The Foundation works for inclusive finance in Africa

By Mathilde Thonon and Flora Helard, In-Venture

© In venture

In Benin, more than half of the population lives in rural areas, far from the cities where most traditional banking services are concentrated. To address financial exclusion, microfinance institutions such as RENACA and ACFB have emerged across the country.

For many Beninese, it is difficult to both save and take out a loan. Lacking sufficient income and collateral, rural dwellers, as well as women and young workers, often find themselves deprived of financing that could help them start a business and contribute to Benin's economy. To address the exclusion of these populations, microfinance institutions such as RENACA and ACFB have emerged across the country.

The Grameen Crédit Agricole Foundation, a committed player in inclusive finance in rural areas, supports RENACA and ACFB in their mission to promote financial inclusion and entrepreneurship in Benin. Through its financial and technical support, the Foundation helps "restore hope to communities and lift populations out of a situation of vulnerability," explains Dieudonné Gnanvo, Director of RENACA. By offering savings, credit, and insurance products tailored to disadvantaged populations, microfinance institutions present an alternative to traditional banks and promote more inclusive and sustainable finance.

RENACA and ACFB, partners committed to the field

Founded in 2008, the National Network of Village and Self-Managed Credit Unions (RENACA) is one of the most active microfinance institutions in Benin. Since 2012, the Foundation has supported this mutual network, which has nearly 145,000 member clients, including 60% women. Present in 6 of the country's 12 regions, RENACA offers its clients individual and group loans and non-financial services such as training in personal and professional financial management. RENACA's social performance is an indicator of success, just as much as its financial performance. The institution places great importance on its customer relations and regularly monitors its contractors to ensure their gradual and sustainable exit from economic insecurity.

The Association of Grassroots Financing Funds (ACFB) emerged from a research and action NGO promoting development agriculture, which originally provided subsidies to women to help them start businesses. To sustain its impact, the NGO opted for microfinance over subsidies and gave way to the ACFB in 2004, which is now present in 44 of the country's 117 municipalities. Since 2016, the Foundation has supported the ACFB in its mission to promote women's entrepreneurship and the economic inclusion of local communities.

Modeled after Nobel Peace Prize winner Muhammad Yunus's Grameen Bank, ACFB specializes in group lending. This allows people without individual guarantees to borrow, since in exchange, the group must commit to repaying if one of its members is unable to do so. The mechanism thus draws its effectiveness from the bonds of trust and solidarity that exist between members, which encourage repayment: ACFB currently has a repayment rate of around 1,00%.

Promoting inclusive finance in Africa: a priority

The trusting and close relationships with clients, fostered by the establishment of numerous branches throughout the country, are also at the root of the success of ACFB and RENACA, which together have helped hundreds of thousands of Beninese secure a better future. With the support of the Grameen Crédit Agricole Foundation, the two microfinance institutions have enabled the development of numerous sustainable economic activities in sectors such as agriculture, access to water, renewable energy, crafts, and education in rural areas.

The Foundation works to develop inclusive finance beyond Benin's borders. Today, it focuses 35% of its commitments in sub-Saharan Africa and is present in a dozen African countries. Africa will continue to be a priority for the Foundation, which will focus 45% of its commitments on the continent by 2022.

Solidarity Banker missions to be filled in Kazakhstan and Haiti

© Didier Gentilhomme

Solidarity Banker is a new type of volunteer mission abroad offered to employees on behalf of microfinance institutions or social businesses, partners of the Grameen Crédit Agricole Foundation. Two missions are available: one on the theme of "Agricultural Loans" in Kazakhstan and a "Business Model" mission in Haiti.

The missions to be filled

The first mission to be carried out in 2019 will be for KMF in Kazakhstan. KMF is the leading microfinance institution in Kazakhstan, with over 220,000 active borrowers and a portfolio of over €250 million. The institution aims to expand its product and service offerings by diversifying its agricultural loan portfolio.

The Solidarity Banker will be responsible for proposing a model for diversifying KMF's current agricultural loan portfolio through the introduction of a new product. They will also provide risk mitigation tools specific to agricultural loans. The assignment is scheduled for the first quarter of 2019.

The second mission will aim to support Palmis Enèji, a social enterprise in which the Foundation is a shareholder in Haiti. Created in 2013 as a program of the French NGO Entrepreneurs du Monde, its mission is to offer efficient, clean, and economical cooking and lighting solutions to Haitian households. It has developed a distribution network of 150 active resellers, spread across five regions of the country, who sell solar lamps and kits, improved charcoal stoves, and gas stoves.

The Solidarity Banker's mission will be to support the company in defining a five-year business plan based on its current position, market, and opportunities. They will also make recommendations for fundraising to support the growth outlined in the business plan. The date of the mission will be determined based on the selected candidate's availability.

How to apply?

Several missions are coming up on CA Solidaires. To discover them:

- Go to the CA Solidaires website “Find your mission”

- Enter "Grameen Foundation" in the search bar. All Solidarity Leave offers will appear!

- Click on the offer of your choice, you will find all the information necessary for your application.

- More information: carolina.herrera@credit-agricole-sa.fr

Spotlight on Foundation Week

€200 million in funding awarded, 102 partners supported, 38 countries, and more than 350 participants during the Grameen Crédit Agricole Foundation's 10th Anniversary Week. Thank you so much for celebrating with us its 10 years of work for inclusive finance and social entrepreneurship. We shared unforgettable moments that mark the beginning of a new phase. New challenges will be faced, but the Foundation will continue to adapt to meet them, to innovate by strengthening its expertise, expanding its areas of intervention, and working in partnership.

The Foundation's 10th anniversary marks a magnificent collective project, but the fight against poverty continues. This new chapter in the Foundation's history—more ambitious, more committed, and more collaborative—is only just beginning, and we are delighted to be writing it alongside you.

Relive the highlights of the Foundation Week :

The Foundation and social impact entrepreneurship: here

The Grameen Crédit Agricole Foundation’s 10th Anniversary Evening: here

Investing in Africa: myth or reality: here

___________________________________________________________

Created in 2008, under the joint leadership of Crédit Agricole SA's management and Professor Yunus, 2006 Nobel Peace Prize winner and founder of Grameen Bank, the Grameen Crédit Agricole SA Foundation is a multi-sector operator that contributes to the fight against poverty through financial inclusion and social impact entrepreneurship. As an investor, lender, technical assistance coordinator and fund advisor, the Foundation supports microfinance institutions and social enterprises in nearly 40 countries.

The Foundation's 10th Anniversary Booklet

Ten years ago, the Foundation was created by Crédit Agricole and Professor Yunus, a pioneer in microfinance and Nobel Peace Prize winner. Ten years ago, alongside those working on the ground every day, we committed to helping build a more inclusive economy. The Foundation's anniversary is an enthusiastic reminder of the conditions of this commitment: fear no challenge, neglect no territory, and leave no one behind.

This is why we wanted to present this booklet to you on the occasion of the Foundation's 10th anniversary. It draws lessons from the mature experience of the microfinance financier that we are. It also offers ideas, proposals, and a perspective on the Bank to continue to act for development, for more inclusive, responsible, and sustainable finance.

To discover here

_________________________________

Created in 2008, under the joint leadership of Crédit Agricole SA's management and Professor Yunus, 2006 Nobel Peace Prize winner and founder of Grameen Bank, the Grameen Crédit Agricole SA Foundation is a multi-sector operator that contributes to the fight against poverty through financial inclusion and social impact entrepreneurship. As an investor, lender, technical assistance coordinator and fund advisor, the Foundation supports microfinance institutions and social enterprises in nearly 40 countries.

The Foundation celebrates its 10th anniversary

© Philippe Lissac

On November 20, Crédit Agricole SA and the Grameen Crédit Agricole Foundation hosted an evening to mark the Foundation's tenth anniversary. The event took place at the Salle Wagram in Paris and brought together nearly 200 guests. After 10 years of action, the Foundation and its partners reaffirm their commitment to inclusive and sustainable finance.

An evening to mark the Foundation's 10th anniversary

The event, organized to mark the Foundation's tenth anniversary, brought together nearly 200 people at the Salle Wagram in Paris and provided an opportunity to celebrate the Foundation's 10th anniversary alongside its founders, directors, and partners. Foundation President Jean-Marie Sander opened the evening by recalling the Foundation's origins and how, 10 years later, with over €200 million in funding granted and 100 partners supported, the Foundation and its founders, Crédit Agricole and the Grameen Trust, continue to work together for socially responsible finance.

Eric Campos, General Delegate of the Foundation and CSR Director of Crédit Agricole SA, then reviewed the Foundation's 10 years of activity and its impact, highlighting the unique alliance between the Foundation and a banking group with mutualist roots. The evening featured two roundtable discussions and speeches by two Foundation directors: HRH the Grand Duchess of Luxembourg and Jean-Michel Severino, President of Investisseurs & Partenaires.

Women and Africa, at the heart of the Foundation's actions

The issue of women's financial inclusion, a priority for the Foundation since its inception, was the subject of the first roundtable. Soukeyna Bâ, former Minister of Senegal and administrator of the Foundation, Nejira Nali, Director of Mi Bospo, a microfinance institution supported by the Foundation in Bosnia, and Bagoré Bathily, Founder of Laiterie du Berger, a Senegalese social enterprise in which the Foundation is a shareholder, discussed the importance of women's empowerment as a lever for development. In her speech, HRH the Grand Duchess of Luxembourg also highlighted the key role of women in the microfinance and entrepreneurship sectors, calling for more active participation from stakeholders in the world of finance in the fight against poverty.

The second round table of the evening focused on the Foundation's 10 years of action and brought together Professor Muhammad Yunus, 2006 Nobel Peace Prize winner, Raphaël Appert, Managing Director of Crédit Agricole Centre-est and First Vice-President of the Fédération Nationale de Crédit Agricole, and Philippe Brassac, Managing Director of Crédit Agricole SA. The founders of the Foundation reaffirmed their commitment to multiplying the Foundation's impact and better responding to the new challenges of the fight against poverty. Jean-Michel Severino's remarks then focused on development issues in Africa and the prospects for the inclusive finance sector in this diverse continent.

2019-2022: An ambitious action plan for greater impact

Digital transformation, ecological transition, and the structuring of agricultural sectors will be at the heart of the Foundation's actions over the next four years. With a target of €160 million in funding by 2022, the Foundation will continue to adapt by strengthening its expertise, expanding its areas of intervention, and working in partnership. This was the message delivered by Jean-Marie Sander in his closing speech, which was followed by a performance by the Phare Circus, a social enterprise in Cambodia in which the Foundation is a shareholder.

The Foundation's 10th anniversary marks the beginning of a magnificent, collective project. A new chapter in the Foundation's history—one that is collective, ambitious, and committed—has just begun.

Investing in Africa: myth or reality

To conclude "Grameen Crédit Agricole Foundation Week," Crédit Agricole SA and the Foundation organized a conference on the Crédit Agricole Campus in Montrouge on the challenges and opportunities of investing in Africa. Three special guests shared their perspectives on this diverse continent.

Alongside the Crédit Agricole Group, the Grameen Crédit Agricole Foundation has been committed to promoting inclusive finance and socially impactful entrepreneurship for 10 years. To mark its 10th anniversary of collective action, Crédit Agricole SA and the Foundation organized "Grameen Crédit Agricole Foundation Week."

The "Investing in Africa: Myth or Reality" meeting closed the week on November 22. Can we look to our future while ignoring the African continent? Our three exceptional guests shared their perspectives on this diverse continent, its challenges, its issues, and its investment potential, sharing their expert insights and personal experience of the continent with the many attendees.

_________________________________

Created in 2008, under the joint leadership of Crédit Agricole SA's management and Professor Yunus, 2006 Nobel Peace Prize winner and founder of Grameen Bank, the Grameen Crédit Agricole SA Foundation is a multi-sector operator that contributes to the fight against poverty through financial inclusion and social impact entrepreneurship. As an investor, lender, technical assistance coordinator and fund advisor, the Foundation supports microfinance institutions and social enterprises in nearly 40 countries.

The Foundation and social entrepreneurship

© FGCA

To mark its 10th anniversary of collective action, Crédit Agricole SA and the Foundation organized "Grameen Crédit Agricole Foundation Week." To kick off the Foundation Week, three entrepreneurs shared their experiences during a conference on the Foundation's work to promote socially beneficial entrepreneurship. Alongside the Crédit Agricole Group, the Grameen Crédit Agricole Foundation has been committed to promoting inclusive finance and socially beneficial entrepreneurship for the past 10 years. To mark its 10th anniversary of collective action, Crédit Agricole SA and the Foundation organized "Grameen Crédit Agricole Foundation Week."

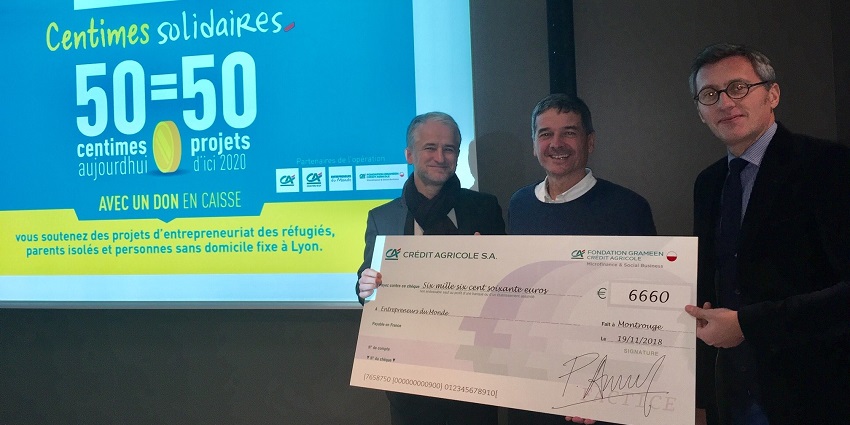

Foundation Week kicked off with the "Foundation and Social Impact Entrepreneurship" meeting held on November 19. The event brought together three social entrepreneurs supported by the Foundation to discuss key issues in the sector. It was also on this occasion that the check corresponding to the amount raised through the Centimes Solidaires initiative was presented to the NGO Entrepreneurs du Monde.

_________________________________

Created in 2008, under the joint leadership of Crédit Agricole SA's management and Professor Yunus, 2006 Nobel Peace Prize winner and founder of Grameen Bank, the Grameen Crédit Agricole SA Foundation is a multi-sector operator that contributes to the fight against poverty through financial inclusion and social impact entrepreneurship. As an investor, lender, technical assistance coordinator and fund advisor, the Foundation supports microfinance institutions and social enterprises in nearly 40 countries.