For the 15th anniversary, 4 of our partners sent a message

During the SAT 2023, in Lomé, Togo, we were able to meet different partners.

Strong partnerships are built on mutual trust, meaningful collaboration, and shared experiences. With that in mind, we're excited to share the inspiring voices and stories of our partners. Discover these captivating stories celebrating several years of shared journeys.

Discover the one from Kaba Moise Senghor, Managing Director of VisionFund Senegal, a microfinance institution located in Senegal

VisionFund Senegal is a microfinance institution founded by World Vision International whose mission is to facilitate access to local financial services for rural and vulnerable populations, the opportunity to launch or develop income-generating activities and, in general, the possibility of improving their living conditions. @VisionFund Senegal primarily targets women micro-entrepreneurs, using the group lending methodology.

VisionFund Senegal has 58,895 beneficiaries, including 98% women and 74% in rural areas, as of September 2023.

Mariama Yvette Moudraogo, Vice-President of the Management Board of GRAINE, a microfinance institution located in Burkina Faso.

GRAINE SARL is a microfinance institution founded in 2006 and initiated by Catholic Relief Services (CRS). Its mission is to help improve the economic and social conditions of poor populations in Burkina Faso, primarily women living in rural areas, by providing them with appropriate financial services.

GRAINE SARL has 100,549 beneficiaries in October 2023, including 62,3% women and 60% in rural areas.

Aloïse Aly Ndiaye, Deputy Director General of CAURIE MicroFinance, a microfinance institution located in Senegal and one of the Foundation's oldest partners, since 2009

Caurie makes a lasting contribution to the economic and social advancement of vulnerable micro-entrepreneurs, mainly women, by offering them appropriate financial products and services.

CAURIE has 72,502 beneficiaries including 83% women and 62% in rural areas, in September 2023.

Razack Dimon Challa, Head of the Activities Coordination Service at RENACA, an institution located in Benin

RENACA aims to strengthen the entrepreneurial economic activity of vulnerable rural and urban populations by providing them with financial and non-financial services. The institution encourages its members to save, with these deposits serving to fund a common fund, which provides a basis for granting loans to small producers.

RENACA has 55,423 beneficiaries, including 60% women and 40% from rural areas.

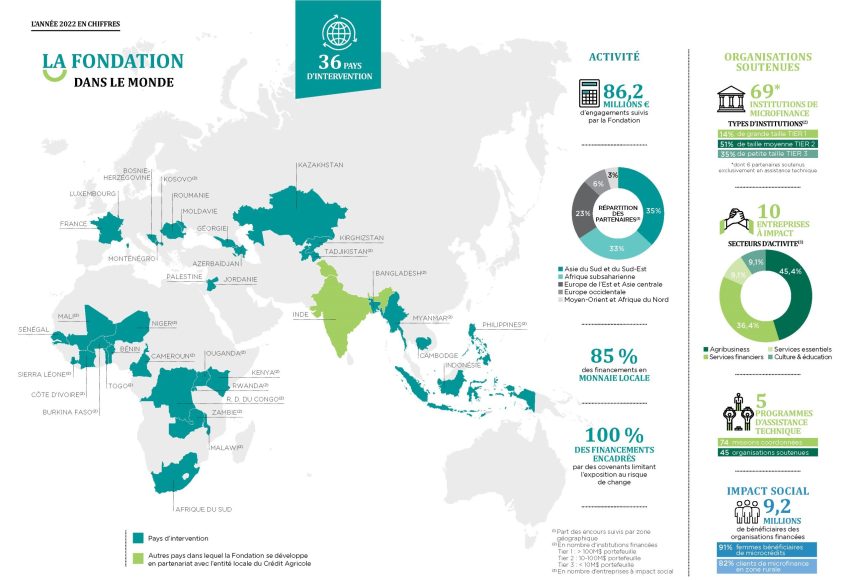

To learn more about the organizations we support, Click here