Facilitating access to microinsurance for rural farmers: training of the Foundation's partners in Cambodia.

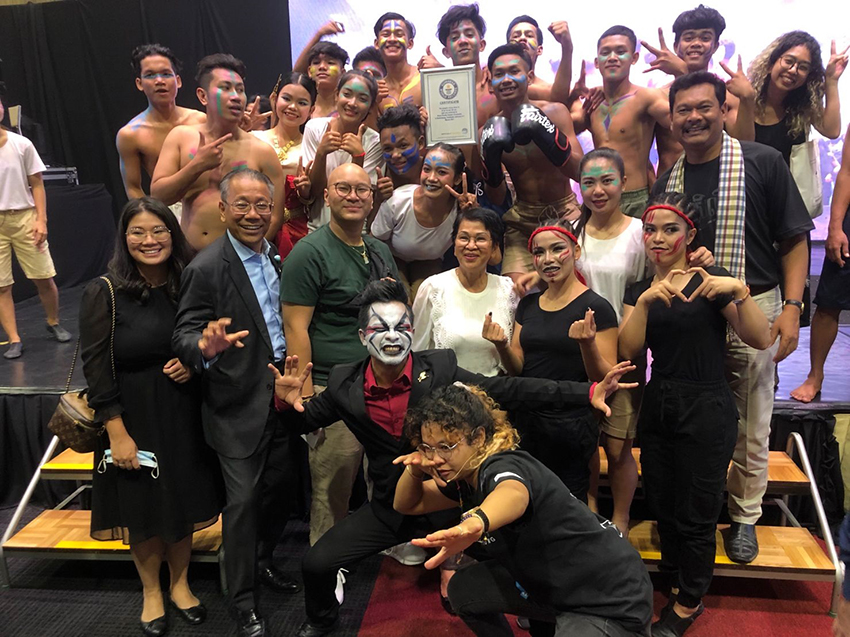

THE International Labour Office (ILO), Proparco and the Grameen Crédit Agricole Foundation organized a training session on microinsurance in Phnom Penh, Cambodia, in March 2023. This training, intended for the Foundation's Asian partners, brought together representatives from Chamroeun (Cambodia), Annapurna and Pahal (India), and VisionFund (Myanmar). It is part of the technical assistance program coordinated by the Foundation, organized by the ILO and financed by Proparco.

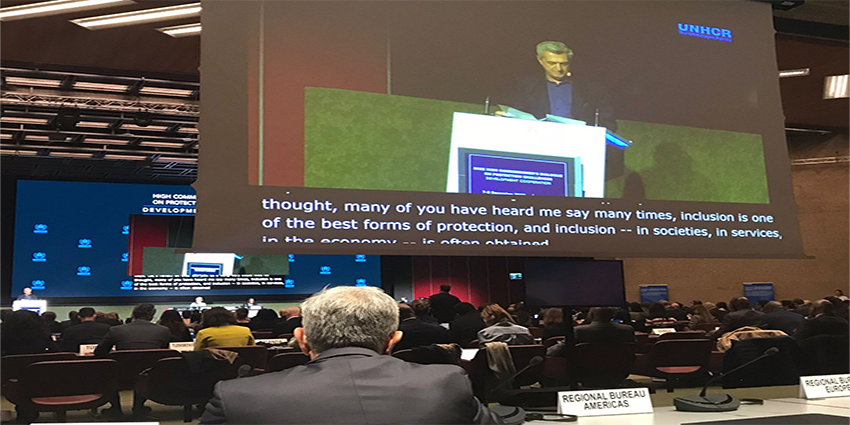

The two-day training, led by Craig Churchill, Head of the ILO's Social Finance Enterprises Department, and assisted by Ali Tareque Parvez, aimed to equip partner institutions with the tools they need to develop a comprehensive strategy to improve the effectiveness and value of microinsurance and strengthen its contribution to their business strategy. Participants shared their microinsurance experiences and learned about the key principles of implementing a microinsurance program.

The beneficiary institutions appreciated the relevance and adaptation of the training content to their needs. Several video testimonials from partners are available online illustrating the positive feedback on this training.

- Interview with Yanick Milev, CEO of Chamroeun and Member of the Board of Directors of CIE Prévoir. Learn more about Chamroeun.

- Interview with Pramod Panda, Head of Insurance Department, and Amrit Sarangi, Head of SME Microinsurance. Learn more about Annapurna.

- Interview with Alok Rajpat of Pahal. Learn more about Pahal.

- Interview with Gaw Mu, Product Manager at VisionFund Myanmar. Learn more about VisionFund Myanmar.

This training is part of a broader technical assistance program offered by the Foundation. This program also includes the development of a customized technical plan, including product design, adaptation of internal processes, establishment of partnerships with insurers, and product marketing.

The ultimate goal of this program is to develop microinsurance in rural areas and facilitate access to better risk management solutions for vulnerable people. By strengthening the microinsurance skills of its Asian partners, the Foundation contributes to improving insurance products and services for underserved communities in developing countries.

To learn more about the program, click here