successful transitions are built from the ground up, closely aligned with community needs. She highlighted the importance of a leadership exercised by women, for women and with women, an essential condition according to her, for local solutions to inspire and guide global development policies.

This edition of the GSEF, placed under the sign of dialogue, of the cooperation and of the sharing experiences, This has enabled the creation of new bridges between public, private, and civil society actors. The fruitful discussions throughout the forum have given rise to concrete perspectives for strengthening the collective impact of the social and solidarity economy in the years to come.

The meeting concluded with a final declaration that will define a common roadmap for the next two years, confirming the global momentum towards a fairer, more inclusive and resilient economy.

Strengthening financial inclusion in Malawi: a new partnership between the Grameen Crédit Agricole Foundation and Centenary Bank Malawi

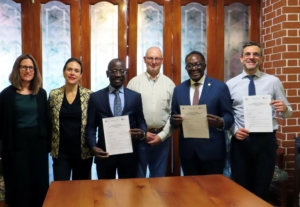

On October 13, 2025, in Nairobi (Kenya), the Grameen Crédit Agricole Foundation and Centenary Bank Malawi (CBLM), member of the Centenary Group, signed a Statement of intent marking an important step in the development of inclusive finance in Malawi.

This partnership is part of the shared mission of both institutions. to promote inclusive financial services, innovative And durable, with particular attention paid to women entrepreneurs and rural populations.

This future collaboration is based on three major pillars:

- Technical assistance : the Foundation and CBLM will work together to identify and implement technical support in key areas such as inclusive finance, risk management, digitalization and agricultural finance.

- Financial support : The Foundation aims to become CBLM’s first private international lender, thereby helping to strengthen its financial base and expand its financing capacity.

- Catalytic effect By supporting this partnership, the Foundation aims to encourage the attraction of additional investments and stimulate the development of the Malawian financial sector.

This new commitment builds on the vision and successes of the Centenary Group, particularly through Centenary Bank Uganda, and is in line with the Foundation's strong historical roots in Malawi.

The Foundation extends its sincere thanks to Mr. Godfrey Helewala, Managing Director of CBLM, and Mr. John DeLuca, Executive Chairman of the Centenary Group, for their trust and commitment. Together, they are laying the foundations for a more inclusive and resilient financial future for Malawi.

Grameen Crédit Agricole Foundation at the African Inclusive Finance Week (SAM 2025)

The Foundation participated in African Inclusive Finance Week (SAT 2025), which was held in Nairobi from October 7 to 11. This major industry event brought together more than 1,200 inclusive finance actors from across the continent to discuss the challenges and the sector innovations.

SAM 2025 Nairobi, Kenya ©Philippe Lissac/GODONG

Present alongside numerous partners, the Foundation took part in several panels and workshops devoted to essential themes:

On the first day, the Foundation organized a workshop on the ’ Climate emergency and economic vulnerability : Spotlight on inclusive finance and insurance», with the participation of the MicroInsurance Network (MIN) and hosted by Hanadi TUTUNJI.

Later in the day, Edouard SERS and Philippe GUICHANDUT spoke and moderated a session on « Impact Bridges : Connecting Europe and Africa for a Sustainable Future», organized by Financing Innovation Tool (FIT).

On the second day, Khady FALL spoke in the workshop « When regulations change, who is left behind? – How are new regulations redefining inclusive finance in Africa? The case of UMOA», and Philippe GUICHANDUT spoke in the workshop « Prospective : mixed models and non-traditional financing possibilities».

Finally, on Thursday, the Foundation organized a workshop on the ’ Financial inclusion of forcibly displaced persons : what economic opportunities for displaced people, PSF and investors? », led by Hanadi TUTUNJI who also spoke later in the workshop « Climate Risk Coverage for Impact Investors »", organized by the MicroInsurance Network.

And finally, the Foundation organized a final workshop on the « Techno-Human : AI & Digital for Inclusive and Human Finance in Africa».

The discussions highlighted several strong trends:

- Digital transformation, which opens new perspectives for reaching rural populations, while highlighting the importance of the human connection in customer relations.

- Climate finance, which has become an essential lever for strengthening the resilience of vulnerable communities in the face of environmental shocks.

- Blended finance, combining public and private capital, as a key driver of sustainable financing and attracting responsible investments.

For the Foundation, committed to supporting microfinance institutions and social enterprises in Africa—which represent more than 50 % of its partners and 40 % of its portfolio—this edition of the SAM was an opportunity to strengthen ties, listen to the needs on the ground and reaffirm its commitment to more inclusive and resilient finance.

The FGCA approach: a rigorous and human investment process

What are the Foundation’s commitments to impact finance?

Maxime Borgogno, Investment Officer, sheds light on the selection process for supported organizations and the evolution of the Foundation's investment strategy.

An approach based on three key criteria:

Our selection process is based on three fundamental pillars:

- The impact: The organization's ability to reach vulnerable populations and offer them appropriate services.

- The social mission: The institution's commitment to ensuring social benefits for its employees and clients.

- Financial performance: The health and viability of the microfinance institution.

The heart of our process: field due diligence

Funding application reviews include in-depth due diligence, including a site visit. This step is crucial for us to understand our partners' business models, governance, and social performance. It's by visiting our partners' sites that we can best identify their needs, understand their challenges, and build relationships of trust.

Investment strategy and climate issues

The Foundation's investment portfolio is evolving to adapt to a constantly changing global context. Our 2022-2025 strategic plan places a particular emphasis on financing climate risk mitigation and adaptation. This focus guides us in our search for new partners, targeting those who actively integrate climate issues into their activities. This is also why we have strengthened our presence in sub-Saharan Africa and South and Southeast Asia, regions particularly vulnerable to the effects of climate change.

➡️ Watch the video to learn more about our approach!